While banking product portfolios tend to become similar, banks must select between 2 most popular strategies (or combine them): to compete in pricing or to focus on customer experience improvement. If you prefer the first strategy, you may skip this article. Here we are going to accentuate engaging and personalized customer experience (CX) in the context of digital customer onboarding for banking customers. Also, we will guide you through the traditional perception of onboarding in banks and suggest extending the concept.

written by:

Alexander Arabey

Director of Business Development, Partner

While banking product portfolios tend to become similar, banks must select between 2 most popular strategies (or combine them): to compete in pricing or to focus on customer experience improvement. If you prefer the first strategy, you may skip this article. Here we are going to accentuate engaging and personalized customer experience (CX) in the context of digital customer onboarding for banking customers. Also, we will guide you through the traditional perception of onboarding in banks and suggest extending the concept.

As a software vendor, we noticed banks’ growing interest in technical solutions to both acquire new customers and to ‘wow-and-win-back’ already existing ones. Personalization, omnichannel approach, and a frictionless communication process - these three are the core points of refined customer experience. According to Deloitte, 38% of customers consider user experience (UX) the most important criterion when choosing a digital bank. You got it: no matter how great the functionality of the bank’s digital products is, and no matter how attractive the bank’s offline offers are, the efforts are all in vain if the onboarding isn’t catchy.

What Is Digital Customer Onboarding?

Onboarding in banks quite often is limited to the very first interaction with customers, collecting their data, and filling out a loan application, for example. At the same time, onboarding can be a new opportunity to help existing customers start using new products and services.

The development of digital onboarding for new customers implies making the process of opening an account seamless and comfortable. In this case, the main goals are:

- improve CX with intuitive navigation

- avoid unnecessary re-routing to physical channels (by dealing in the web interface or in the banking app)

- provide reliable online identity verification

- implement autofill to avoid asking the same questions

- provide fast access to the account or product after onboarding is complete.

If we are talking about winning back existing clients, the onboarding looks slightly different. It sets more massive objectives and includes more stages. Let’s consider the details and see how a software solution for all types of digital customer onboarding in banks might look like.

Digital Onboarding for Existing Customers: Why It Is Special

- It is not about explicit sales. it’s about building trust, educating about new products and services, providing insights, demonstrating care and entertaining.

- The process is seamless and adds value at every step. In order not to be annoying, the digital customer onboarding process should be well-planned, thoroughly tested and consistent.

- The average time frame of onboarding for existing customers is 30-180 days. If the customer fails to take target actions, there is a 90% probability that they won’t do that in the future. However, you can try to take these users through the onboarding cycle again over time, taking into account the steps they drop off at. It’s a chance to analyze the bottleneck and to fix it.

The goals are to target the right audience, timely update them about bank products, demonstrate the best ways to use them and, as a result, carefully involve (or re-involve) the customer in the bank’s ecosystem. There is an opportunity to outreach to your existing customers in a simple or gamified way in any of the following cases:

- the bank introduces new products to the market - especially when it comes to presenting multifaceted services, which require customer comprehension

- the bank is aimed at increasing customer loyalty and brand awareness

- when the mission, values, and positioning are reviewed - for example, back in the day the bank had only corporate and insurance entities, and currently, it is entering the retail market segment.

