Remember the days before AI chatbots in banking? You'd call a friend in the morning and say, “I'm busy till the evening — going to the bank, you know the lines there.” Or this: “Press 2 to check your card balance, press 3 to contact an operator”. How annoying was that, right? Now, imagine you're that operator with 30+ people hanging in line for a consultation. Not a great image for your brand, is it?

Today's bank customers don't want to go anywhere to trifle issues or wait on hold for more than 10 minutes. They demand quick solutions. Exactly the kind that chatbots offer. Let's take a peek into their binary world to explore what features they boast today and get a glimpse of what lies ahead.

written by:

Alexander Arabey

Director of Business Development

Contents

Howdy, Digital Banking!

Like everything else in the tech world, banking chatbots didn't appear out of thin air. It wasn’t a case of developers getting bored and seeking conversation partners (though that scenario is amusingly plausible). No, these AI assistants emerged in response to specific triggers within the banking industry. What exactly sparked their inception?

Lack of Prompt Customer Service

Unlike their traditional brick-and-mortar counterparts, digital financial institutions rely heavily on automation and self-service options. While this approach helps banks save budget and drive efficiency, it also creates a gap between clients and the company. For instance, when customers encounter a problem they can't solve on their own — like a suspicious transaction that doesn’t align with their recent purchases — they seek human assistance. And the aid is wanted right here and now. Traditional banks, on their side, are not always there to help. They may not have enough customer service representatives to handle the myriad queries flooding in. To balance the need for automation and human touch, conversational banking chatbots have emerged as the solution.

The Complexity of Digital Banking Platforms

Recall your recent experience with a freshly updated banking app. Minor bug fixes might be a breeze, but what about major updates with a brand-new app interface? That's where things get intriguing. Many users grapple with navigating modern financial software, especially when dealing with a non-user-centric design. And let’s not overlook the plethora of features that banking apps have in store. See the problem? Mismatched customer expectations often result in a subpar user experience, confusion, and potential errors.

The Rise of Mobile Banking

The world has become smartphone-dominated, would you agree? Insider Intelligence's Mobile Banking Competitive Edge Study reveals that 97% of millennials actively use mobile banking apps. However, technical glitches remain a major hurdle for users, accounting for 56% of negative mentions on social media, with 17% of these related to app crashes (The Ipsos study). Whether it's a transaction error or a login hiccup, these incidents significantly degrade customer engagement.

As more users move to mobile and remote banking services, financial institutions should adapt and leverage technology to meet client needs. Chatbots offer a practical way to address the challenges of mobile digital banking. They never sleep and hence are ready to resolve any technical issues, route transactions, and swiftly address customer inquiries.

Chatbots in Banking: Key Facts about Next-Gen Conversationalists

Chatbots have gracefully stepped onto the financial stage to fill the gap between efficiency and empathy, offering a virtual handshake to clients navigating a web bank. What should you know about these never-mind-chatting creatures?

Understanding Banking Chatbots

Chatbots, a key part of conversational banking, serve as a liaison between traditional banks and modern users. How exactly are they conversational? The answer is refreshingly straightforward: they simply talk to users in natural language.

Unlike their rigid, scripted counterparts, conversational chatbots are finely tuned with a blend of advanced technologies — natural language processing (NLP), natural language understanding (NLU), machine learning (ML), and AI techniques — to understand and respond in a manner that mirrors human speech. Such sophisticated tools allow them to adapt to subtle nuances and contextual cues when interacting with users.

Whether it’s providing account information or assisting with financial transactions, chatbots do it conversationally. But why do we need them when we can talk to humans? Here’s the catch: efficiency. While human operators excel at empathy and complex problem-solving, chatbots master scalability. Beyond customer care and traditional financial duties, their primary mission is to automate banking processes by handling loads of client issues simultaneously without sacrificing efficiency.

