Creating a more responsive and sensitive customer experience — that is exactly what the present-day digital banking industry is striving for. Obsessed with the idea of delivering new digital services at an unprecedented speed and scale, many banks were quick to say good-bye to the ‘monolithic’ IT environments, and say hello to the brand-new microservice architecture. However, is the adoption really justified, or is highly distributed design greatly overestimated? Let’s find out.

written by:

Anastasia Borodinets

Creating a more responsive and sensitive customer experience — that is exactly what the present-day digital banking industry is striving for. Obsessed with the idea of delivering new digital services at an unprecedented speed and scale, many banks were quick to say good-bye to the ‘monolithic’ IT environments, and say hello to the brand-new microservice architecture. However, is the adoption really justified, or is highly distributed design greatly overestimated? Let’s find out.

Contents

What Is a Quality Assurance Plan?

Microservices, microservices, and more microservices… Since 2010 the microservice architecture has been discussed (and implemented) incessantly by many business industries from IT to entertainment, e-commerce, and digital banking. In today’s world, one can hardly find a person who, while browsing the Internet, would not come across an article describing the benefits of “highly maintainable and testable, loosely coupled and independently deployable” services.

So, why is the architectural style rapidly gaining popularity now? One of the main reasons is that the microservices approach which implies creating smaller IT services that are easier to manage and implement allows companies to build new applications or update existing ones much faster than in the case of monolithic architectures.

However, is the ability to do releases more aggressively so critical within the business community?

Judge for yourselves: F5’s 2020 State of Application Services Report describes that 69 percent of organizations use 10 or even more application services, while 62% of companies state that without applications their enterprises could not operate at all.

As we see today, tens of thousands of businesses (including banks) extremely depend on their application services. Naturally, for such businesses, the number of app downloads plays a critical role.

However, to increase mobile app downloads, companies need to constantly update and upgrade their digital services; furthermore, they should do it better and faster than rivals do. Thus, the answer to the question above is certainly “YES”.

Moreover, while improving applications, banks need to ensure a high-quality continuous user experience.

According to numerous Internet sources, microservices can address these challenges almost in a blink of an eye.

However, does such an optimistic forecast correspond to reality? Can the microservices-based approach actually turn the software release life cycle into an easy-to-solve task? Can it really help with getting a competitive edge in the digital banking sector? In the end, won’t the adoption become a headache for your business?

Now let’s put praising microservices on hiatus and try to objectively assess all the strengths and weaknesses of the architecture.

Microservice Architecture in Digital Banking — Pros and Cons

Well, we’re going to start on an optimistic note and study the pros.

