Previously we touched upon Digital Banking for Millennials (part 1 and part 2), considering both the marketing and the financial app development aspects.

This time we got inspired by the skyrocketing initiatives from banks and fintechs aimed at young users, who were born in the late 1990s onwards. Researchers call this target audience Generation Z. There is also a term Generation Alpha used for kids and teens born after 2006.

In the US, almost 80 million people out of 330 million are under the age of 19 - which is close to a quarter of the total population of the country. As far as the European teen & kid market is concerned: 1 out of 5 Europeans belong to this age group.

It seems to be an impressive market, right?

At the same time, it’s pretty much clear why traditional banks don’t create a large number of their products at Generation Z. Indeed, high school and college students are not able to bring tangible profit - in comparison to more ‘profitable’ and financially independent Millennials.

All that created an opportunity for neo-banks and fintechs that dare to take a risk and deal with software development aimed at youth. They are assured: traditional banks underestimate the opportunities provided by pocket money and the growing loyalty of kids and teenagers, which can bring profit later.

Many experts, including Marcel van Oost, a fintech agent, and industry advisor considers the pocket money market extremely promising: 73% of the US families provide their kids with pocket money on a regular basis. This way US kids and teens receive over 40 billion dollars every year. Gen Z of Great Britain aged from 6 to 18 earned £4.5 billion. It includes income from social media and increasing allowances.

Most parents say they allow their children ‘earning’ their pocket money by dealing with domestic chores: mowing the lawn, vacuuming and cleaning up their rooms. However, the primary objective of grown-ups is to educate children about financial literacy and show them the value of money to build rational spending patterns.

Generation Z: what they want, how they spend, and what are they saving up for?

By the present day, banks are already informed about expectations of Gen Z’s parents, but now the time has come to focus on the needs of these children and teens.

While Millennials are open to technologies, the representatives of Generation Z are born surrounded by technologies, therefore their expectations are extremely high: their average attention span is 8 seconds - compared to 12 seconds for Millennials. Trying to attract their attention is not going to be an easy task for fintechs, and iOS and Android banking app development.

The young audience is redefining the digital experience with finance: they expect to receive value by a couple of taps on the screen, but let’s face it: most incumbent banks are simply not able to meet such standards.

Generation Z grew up in the times of the global financial crisis 2007-2008, and probably that’s the reason why their parents find it so important to teach them how to deal with money.

Spending and saving go hand-in-hand in the younger generation. Their spending patterns are similar in the most part: they spend on groceries (like sweets), entertainment with their friends, eating out, playing video games, purchasing toys, and books. As far as the shopping channels are concerned, despite stunning digital experience, Gen Zs stick to in-store purchases instead of online shopping. This tendency slightly changes as they grow up: for example, six-year-old kids carry out only 13% of transactions online, while 14-year-old teens - already 38%.

As far as savings are concerned, Generation Zs save on bigger purchases: mobile devices, video games, and costly branded toys. The piggy bank of the British kids made £550 million in 2018.

Many fintech and banking apps allow signup for 7-8-year-old kids. Although the number of the youngest fintech app users is barely noticeable, it is one of the mobile banking trends.

