Recently, the financial sector has undergone drastic changes, which would seem futuristic a couple of years ago. At the same time, fintech has become a fertile soil for sophisticated cyber attacks. Thousands of fintech businesses around the globe store a vast amount of personal data, but not each of them does it in strict compliance with best data safety practices. What should every fintech company be aware of to avoid multimillion-dollar fines for data breaches? Fintech security: the most common challenges and effective solutions – this is what we are going to share with you in our today’s article.

written by:

Anastasia Borodinets

Recently, the financial sector has undergone drastic changes, which would seem futuristic a couple of years ago. At the same time, fintech has become a fertile soil for sophisticated cyber attacks. Thousands of fintech businesses around the globe store a vast amount of personal data, but not each of them does it in strict compliance with best data safety practices. What should every fintech company be aware of to avoid multimillion-dollar fines for data breaches? Fintech security: the most common challenges and effective solutions – this is what we are going to share with you in our today’s article.

Modern fintech solutions significantly simplify and reduce the cost of financial services — from mobile payments to wealth management and extending loans. However, along with the increase in the number of flexible and attractive fintech services, cybersecurity breaches have also shown dramatic growth. According to the BCG Report, financial firms suffer from cybersecurity attacks 300 times more frequently than companies in other industries. In addition, another statistical report says that 98 percent of the top 100 global fintech startups are vulnerable to cyberattacks, which happens even though they are well-funded.

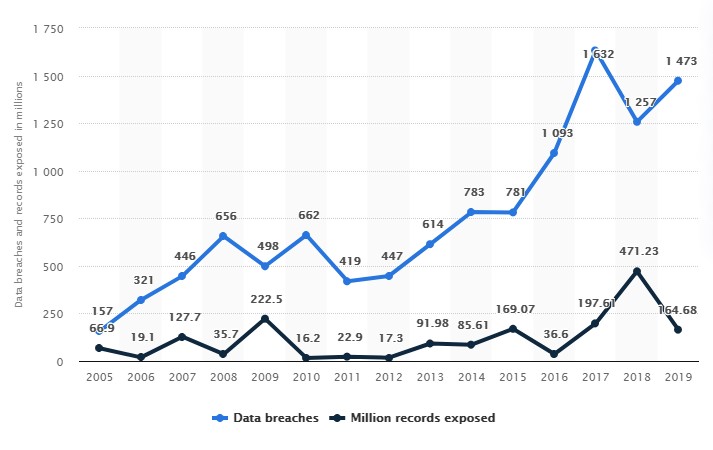

Without detracting from the benefits of using the latest technologies, we have to admit that their adoption has brought a range of cybersecurity challenges for the fintech industry. A recent study published by Statista demonstrates the ever-growing hackers’ interest in digital data.

Source: Statista

Another deteriorating factor is that the latest methods of the hacker community have made it more difficult for companies to detect and protect themselves from cybercrimes. Advanced covert surveillance methods enable hackers to monitor and steal confidential customer information (passwords, bank account details, etc.) over a long period without detection.

So, what are the greatest threats to the confidentiality of data in the financial services sector today, and how to fight them? Read on for the answers.

Top 5 Security Challenges for Fintech and How to Fight Them Back

CHALLENGE #1: DATA OWNERSHIP

Data digitization has become an integral part of each modern financial services firm. Data collection and storage are critical processes for fintech startups. Based on private data obtained, fintech players analyze customer buying behavior and patterns and build strategies to attract and retain more clients. However, ensuring the security of massive amounts of personal information is a truly difficult task.

Сombat maneuver: Constant vigilance

Given that cyber threats are becoming increasingly sophisticated, fintech businesses should work out strict regulatory mechanisms for all operations regarding data: be it access, modification, transfer, or deletion.

Along with that, to help companies combat potential data breaches we have the GDPR (Europe’s General Data Protection Regulation) effective since 2018. Another great example of data law is the California Consumer Protection Act (CCPA), which oblige fintech companies to comply with data privacy regulations. Besides, among many other laws and regulations, fintech firms that process credit card transactions must comply with the PCI DSS – a widely accepted set of policies and procedures aimed at preventing credit, debit, and cash card frauds.

Sure, excessive control over data and multiple laws and regulations may irritate many business owners, but financial cybersecurity requires constant, careful monitoring and use of the latest data security solutions as class action lawsuits and sizable fines for data breaches can ruin the company’s reputation.