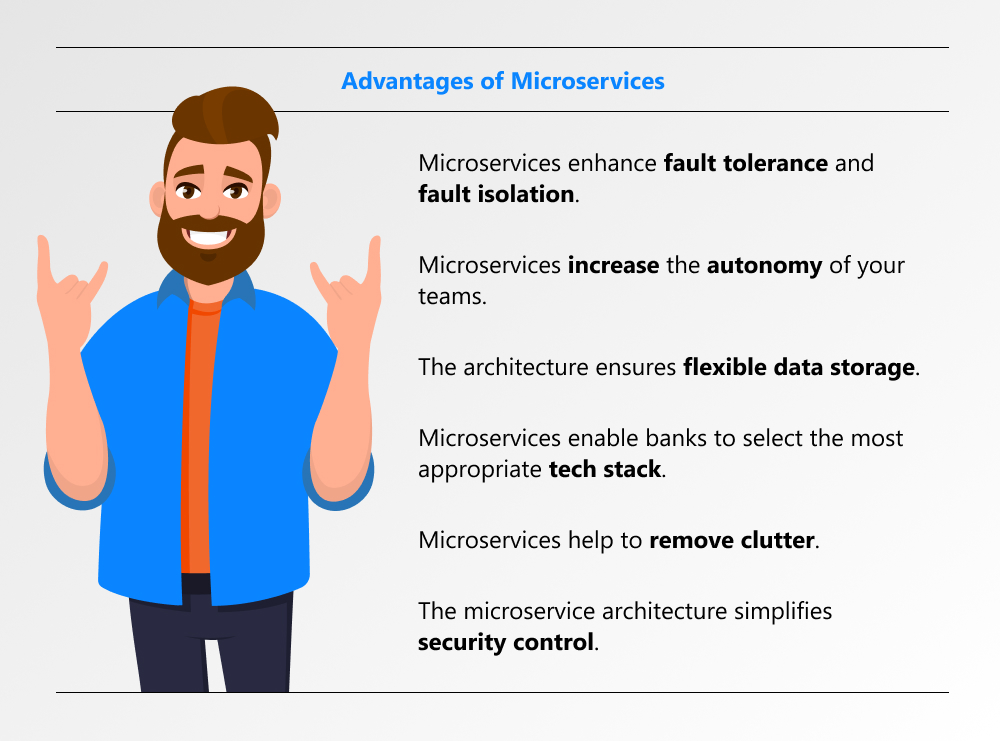

Advantage #1: Microservices enhance fault tolerance and fault isolation.

Advantage #1: Microservices enhance fault tolerance and fault isolation.

One of the major advantages of microservices is encreased fault tolerance and fault isolation. Since microservices are loosely coupled, they can be highly fault-tolerant. It means, in case of a certain service failure it won’t disrupt other services in the application.

As opposed to microservices-based applications, monolithic apps are designed as a unified block of code, where different modules are closely connected. Thus, if a feature crashes, it could be a cause for the whole system downtime.

Moreover, microservices enable us to locate and isolate issues easily, since just one module needs to be detected, which reduces the time required to resolve the issue.

Advantage #2: Microservices increase the autonomy of your teams.

The architecture enables teams to develop numerous projects simultaneously.

This means new features can be implemented without waiting for multiple teams to sequentially finish their specific chunk of work.

Thus, increased teams autonomy tackle the problem of productivity and speed, which allows banks to offer new digital services much faster.

Advantage #3: The architecture ensures flexible data storage.

Another key advantage of microservices is that they let companies store data in different locations.

With SOA and monolithic architectures, data storage options are limited to only one location. The approach is quite good for small, homogenous data sets. However, considering that banks generally deal with large data sets, where the data can acquire different characteristics, some problems may arise.

Microservices make developers free to select the most suitable storage type which supports the needs of every service in the best way.

Advantage #4: Microservices enable banks to select the most appropriate tech stack.

One of the greatest advantages of the approach is that every microservice can be written with different technology. With microservices, developers can apply any revolutionary new tech stacks to a single service.

Due to the architectural style, decoupled services written in different languages can coexist in harmony with other components. This advantage also enables teams to add new components to the system seamlessly and safely.

Advantage #5: Microservices help to remove clutter.

As technologies are outdated quickly, programmers replace them constantly with new ones. With the monolithic architecture, this means yet another new piece of technology can be added to the existing stack.

The approach means that over time, a monolithic application becomes very cumbersome. With microservices, it becomes possible to decouple a large monolithic app into small services, which gives you the ability to reduce the size of your codebase due to removing the unwanted and unused functionality.

Advantage #6: The microservices architecture simplifies security control.

The newest microservices solutions can detect vulnerabilities across the whole system while reducing false positives to zero. Moreover, due to each service isolation, it’s much easier to identify what is causing the security issue. As a result, with microservices banks become more protected from revenue losses caused by unexpected mobile application downtime.

Well, the major benefits have been listed above. Now, to understand whether the game is really worth the candle, we’re going to investigate the potential disadvantages of the microservice architecture.