Onboarding: Technical Implementation

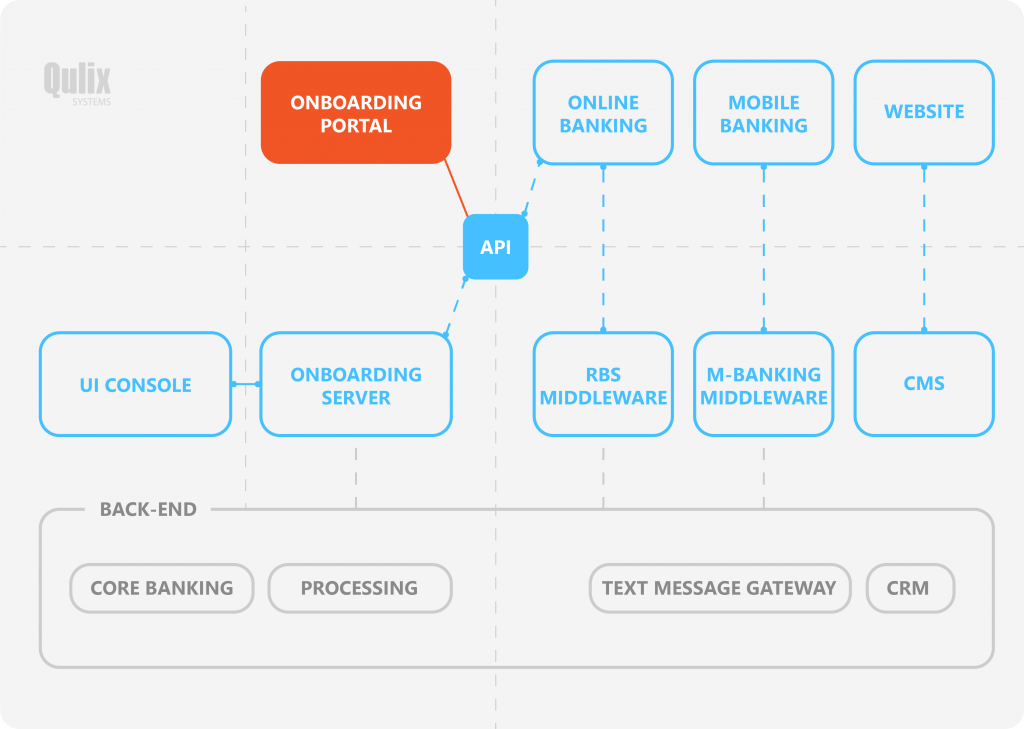

In a nutshell, the Digital Onboarding solution is an additional module that integrates into the digital infrastructure of the bank (CRM).

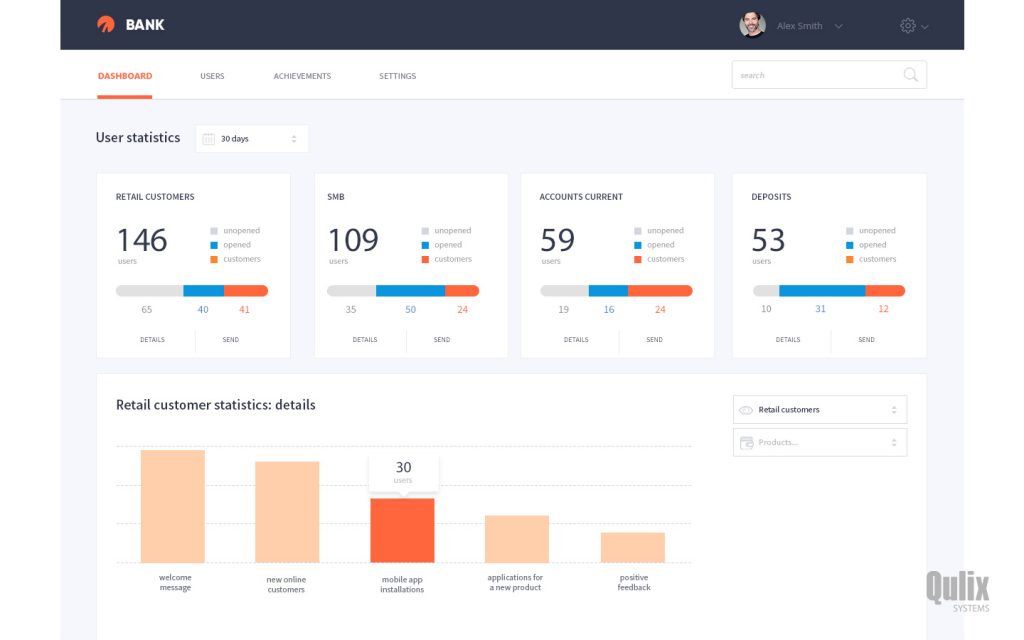

For bank’s managers, it looks like a dashboard with the list of recent user actions, statistics and adjustable planning of personal interaction programs.

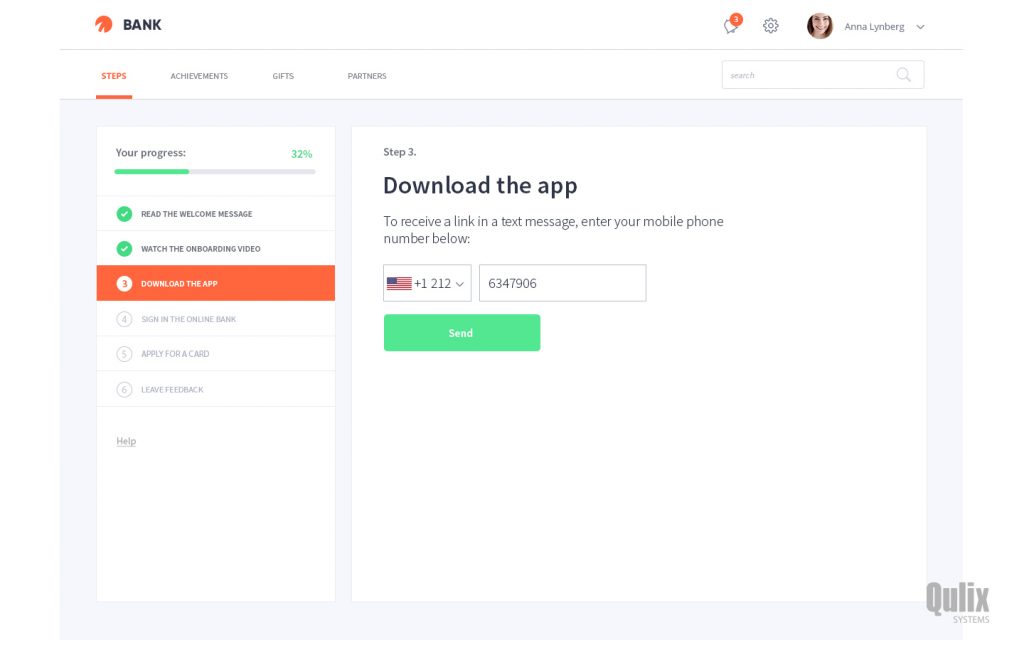

For customers, it looks like a consistent part of the user journey in their digital banking account. The system can interact with customers via internal (online banking or mobile banking), and external channels (for example, text messages or emails).