CHALLENGE #2: CLOUD-BASED SECURITY RISKS

Today most of the financial services companies use cloud computing for digital transformation. Cloud computing technology provides mobility, flexibility, increased collaboration, and almost unlimited scalability, that’s why so many websites, mobile apps, and digital wallets are powered by cloud computing. At the same time, cloud usage should be controlled and reasoned, as nearly 80% of companies experienced a cloud data breach in the past 18 months.

Сombat maneuver: Reasoned cloud usage

Choosing a trustworthy vendor is one of the key challenges for ensuring cyber security in the banking and fintech sector. Unfortunately, some unfair cloud providers try to attract customers by offering them low prices. When selecting a cloud computing vendor, don’t let the price seduce you, since later such savings can turn into astronomical data breach penalties and fines.

Another issue is choosing the appropriate cloud model to meet your business needs. If your company deals with sensitive data, you’d better not even consider public cloud as an option (this article will help you understand why private cloud pays off, in the end).

On the other hand, if your data portfolio permits using public cloud capacities, you can also read RightScale 2019 State of the Cloud Report from Flexera to find information about the safe mixture of public and private clouds.

CHALLENGE #3: CROSS-PLATFORM MALWARE CONTAMINATION

Propagation of malware from one platform to another is also one of the most common nightmares for almost each fintech startup. Traditional financial institutions such as banks collaborate with fintech players to improve their banking and payment infrastructure. To do this, banks open their infrastructure to third parties and share their data using APIs.

The dark side of such integration is that it may become a reason of cross-platform malware contamination as hackers develop malware that can infect and propagate from one platform to another.

Сombat maneuver: Safe integration

Not all participants of the above-mentioned integrations maintain the same level of the cybersecurity of their systems. Some players ignore advanced and reliable technologies, and this can provoke certain cybersecurity risks. Require diligence from your digital transformation partner, which can be reflected in SLAs or other types of contracts that you sign when starting your collaboration.

Moreover, the equal level of digital expertise may not only guarantee safe systems operation but also save you many compatibility issues.

CHALLENGE #4: DIGITAL IDENTITY

Code-generating apps, one-time passwords (OTPs), and biometrics heavily used in the age of smartphones take the podium instead of old-school passwords. Seems like we have made a huge step forward to 100% data safety. Yet, the increased use of mobile phones in the fintech industry creates a favorable environment for hacking attacks, despite all the measures described above.

Сombat maneuver: Digital identity management

Now fintech companies need to take all possible measures that prevent hackers from cloning digital identities and gaining access to personal and highly sensitive data of the clients. Fintech security requires cybersecurity engineers to use patented data backup and disaster recovery services based on modern technologies like artificial intelligence and machine learning (see this for the difference between the two terms).

Well, we’ve detected the main cybersecurity threats to the financial services sector today and see how we can tackle them. Nevertheless, we have three more security tips for those willing to ensure unprecedented safety of their client’s data. Thankfully, the latest developments in the tech industry are accessible for any company and greatly ease the heavy fintech startups’ burden of protecting confidential data.

Three More Modern Fintech Data Security Approaches and Techniques

Data encryption

Data encryption is a security method where data is translated into another form, or code, and can only be accessed or decrypted by people with the correct secret key (formally called a decryption key).

Tokenization

Tokenization is a popular security measure, which banks and other financial institutions use to protect sensitive data from criminals. How does tokenization work? Tokenization is a process of turning meaningful data into random strings of symbols, so-called tokens. These tokens can be decrypted only by the person having access to a special database (token vault), which in most cases is protected by encryption. Without access to the database, tokens are completely useless to hackers.

Secure code

Remember, a buggy code is easier to break. Check its safety by doing code reviews and employing pair programming.

Choosing a programming language also needs particular attention, as fintech startups require using a fast, scalable, versatile, and well-supported language.

Wrapping Up

As the list of cyber security threats to the financial sector keeps growing, banks’ cybersecurity strategy, as well as other financial companies’ defense philosophy should include not only the best data security software, but also constant vigilance, regulatory compliance, reasoned cloud usage, data encryption, tokenization, secure code along with experienced cybersecurity partners. By neglecting these minimal measures that keep customers’ data secure fintech companies risk not only losing revenues but also their good reputation.

At the same time, for some companies hiring in-house tech talent is impossible due to a tough budget. In such a case, сybersecurity outsourcing may be the best way to protect yourself from the onslaught of cybercrime.

Qulix Systems cybersecurity experts are always happy to share their insights on data protection issues. Top experts will evaluate your security system’s cyberrisks and offer solutions to improve existing cybersecurity strategy, if necessary.

Hire our cybersecurity professionals by getting in touch with the Qulix Systems Support Team.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 781 135 1374

E-mail us at request@qulix.com