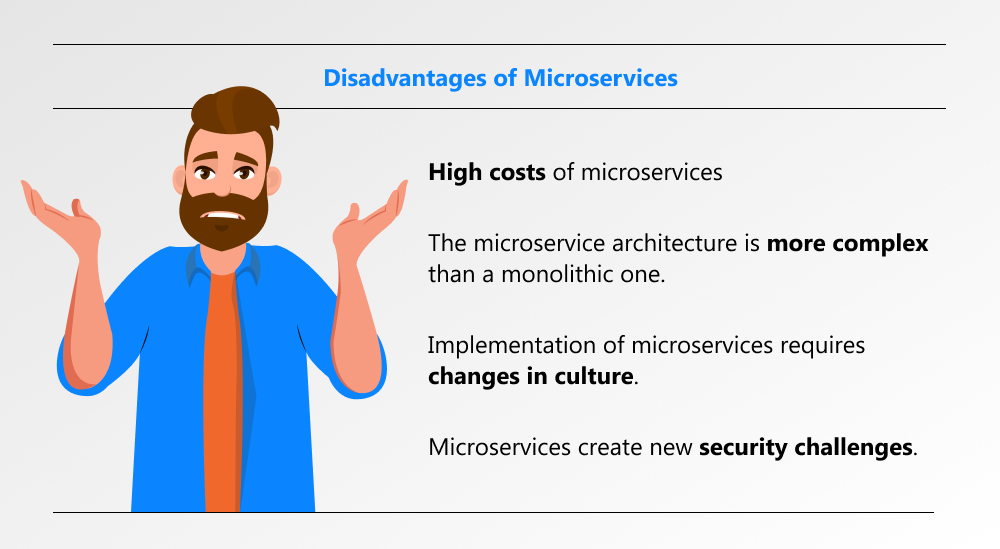

Disadvantage #1: High costs of microservices

Since services need to constantly communicate with each other, this usually results in a vast amount of remote calls, so processing costs can be higher than with the traditional monolithic architecture.

To minimize the problem, development teams should create solutions that can reduce the number of calls.

Additionally, due to the lack of uniformity, you will have to use more tools, servers, and APIs.

Thus, banks should be clearly aware that each individual module will require additional resources for development, management, and maintenance.

Disadvantage #2: The microservice architecture is more complex than a monolithic one.

Well, this goes without saying: a greater number of services automatically makes the development lifecycle more complex.

Any microservices initiative is inextricably linked to colossal efforts and effective IT automation strategies to ensure seamless monitoring, testing, and deployment.

For a deeper understanding of the issue, here are some of the most common challenges that banks can face when adopting the microservice architecture.

- It’s quite difficult to maintain numerous programming languages and frameworks.

- Every service included in your application requires individualized monitoring and testing.

- The microservice approach leads to the increased documentation overhead.

Disadvantage #3: Implementation of microservices requires changes in culture.

Migration to microservices is a process that can be started only by 100% Agile banks that have already embraced DevOps culture.

Implementation of microservices allows small teams to work like independent businesses, which increases productivity.

However, in order to successfully manage the entire life cycle of the service, each team must be mature enough.

Besides, in most cases, the microservice transformation implies a delegation of power from managers to separate teams. It is natural that some employees won’t accept such modifications in the organization chart easily.

Finally, remember that in some scenarios separation between multiple teams can become a barrier to create great digital banking services.

Disadvantage #4: Microservices create new security challenges.

There can be some cybersecurity challenges caused by an increase in the amount of data exchanged between modules.

Since you’re working with multiple small containers, you’re laying open more of the system to the network which makes it more vulnerable to intruders.

Another loophole for hackers is the source code, which is often used for several apps.

Given the importance of cybersecurity for banks, it is better to abandon the idea of microservices adoption if the development team has no appropriate tools and training.

Concluding Lines About Microservices

Concluding Lines About Microservices

Today’s competition in the digital banking market is as fierce as it has never been before.

In the fight for customer loyalty and retention, delivering a better, smarter, and simpler customer experience is the most effective weapon.

The microservice architecture can provide banks with the flexibility to deliver intelligent digital services to users as quickly as possible.

Designed to easily innovate and continuously develop large-scale and sophisticated apps, ensure more frequent upgrades, faster recovery and lower probability of failure, the microservice architecture can help you leave your rivals chained to the traditional infrastructure far behind.

Yet, despite the numerous advantages of microservices, the adoption does not benefit each bank.

Your in-house development team should be extra careful in determining whether the digital success that microservices can bring is possible in your case.

Thus, it might be cheaper for young low-budget startups to build an application with the monolithic architecture, while solid banks with millions of users having a highly experienced IT team can afford using the microservice approach, regardless of the challenges that they might face in their microservice journey.

If you still haven’t been able to assess all specific problems and risks associated with microservices, Qulix Systems will be happy to help you! Our developers, PMs, and QA engineers have helped dozens of clients migrate from monolith to microservices with minimal disruption to operations.

For more detail, please visit our website or get in touch with our support team.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com