Chatbot Use Cases in Banking: a Statistical Insight

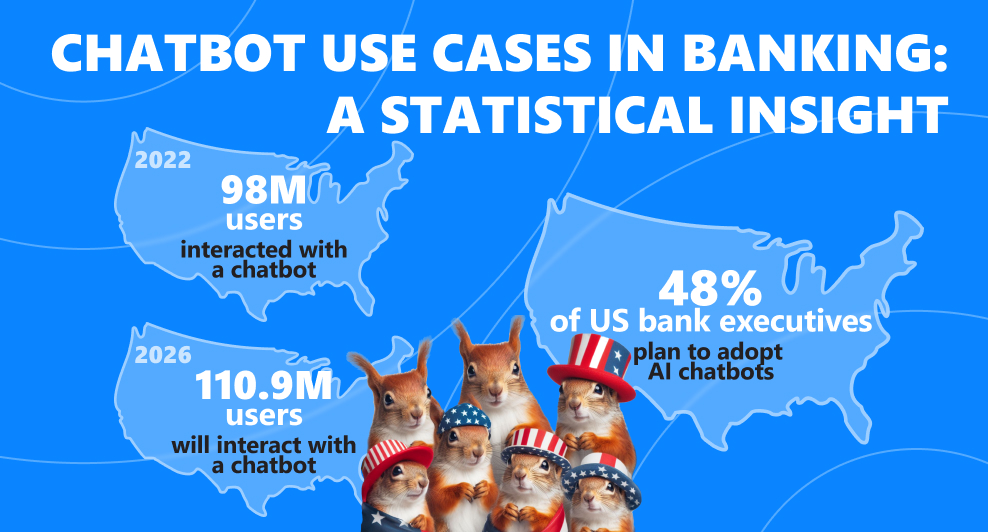

A prime example is the US, where the adoption of chatbots in the banking industry is soaring. In 2022, an impressive 98M users (37% of the US population) interacted with a smart assistant. This number is projected to grow to 110.9M users by 2026, according to a recent study by the Consumer Financial Protection Bureau.

Besides, a Google Cloud survey conducted in October 2023 reveals that 48% of US bank executives plan to actively incorporate artificial intelligence into their operations to enrich customer interactions with virtual helpers.

What It’s Like to Be a Chatbot in the Banking Sector

Imagine a banking chatbot as a human being. What comes to your mind? Perhaps a young banking graduate from a prestigious university, who anticipates your needs before you even voice them. In reality, not all existing banking systems can boast chatbots that meet this lofty benchmark. What characteristics should they possess to earn the honorable title of a “knowledgeable banker”? Let's delve into the benefits of chatbots in banking, explore their key traits, and discuss best practices for unlocking their full potential.

A Friend of AI

Launching a chatbot without AI is like having a broom instead of a smart vacuum cleaner. Such a chatbot is limited to elementary customer queries, responding to simple “yes” and “no” questions. Sure, it may serve as a primitive assistant for newbies in the banking industry. But why settle for mediocrity?

Conversational chatbots powered by AI are quite another matter. They excel in those trendy acronyms from the developer world: NLP, NLU, and ML. What sets AI-driven bots apart? Their power to engage in meaningful conversations, interpret context, and learn from previous interactions. The takeaway? If you're eager for more satisfied customers, equip your bot with artificial intelligence.

A Virtual Sales Rep

By replacing human staff members, chatbots save you money. With their round-the-clock availability, your clients get what they crave most — instant answers. But that's only a secondary benefit. More importantly, bots can significantly impact your bank's profitability. How do they achieve this?

Although financial companies are primarily associated with money management, their services extend far beyond mere transactions. Personal loans, credit cards, wire money transfers, and investment advice are part of the mix. Plus, customers don't use everything at once. That's where chatbots join the game. Acting as tireless sales reps, bots analyze vast amounts of personal data from customer accounts (demographics, personal preferences, purchase history) to recommend the most suitable financial products for each client:

- A tailored loan package;

- A credit card with optimal rewards;

- A lucrative investment opportunity.

Your Brand Mascot

Your banking business brand is more than your logo or slogan — it's your identity, values, and promise to customers. The same goes for your chatbot: it's not just software — it should act as an extension of your brand. By customizing your bot to match your bank’s branding, language, and messaging guidelines, you'll create a cohesive customer experience. Test yourself: when users see your chatbot, do they recognize it as part of your bank's ecosystem? If not, that's something you need to work on. Set the following goal: whether a customer walks into a bank branch or chats with your virtual assistant, they should easily recognize the same trusted brand in every word, spoken or written.

