How to make a mobile wallet app? If you have never asked this question before, it's time to think about it if you want to succeed in the industry and stay ahead of the competition. The global mobile wallet market is expected to reach $46 billion by 2028, according to Research Dive.

E-commerce and retailers, banks and financial institutions, telcos and logistics companies, healthcare providers and the service sector have begun to join the trend and create mobile wallets. In this article, we'll speak about mobile app development and tell you how to build your own e-wallet.

written by:

Olga Shimko

Senior Software Developer, Qulix Systems

How to make a mobile wallet app? If you have never asked this question before, it's time to think about it if you want to succeed in the industry and stay ahead of the competition. The global mobile wallet market is expected to reach $46 billion by 2028, according to Research Dive. E-commerce and retailers, banks and financial institutions, telcos and logistics companies, healthcare providers and the service sector have begun to join the trend and create mobile wallets. In this article, we'll speak about mobile app development and tell you how to build your own e-wallet.

Contents

Exploring Mobile Wallet Apps

A mobile wallet is an application that allows users to make various types of transactions, such as money transfers, payments for purchases and services, and so on. It frees you from having to carry around a wallet with cash or credit cards. Today, there are 6.378 billion smartphone users in the world (80.69% of the world’s population) who never part with their devices and mobile apps. It's easy to install a digital wallet app on the smartphone and make payments at any time and in any place.

The COVID-19 pandemic has accelerated the development of contactless payments as paper money has become a source of infection. Mobile payments accounted for 21.5% of transactions in 2020. By the way, you can use a mobile wallet app not only to pay for goods and services. Users can add loyalty cards, tickets, identity documents, driver's licenses, and so on to their e-wallets.

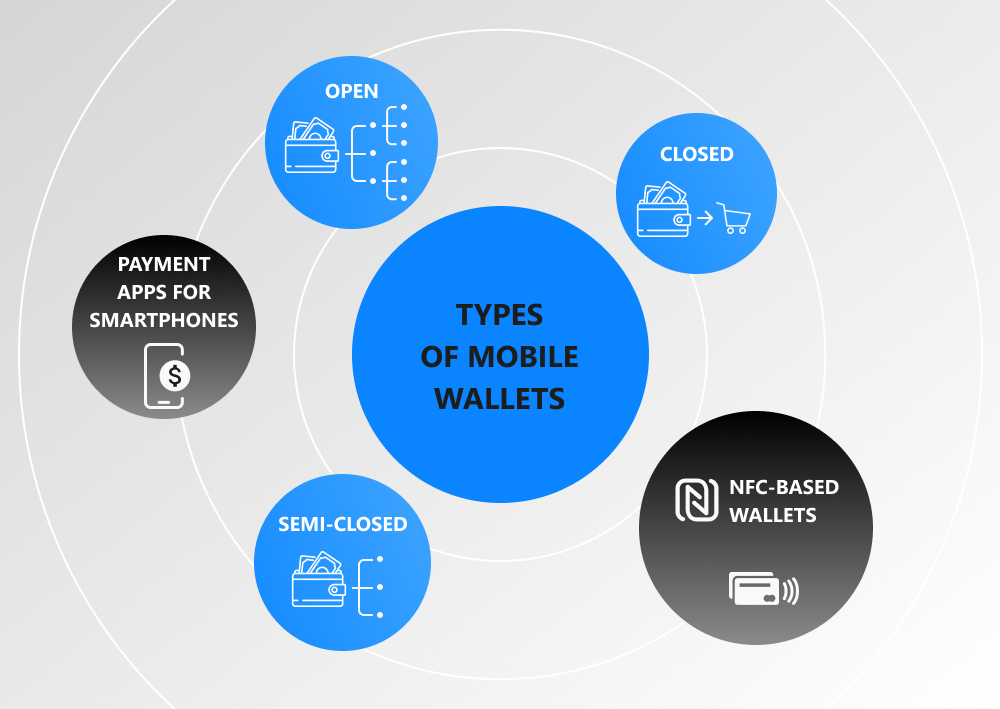

There are the following types of digital wallets:

- Open wallet apps provided by banks that allow users to make any kind of transaction or withdraw cash at ATMs (PayPal, Venmo);

- Semi-closed mobile wallets that allow customers to send and receive money; however, users can't withdraw money. You can pay a range of merchants who have a particular contract with the payment platform (Square, Stripe);

- Closed mobile wallet apps that are issued by companies or retailers to allow customers to buy products and services from the issuing merchants (Amazon Pay, Walmart, Starbucks);

- Mobile payment apps developed for some smartphones (Apple Pay for iPhone, Samsung Pay for Samsung phones, Google Pay for Android phones); and

- Digital wallets based on near field communication (NFC) technology. They allow users to connect credit and debit cards to pay online or in brick-and-mortar stores by connecting a smartphone or even smartwatch to a payment terminal.

