Conversational AI for finance is a true industrial paradigm shift. The financial inclusion rate has been steadily rising over the years, which led to the fact that over 70% of the global population has an account with one or even several financial service companies. The idea that people still handle this work volume is enough to send panic attacks left and right. But with a technology that reinvents the concept of customer experience and establishes a radically new order of doing finance business, the situation doesn't look grim anymore.

In this article, we will explore how you can apply conversational AI in finance, and what companies have already yielded results.

written by:

Anton Rykov

Product Manager

Contents

Conversational AI 101: Definition, Goals, Benefits

Conversational AI is the type of artificial intelligence that enables computer systems to understand, process, and generate human-like conversations. The success of this mission is secured by machine learning, speech recognition technologies, and natural language processing (NLP). Such systems are trained to perform a certain task, i.e., each company uses a specific data set to teach the program how to carry out a particular assignment.

The reason conversational AI differs so much from traditional chatbots hides in its work mechanics: unlike the latter, it doesn't depend on scripts or decision-making trees. Instead, it adapts to various conversation scenarios and gets smarter with every new interaction. No wonder that the ConAI market is expected to grow from $9.6 billion in 2023 to $47.6 billion in 2033 (Future Market Insights).

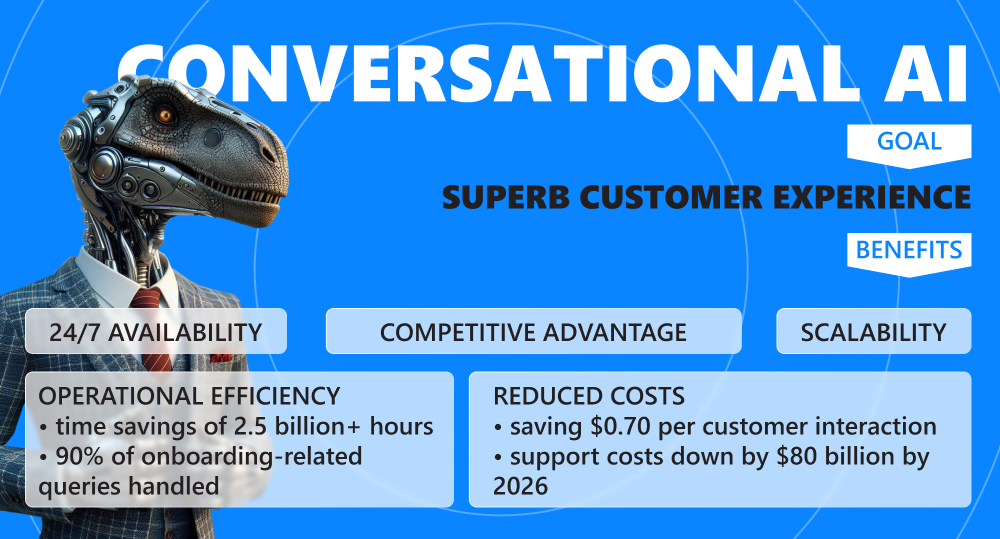

Since this type of AI generates human-like responses, its primary implementations are chatbots, virtual assistants, and voice assistants. All these services are generally used to cater to client inquires. Hence, the ultimate goal of conversational AI solutions is to provide an unparalleled customer experience. That, in its turn, is the foundation of many remarkable benefits that financial companies consequently gain.

*By the way, our company provides a wide range of AI-related services. Fill in our contact form, and we'll be anxious to listen to your vision.