A Smart Guard

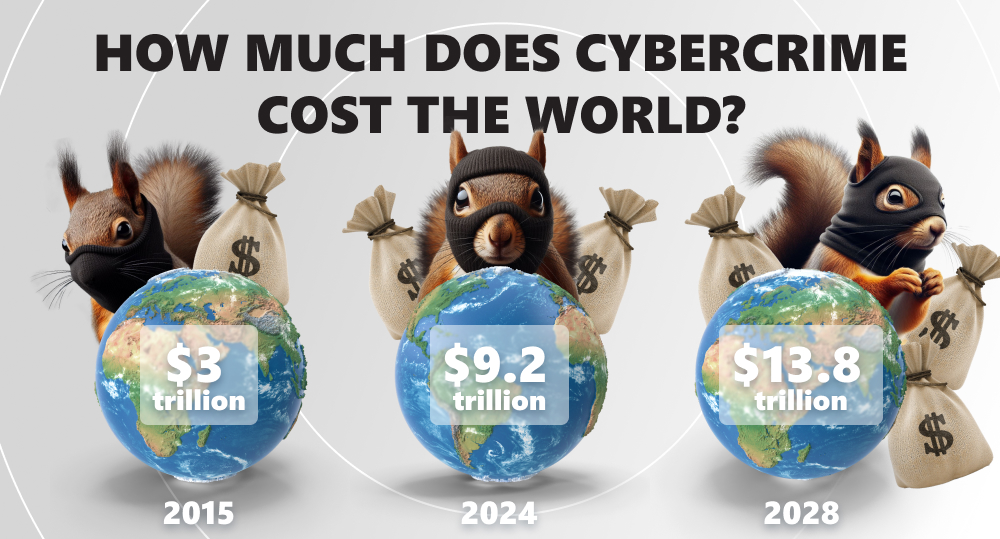

Have you ever wondered how much cybercrime costs the world? Back in 2015, Microsoft estimated that the price tag was already a colossal $3 trillion. Statista's Market Insights predicts the global cost of cybercrime will skyrocket over the next four years, reaching an eye-watering $13.8 trillion by 2028, up from the current $9.2 trillion in 2024. Somewhere in those numbers could easily be a hacker's profit from your bank's customer data. Do you want that?

Remember, your clients trust your organization with their financial lives. That's why you must equip your bot with the utmost safety level. What precautions will make your banking chatbots secure? Encryption protocols, safe data storage, and multifactor authentication are the bare minimum you should provide. Otherwise, people will stay away from your financial institution, knowing their bank accounts are at risk, as your chatbot is inadvertently leaking customer data to third parties.

A Digital Chameleon

Today's banking customers expect good customer service and smooth communication with financial professionals across several channels — be it websites, messaging apps, and social media platforms. How to meet these expectations? The answer lies in multichannel chatbots that can adapt to their surroundings, seamlessly transitioning from one medium to another. Whether a customer prefers a web chat, WhatsApp, or Facebook, the chatbot remains consistent. It’s like having a personal banker who speaks the language of each platform. Imagine starting a conversation on the bank's website and then continuing it on Instagram. The bot gets to know you, remembers your preferences, and delivers personalized services, improving customer satisfaction.

How to Use Chatbots in Banking: Best Practices for Each Role

Characteristic

Best Practices

Friend of AI

- Extend your bot with artificial intelligence;

- Consider the limitations of AI technology;

- Involve NLP, NLU, and ML techniques.

Virtual sales rep

- Train AI chatbots to understand the entire customer journey;

- Tailor chatbot responses to each user;

- Arm your financial advisor with comprehensive information about your banking products and services;

- Teach your bot to address customer objections empathetically, building trust.

Brand mascot

- Craft a distinct bot personality that aligns with your brand's voice and values;

- Ensure it resembles your bank’s feel and touch across various digital environments;

- Remember about the visual aspect: design an avatar that reflects your brand’s identity and resonates with users.

Smart guard

- Encrypt all information transmitted to and from the chatbot, both messages and any user data stored within the system;

- Implement role-based access controls to limit permissions;

- Use robust communication protocols between personal banking chatbots and other systems, monitoring network traffic regularly;

- Set time limits for sensitive messages. After a certain period, they should self-destruct to minimize risks.