This way banks can involve customers in a dialog across mobile, desktop, and call centers and have their own digital experience, which eventually results in sales. Banking managers gain access to customer applications and user history to follow up with customers and provide relevant information.

Pre-built components are based on StandFore FS digital banking platform by Qulix Systems. They significantly decrease the design time and reduce the development work — for banks it means shorter time-to-market. In addition, banks can receive real-time detailed analytics and carry out A/B tests to learn the ropes about customer decisions, and timely optimize their experience.

Steps of Extended Digital Customer Onboarding

These steps can be applied to both new and existing customers:

- Acquiring contacts

- Creating an account in the bank’s digital system

- Inviting the user to explore the account, list the benefits and involve them into interaction

- Updating about banking products (messages, articles, videos)

- Sharing valuable content on the ABC of finance (text, graphics, video)

- Motivating to share feedback, refining the relationship with the bank

- Offering products or services (finally proceeding to sales)

- Investing in continuous engagement.

How Banks Can Implement Onboarding for Existing Customers

Timeframe

You can eliminate many friction aspects by hiring a software vendor with a good understanding of the business domain (banks and fintech). In this case, the technical part of digital customer onboarding (integration into banking infrastructure) usually takes several months.

Human resources

When banks ask vendors about the required number in-house employees to assist in the onboarding module delivery, we suggest the following: there should be a project manager (full-time) and a technical specialist (part-time) to cooperate with the vendor and coordinate the project. As a rule, the project manager is a marketing department employee using the help of a bank’s technical specialist when elaborating on project requirements.

Preparation

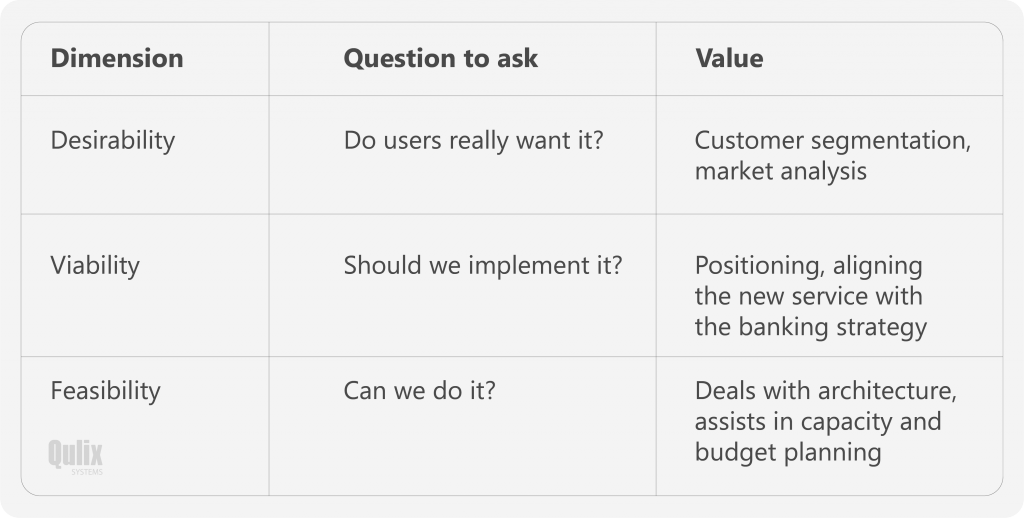

However, the onboarding module development should not only focus on customers. In a perfect scenario, there is a balance between desirability, viability, and feasibility. How to reach it?

Limitations of Digital Customer Onboarding

At the initial stage, banks may need IT consulting to evaluate the existing digital infrastructure and CRM opportunities. An audit carried out by a software vendor helps to obtain reliable cost estimates and to find out, what system elements would or wouldn’t work. At the same time, the most important aspect is to remain realistic in terms of budgets and marketing efforts. For example, if the system can use text messaging, what onboarding stages are implemented in the bank’s mobile app, at which point call center specialists or customer relationship managers enter the game and so on.

There are some global limitations as well: for example, rigid regulatory requirements in banks, complex legacy systems and technologies, and a lot of people-dependent processes. It’s important to realize that awesome front-end cannot be plugged into old machinery. This way digital customer onboarding is impossible without "thinking digitally." Digital transformation requires a grand shift in the leadership team’s mindset.

Qulix Systems offers its Digital Banking platform StandFore FS for software development in the field of retail and corporate banking. Our work is supported by in-depth knowledge of the financial business domain, so we leverage our experience to identify winning strategies.

Contact us at request@qulix.com to learn how you can increase revenue with a top-notch digital sales experience.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com