Let's Scrutinize the Benefits

24/7 availability

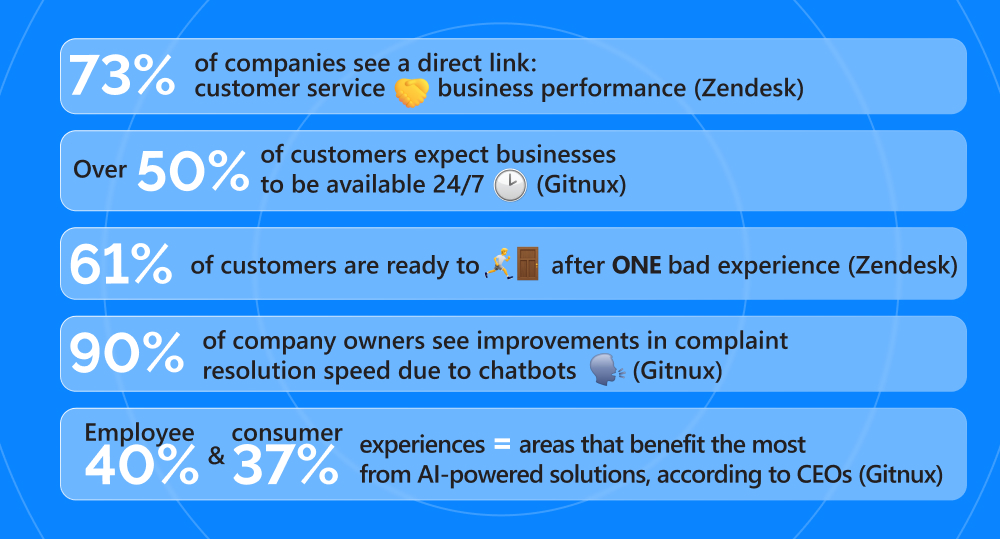

Unlike a human agent, a virtual assistant or a chatbot doesn't need a break. If a customer's inquiry is within a (constantly growing) list of AI capabilities, the client will get an excellent round-the-clock service across many channels.

Operational efficiency

AI systems can automate routine tasks and respond to customers significantly faster than people. The application of AI-powered chatbots results in saving of over 2.5 billion hours of customer service. Chatbots also reduce the average response time by 77% and are capable of handling 90% of onboarding-related queries (MarketSplash). The rest is for support teams, who now have the opportunity to concentrate on those high-value tasks.

Reduced costs

Since it's technology and not human that does the job, you can reduce customer service expenses by 30% (MarketSplash). Gartner predicts that the contact center labor spendings will be down by $80 billion in 2026.

Competitive advantage

A thought-through AI strategy results in streamlined processes, speedy query resolutions, and high client satisfaction rates. Together, these enhancements can move your company's position in the market forward, increasing customer retention and expanding the client base.

Scalability

If the workflow escalates, you will still be able to resolve customer inquires just as quickly as before, with no harm to the quality or additional support agents. Also, technological advancements will allow AI to adapt to more subjects and engage in more interactions with clients.

What about Use Cases?

The next topic on our agenda is how a certain financial institution may apply ConAI. How does it make the lives of banking services providers better and richer?

We've selected a few use cases and divided them into four separate categories to help you navigate the world of AI application with ease. It goes without saying that this categorization is one of the many ways to group the use cases.

1. Customer Satisfaction

This is the first and the main subset of use cases for financial companies to consider. Every possible application of AI here works towards boosting client satisfaction rates.

- Customer onboarding and KYC. Instead of people onboarding people, you can delegate the task to an AI-powered conversational system. Like a human assistant, a virtual helper can guide the customer through the process, accompanying them every step of the way and maintaining a pleasant atmosphere. From account opening to KYC submission and verification, a chatbot can request documents, verify IDs, and even send updates on the status of the client's application. Due to this automation, companies save time and money, more customers get through the process quicker, and employees of finance companies get to focus on less monotonous tasks.k.

- Personalized product recommendations. Spending habits, credit card history, customer journey across your finance company's channels, preferences — conversational AI in banking analyses all this data to craft intelligent product recommendations. For example, it can offer the most suitable investment plan, an optimal mortgage, or a credit card that would be just right. It is impossible to tailor banking services to each particular user without AI. Hence, this approach makes customers feel seen and fulfills their needs. On top of that, it boosts sales up to 30%. Research shows that 64% of businesses believe that chatbots will allow them to deliver a more personalized customer support experience.

- Customer retention. Customer expectations continue to grow, and companies need to take an extra step to meet their needs. According to a Zendesk article, almost three quarters, or 73% of companies, see a direct link between customer service and business performance. They also found that 6 in 10 customers, or a staggering 61%, are prepared to walk away after a single bad experience. Hence, it is vital to provide accurate and swift customer support, i.e., automate it, which is what AI is brilliant at. No leaving people on hold, no queues, only speedy and uplifting responses to resolve customer disputes and let them get on with their lives ASAP.

*To use data efficiently, you need to brush it up first, and our company provides outstanding data management services. Click the link to uncover the details.

2. Personal Banking Assistance

- Account management. With AI, customers don't have to either use mobile banking or visit a financial institution anymore. With simple text or voice commands, they can in no time view their balances, see transaction histories, manage banking products (a credit card or a credit limit), transfer funds, automate data entry to reduce human error, etc. AI-powered conversational systems even automate money transfers, like a bill payment. Biometric authentication that usually accompanies chatbots responsible for account management ensures the safety of transactions.