Mobile Wallet App Development: Benefits for Businesses

Does any software development company or a business need to create a digital wallet? Developing a mobile wallet application will open up a lot of new opportunities for companies engaged in retail, telecommunications, logistics, healthcare, financial, banking, and other sectors. Airship's survey of US and UK consumers found that 54% of respondents have already used mobile wallet apps and would like brands to use loyalty cards, coupons, and other formats more often.

Reduced transaction costs

As payment card issuers and transaction operators, banks take a commission for their services. It may differ depending on the company, profit, and sales volume. Nevertheless, every business wants to cut commission fees. A mobile wallet app can help you get rid of intermediaries and save money on issuing a payment card since users don't need to use a physical card. They will simply download and install your digital wallet app on their smartphones.

For example, implementing mobile wallets will help retailers reduce employee costs. 86% of buyers don't visit retail stores due to long queues, while 38% even refused to make purchases for this reason. Digital wallets eliminate the need to waste time queuing up since it takes you just a few taps to pay using your mobile payment app.

Improved customer experience

A mobile wallet app allows businesses to promote and sell their products and services. Creating a loyalty program in the app will allow companies to enhance customer engagement, increase sales, and provide a high level of customer value. According to Walker-Sands research, 63% of consumers say they will change their buying habits to get the most out of loyalty.

The more often customers interact with your brand and product, the more bonuses they receive. They can use these bonuses to get discounts or buy any other products from your company. For example, Starbucks offers its app users various bonuses that they can spend on coffee and desserts. This improves customer experience by allowing buyers to pay directly from the e-wallet app, speeding up the whole buying process.

Attracting new customers and retaining old ones

If you create a wallet app for Android and iOS, you'll get a chance to directly communicate with your customers, increase their loyalty, as well as increase your brand awareness. If you are a medical institution, logistics or transport company, cafe or restaurant, let customers pay for services through your application, receive messages about new products, promotions and discounts.

For example, customers of a telecommunications company can replenish accounts, make payments, collect loyalty points, store digital documents, exchange gifts, and do other things directly from their mobile wallet app. Your marketing team, in turn, will be able to track which services are most often used by subscribers in order to send them a personalized offer. When you give your clients what they want, they will stay with you for a long time.

Increased profits

When customer satisfaction grows, sales usually rise as well. This is the conclusion made by McKinsey researchers. They revealed that 70% of buyer experience depends on how customers feel they are being treated. Consumer demand grows when customers are interested in and satisfied with your brand and products.

Other Benefits Provided by Digital Wallets

Are you ready to build a mobile wallet? If not, look at other advantages and opportunities offered by these apps.

Convenience

Users no longer need to carry around a wallet full of cash, various payment cards, loyalty cards, and other documents. All of these things can be successfully stored in mobile payment applications. According to LivePerson, 61.8% of people would rather leave their wallets at home than their smartphones. Everything they need is always at hand, easy to operate, and simple to use.

Time-saving

Users don't need to go to the bank to pay their bills or do other things with their bank accounts. When shopping at retail stores, the queue will move faster because buyers don't have to fiddle with cash and payment cards. It is enough to bring the smartphone to the reader and the payment is complete. In the case of online shopping, the digital wallet saves time on entering credit card information and identification because everything is already confirmed in the e-wallet mobile app.

Better tracking of expenses

The digital wallet stores all transaction information, which allows users to analyze it every month to better control spending. If you find it difficult to meet your budget, you can set limits for certain categories of expenses that will prevent you from spending too much money.

Enhanced security

All data you have in your mobile wallet app is encrypted and never sent to third parties. The user must confirm the transaction with a fingerprint, pin code, etc. The application, in turn, is additionally protected by your device's security system, such as Face ID, fingerprints, passwords, and so on. Even if the smartphone is stolen, it will be difficult for a thief to gain access to your money.