Digital chameleon

- Identify the platforms your audience uses most often (mobile, web, etc.) and create tailored versions of your software for each medium;

- Customize your chatbot to adapt to the current communication environment and offer relevant functionality;

- Make your virtual helper contextually aware. Its ability to remember previous interactions and conversations will definitely help retain customers.

The Present and Future of Chatbots in Banking

Chatbots seem to be a relatively recent phenomenon but are evolving as fast as ChatGPT answers. How are they already assisting clients of banks and other financial institutions, and what can we only dream about in blogs like ours?

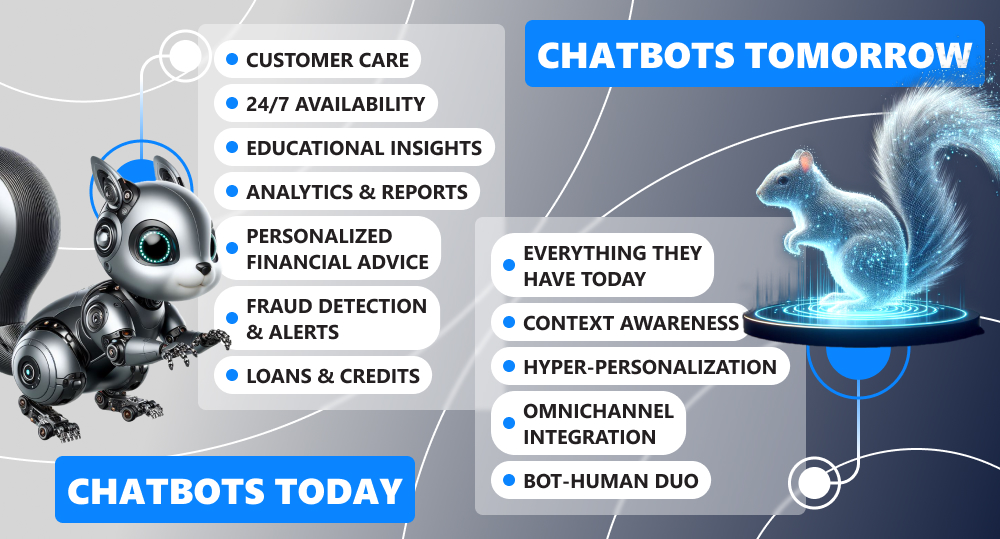

What Your Local Bank Has to Offer

From clunky ATMs to online banking, mankind has come a long way. What seemed impossible yesterday is commonplace today and obsolete tomorrow. This is the reality we live in these days. Let's imagine a typical bank's mobile app with chatbot technology. What can this financial advisory do for you?

Everyday Banking Tasks

Task

Description

Examples

Customer support

Chatbots engage in a human conversation, provide accurate answers to FAQs (e.g., about account balances or transactions), and share up-to-date product information.

Imagine a friendly chatbot named Bankly, powered by natural language understanding, that helps you check your current bank account balance or find the nearest branch location.

Real-life example:

- Erica by the Bank of America

24/7 availability

Unlike human bankers, chatbots never clock out. They’re there when you need them, ready to assist and automate routine tasks.

Whether it’s 3 AM or a lunch break, Bankly is always available to consult you about transferring funds or paying bills. Would like to discuss yesterday’s exchange rate? It's just a message away.

Real-life example:

- JPM Bot by J.P. Morgan

Educational insights

No more ominous or misunderstood words from sales teams. Chatbots can demystify financial jargon for you.

Curious about liquidity or profit margin? Just ask your virtual helper!

Real-life example:

- Ceba by CommBank

Analytics and reports

Chatbots generate breakdowns of client financial activities: monthly expenses or spending habits.

Look, Bankly has prepared a monthly spending report for you. It even lists all your favorite stores. Whoa, it seems you’ve been quite generous with the gas money — time to cut back!

Real-life example:

- Fargo by Wells Fargo

Human-machine alliance

If the chatbot feels it cannot properly handle a customer's query, it will forward it to a qualified human operator.