- Payment reminders. A chatbot can send regular notifications to keep users from forgetting about their financial responsibilities and helping them avoid associated charges. As AI has access to transaction history, it can build up a payment schedule and send personalized reminders, or wait until you set a timetable and monitor your payment consistency from there.

- Self-service. As Zendesk found, 67% of customers prefer self-service to talking to a customer support representative (everyone needs a rest from other people every once in a while, right?). That is why it is crucial for finance companies to implement a chatbot that enables users to perform a variety of tasks on their own. For example, AI can analyze a user's personal information, like their age and income level, help them select the best investment plan, and arrange the necessary paperwork. If you do not provide such an option, businesses are going to miss out on a selling opportunity, too, and lose a part of their client base.

- Financial advice. AI-powered conversational systems are a remarkable asset to collect personalized market insights, stock prices, and relevant news from. Based on the spending history, they can recommend reducing expenses or opening an emergency savings account, educate on the intricacies of the financial industry, or highlight appealing investment opportunities. Such an interaction between a user and a chatbot enhances customer engagement and ultimately increases customer satisfaction rates.

3. Lead Generation

A chatbot can convert website visitors from “I'm just looking” to “Can I pay for this online?” in minutes. That is because chatbots are capable of recognizing user input in a natural language and offering pertinent products that respond to their needs. Without this technology, you wouldn't even know you had leads. But with it, you have every chance to seamlessly and efficiently convert leads into clients. On top of that, if you elaborate on the idea of lead generation and opt for an omnichannel approach, you are very likely to expand your reach and attract more leads and conversions from untapped channels.

4. Fraud Detection

Financial crime and fraud are expected to cost banks and financial institutions approximately $40 billion by 2027. What can we say? The finance sector has always been known as a honeypot for bees from the realm of fraudulent activities. But thanks to AI, it is possible both to detect fraud and to prevent it.

Curiously enough, it's not just fraud that threatens the industry, but false positives, too. Statistics suggests that the cost of about 15% of transactions being falsely flagged as fraudulent is $118 billion annually. Luckily for the financial industry, AI has reduced these alerts by 60% (!).

All this information leads us to a simple conclusion: due to AI's ability to view data as patterns, detect anomalies, spot violations, prompt relevant specialists to respond to potential threats, and invite customers to connect to banking professional, all participants of the industry have a sounder sleep. And that is the key index of the fact that a finance organization fulfills its duties as a provider of confidence and reliability to its clients.

Examples of Financial Companies that Apply Conversational AI

We all know about virtual assistants like Amazon's Alexa and Apple's AI inventions, such as Siri and Apple Business Chat. We're all in agreement that they make our lives easier and nicer. But what would you say if you saw industry-specific use cases of the AI system? Let's find out!

Capital One: Your Ultimate Financial Assistant

Eno from Capital One can be easily described with one word: a legend. The AI-powered conversational chatbot is the first text-based AI from a US bank. You might also catch that people call it “AI with EQ,” because apart from human speech, it also recognizes emojis and emoticons and uses them to reply. If that isn't the dream banking, we don't know what is!

Eno provides a whole set of services: fraud protection, alerts, spending tracking, account management, customer support, and more.

- It monitors transaction history, spots unusual spendings, and creates merchant-specific virtual card numbers for online shopping to shield the user's credit card account from fraud.

- Eno helps to prevent duplicate charges.

- When a suspicious event occurs (like an atypical charge), it notifies the client and guides them through the resolution process.

- Eno provides users with insights on their expenses to help them understand where their money goes. For example, it reminds about free trial periods that are expiring soon and updates if certain payments are bigger than last month.

- Eno grants users simplicity and speed in account management. It can accept commands to pay bills, show the account balance, and provides support 24/7.

HSBC: Making FX Easy

Foreign exchange, or FX, is a whole other dimension within the universe of finance. And the UK bank HSBC has been successfully conquering it since the launch of their chatbot Sympricot.

This virtual helper uses natural language processing to gather data (including sources that are normally difficult to access, like event weightings, relative value analytics and volatility time-series charting) and provide clients with instant pricing and analytics for FX options. As a result, customers can use Sympricot for execution risk management and access the “in-depth information on liquidity conditions and expected pre-trade performance assessment via the bot.”

The system decreases operational risks and abolishes routine manual tasks that are usually a part of such complex trading.

*Did you know that 80% of our projects are in the banking sector? If you want to have a bite of our expertise, feel free to schedule a consultation.