E-wallet Application Development: Must-have and Advanced Features

A good mobile wallet should effectively solve the user's problem. What's more, it should have great usability and performance, a user-friendly and responsive interface, and intuitive navigation. Also, the user should not suffer from bugs and errors. So, what features must be included in a digital wallet:

User registration - the user must be able to register in the application. Include multiple registration methods, such as email, social media, mobile phone number, and so on.

Banking account or credit card authorization - the users must be able to add their accounts or payment cards to the digital wallet app.

Balance adding and checking - users should be able to check the account balance directly from the e-wallet.

Funds transfer and transfer receipt - this function allows users to make various transactions.

Push notifications - this function allows users to receive information about successful transactions, declined payments, receipt and withdrawal of money, and so on.

Bill payments - users should be able to pay various bills directly from the application.

We have told you about the must-have features. To improve the user experience and encourage your customers to download and install your digital wallet app and recommend it to their friends, you can consider other features like adding and managing loyalty cards, gift cards, various offers, membership cards, discounts, geo-targeting, bill splitting, and many more.

How to Make a Mobile Wallet App: A Brief Guide

To develop your own digital wallet, follow these steps:

#1 Prototyping

Create a prototype demonstrating the functionality of your e-wallet app. As a rule, it includes a diagram of screens and transitions between them.

#2 Design

Design graphic elements, such as screens, backgrounds, icons, buttons, and so on. Check how convenient it will be for users to use the elements of the payment app interface.

#3 Development

You can create and run an MVP (minimum viable product) that will help you understand if your application is in demand, what features can be added or improved, whether it is worth developing it further, and so on.

#4 Testing

Submit the final version of your mobile app to the testing team to check how it works and fix any bugs and errors. If you release a product with a bunch of problems, it's more likely to fail in the market. In this case, you will inevitably incur reputational and monetary losses. Users will remove your app and never want to install it again.

#5 Technical support and updates

Your e-wallet app will inevitably have some technical difficulties and require improvements. That's why you should maintain and update it from time to time.

Important Notes

What else should you consider during the mobile wallet app development process?

Technologies

If you want to develop a mobile wallet, you should take into account the technologies used to provide the payment process. These are:

NFC (Near Field Communication) is a short-range wireless high-frequency communication system that allows you to exchange data between devices that are at a distance of about 10 cm. This means that using NFC gadgets you can pay for purchases and services in a contactless way, get additional information about goods, and so on.

Bluetooth and iBeacon - is a protocol for transmitting a Bluetooth signal between a locating beacon and any device (smartphone, tablet, etc.) that is compatible with Bluetooth Low Energy. The principle of operation of iBeacon is simple - beacons send a Bluetooth signal to devices within their range at regular intervals.

QR Codes are black and white pictures with encrypted text. For example, it can be a website address, email, bank account, and so on. A smartphone with an installed reader application can decrypt the encoding. Scan the QR code with the camera. The app will decrypt it and offer to perform a specific action. For example, go to a website or make a cashless transaction.

Security

If you decide to create a digital wallet, carefully think about security since your app will deal with money and financial transactions. You can increase the security of your wallet with the help of the following methods:

Tokenization

According to this approach, the actual number of a payment card is replaced with a one-time number, i.e. a random combination of characters. The token can be detokenized (decrypted) only by the tokenization provider. The cardholder's main account number (PAN) is stored only in the system of the tokenization service provider. (e.g., ApplePay)

Point-to-point (P2PE)

It is an encryption of a payment transaction from the moment the client interacts with the POS terminal (QR code) until the payment data reaches the processor (especially important for mPOS) (e.g., WeChat)

Secure element (SE)

It's a chip that provides a dynamic environment for secure storage and processing of data and secure interaction with external objects. It destroys if somebody tries to hack or change it. These chips include chips (EMV) on payment cards, as well as chips embedded in mobile devices. (e.g., Google Pay, Apple Pay)

You can use passwords, two-factor authentication, authorization using biometric data, and so on to protect data.

Bottom Line

According to Statista, US consumers prefer to pay for goods and services with e-wallets in 2020. If you want to outrun the competition, increase sales, attract more customers, and increase your brand awareness, it's time to create a mobile wallet app. It will help you inform users about new products and offers, analyze the interaction of people with your application, add new features, and successfully grow your business.

If you want to learn more about e-wallet app development or mobile wallets, please visit our website or get in touch with our support team.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com