There are questions that Bankly is not yet trained to answer. No need to panic, it won't abandon you — just pass the baton to its human teammate. The best of both worlds!

Real-life example:

- DNB chatbot

Complex Financial Tasks

Task

Description

Examples

Personalized financial advice

Chatbots analyze your personal data, transactions, and payment history using machine learning algorithms to offer tailored advice and relevant financial products.

Bankly can recommend investment ideas, suggest budget adjustments, or even encourage you to start a savings account for that dream getaway.

Real-life example:

- NOMI by Royal Bank of Canada

Fraud detection and alerts

Chatbots keep a watchful eye on your account, flagging shady activities and notifying you the moment a threat is detected.

Upon spotting a suspicious purchase of 150 Dogecoins (even though you always invest in bitcoins), Bankly sends you a message saying, “Hey there! Noticed an unusual transaction. Confirm or report?”

Real-life example:

- Eno by CapitalOne

Loan applications and credit inquiries

Chatbots automate the loan process. By gathering essential information, verifying eligibility, and providing real-time updates on loan status, chatbots reduce manual paperwork and application processing time. This can significantly improve customer satisfaction.

Need a quick loan? Bankly will walk you through the process, collecting the necessary details and ensuring a smooth application review. No more manual loan approvals!

Real-life example:

- EVA Chat by HDFC Bank

Potential Use Cases for Chatbots in Banking

As natural language processing and machine learning technologies keep advancing, coupled with shifting customer behavior and expectations, we'll certainly see significant progress in chatbot functionality. Here are some possible scenarios we may encounter in the years (or even months) to come:

- Context-aware bots. Tomorrow's chatbots will become smarter: they'll learn from every interaction, remembering your preferences and history, and will be able to understand customer queries against the previous background.

- Hyper-personalization. Imagine a chatbot that's aware of your spending patterns, financial goals, and even favorite stores where you spend half of your monthly salary. Need some budgeting advice? It could say, “Hey, you’re a frequent visitor to that coffee shop, maybe consider brewing at home to save?”

- Omnichannel integration. Chatbots won't be confined to a single platform. You’ll start a conversation on a mobile, continue it on your laptop, and even switch to voice commands through smart speakers. Context won't get lost — your chatbot will follow you across all devices.

- Bot-human duo. The future lies in collaboration between machines and people. Chatbots will handle routine duties, freeing up human agents for more complex tasks. When necessary, they’ll seamlessly escalate queries to their human counterparts.

Your Own Banking Chatbot? Sounds like a Plan!

With each passing day, we inch closer to developing chatbots that can mirror the finest qualities of human customer service agents. The quest for the ultimate conversational banking chatbot persists, as forward-thinking organizations strive to provide customers with a digital companion that blends efficiency, empathy, service quality, and financial wisdom.

Are you up for the challenge to enhance customer experience? Whether you’re a seasoned developer, entrepreneur, or financial enthusiast, consider creating your banking chatbot. Imagine the global impact you could make by helping users navigate their finances, simplifying complex terminology, and fostering financial literacy.

Ready to take the leap? Reach out to us, and let's transform the way people interact with their conventional banks — one chatbot at a time.

FAQ

Chatbots have become increasingly popular in the finance and banking industry, due to their diverse roles:

- Customer service agents;

- Personal financial planning and investment advisors;

- Onboarding specialists;

- Financial data scientists;

- Fraud detection and prevention guards;

- Compliance and regulatory gurus.

Only 20% of banks and credit unions have currently implemented chatbots for automated service, according to Cornerstone Advisors' survey What's Going On in Banking (2022). Among them, just a handful of institutions actually provide intelligent digital assistant services. The implementation of chatbots in the financial sector is still in the development stage, making it a great area to build your custom banking software.

From immersive customer interaction to transferring money in no time, chatbots still have a lot up their sleeve to fulfill future banking customer needs. Here are some potential chatbots-in-banking use cases:

- Doubling or even tripling cybersecurity with AI advances;

- A hassle-free omnichannel experience;

- Boosting customer data farming with advanced reporting and analytics;

- A shift to bot-powered customer service representatives;

- Proactive financial advisors: help before you ask for it;

- More advanced lead generation and customer acquisition.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 781 135 1374

E-mail us at request@qulix.com