DNB: a Whole New Level of Experience for Customers and Employees

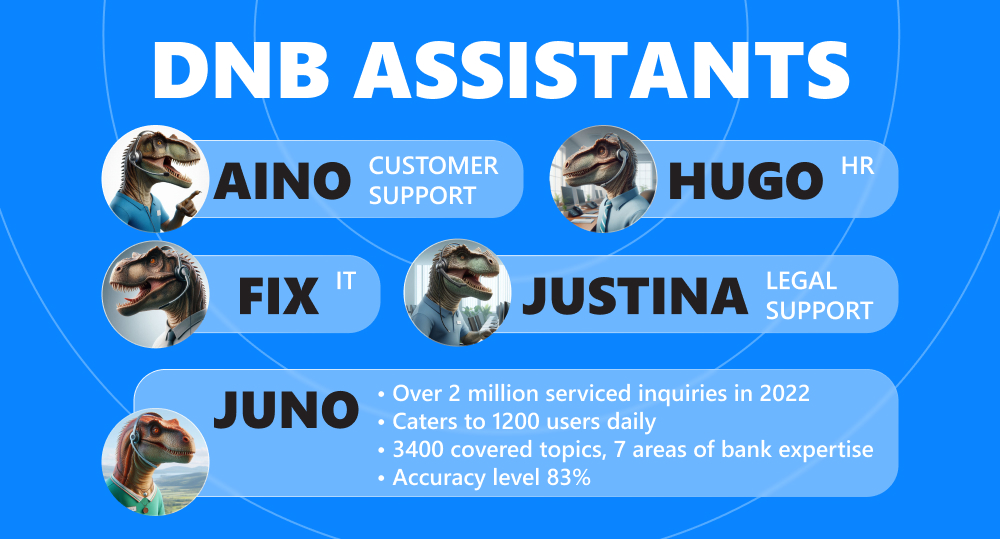

A truly fascinating use case of conversational AI is presented by Norway's largest bank DNB. They have not one, but five assistants that take care of both customers and employees.

Their customer-facing virtual agent Aino automated more than 50% of all incoming chat traffic within the first 6 months since its launch. Three other assistants run on the company side: Hugo (helps employees with HR-related queries), Fix (handles the IT service desk), and Justina (provides support for employees in legal matters).

Still, the star of the bank is Juno. This ConAI agent acts as an advisory support tool for all customer support agents in DNB. In 2022, it answered more than 2 million inquiries, which is about 1200 users daily, with an accuracy of 83%. The bank representative says that “the main reason that the accuracy is only in the high eighties is because the questions were considered out of scope for that service.” Still, Juno can answer questions on more than 3400 topics, which cover 7 different areas of the bank's expertise and are split between corporate banking and the private market.

“Not only are the users and the customers accepting this automation, they’re also wanting more of it because they see how it makes both work life and life as a customer of the bank more efficient,” — DNB has found.

OTP Bank: Banking Made Personal

During the pandemic, a Romanian branch of OTP Group experienced a jump in the volume of customer requests. It rose by 125%, which prompted the bank to reinvent the way they cater to client needs. They wisely decided to resort to the fruits of modernity and implemented Octavian, an AI-powered conversational application that would take the pressure off their call center teams.

Octavian, developed on DRUID, was created to provide personalized assistance 24/7. It can answer FAQs about OTPDireckt or OTPay digital products, bank branches and agencies, as well as sort out website messages. If Octavian identifies a request to postpone installments, it helps the client to fill the necessary form and sends it to an RPA bot that automates internal checks. This process became 30 times faster.

Hold Up, What about Challenges?

They aren't going anywhere. As statistics gathered by MarketSplash shows, the main industrial hurdles include:

Important Conversations

AI-powered conversational systems are a fantastic way to connect with your clients and snatch a leading position in the market. It’s impossible not to reach these heights when increased customer satisfaction, personal banking assistance, lead generation, and fraud detection join the game. These con AI benefits revamp the way both customers and banking professionals approach the subject, while finance organizations and research companies prove: that transformation is very sough-after. So if you want your finance company to stand in one line with the giants of the industry, it is the right time to start asking the right questions and setting up the right processes.

Contact us if you need a reliable and competent partner for such a high-scale endeavor. We have a vast experience with global banks and financial institutions and possess superior technical expertise to implement a state-of-the-art AI assistant for your organization.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 781 135 1374

E-mail us at request@qulix.com