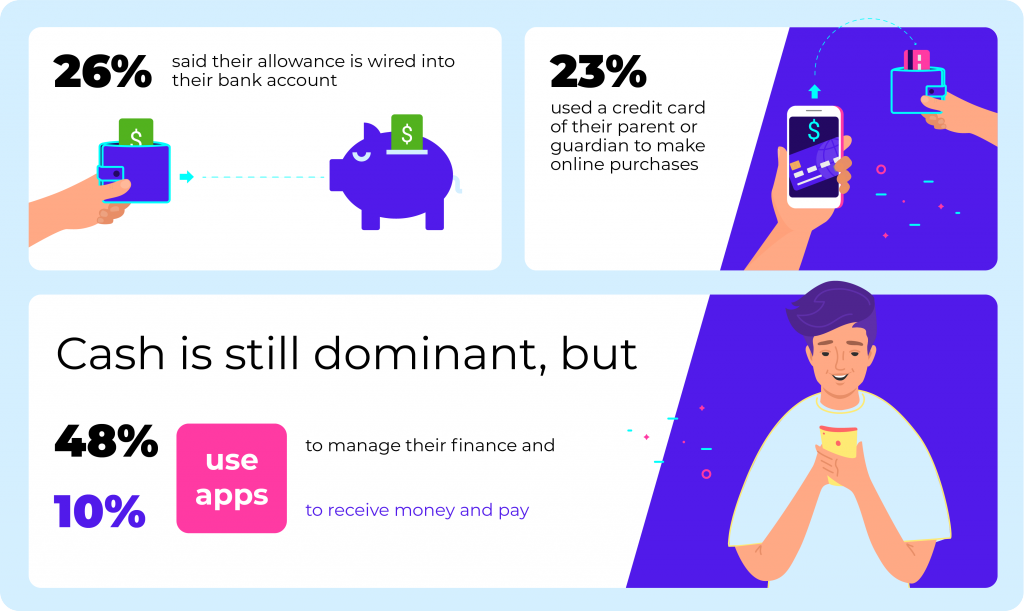

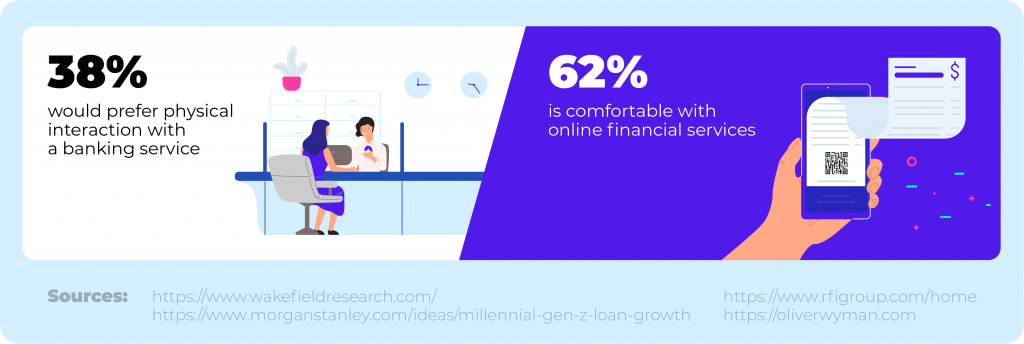

We gathered research results from multiple studies conducted in 2019. The sources surveyed US teenagers from 13 to 18 years old:

How can banks and fintechs make a profit by targeting Generation Z?

The theoretical opportunities for making a profit can strike your imagination:

- Immediate profit: card or app monthly fees - in products designed for youth the fees usually start from $2 and may reach $10.

Banks and fintechs get it: parents are willing to pay for safety and expanded functionality: for example, attractive educational content or easy P2P transfers. Dashboards, tiers of access and control, easy-to-obtain reports will increase the perceived value of the app.

- Delayed profit: becoming a customer’s major financial provider in the future. The idea of acquiring customers early (as kids or teens) to build a long-term relationship seems lucrative to many fintechs.

Banking and fintech products that are targeting kids and teenagers

It’s not a widely-known fact about a popular neo-bank N26 from Germany: a couple of years ago it introduced a pocket-money card and an app, which went live in a beta-version. Afterward, the plans of this fintech radically changed and they switched to serving Millennials. In one of the interviews, one of the N26 leaders admitted that such an initiative was extremely risky by calling it “a crazy idea”.

Well, is it really so today?

Ask Pixpay, who just had successful funding round for the launch of their Card + App digital bank for Gen Zs up to 18 years old. Young users can get familiar with the service at the age of 10 already. Their parents will be in charge: the whole bunch of features is created for them, too: limits, rewards, tasks, and dashboards.

As society is growing cashless and digitalized, the age of pocket money is the right time to get the first plastic card and get used to personal finance management via a convenient mobile app. Previously the key question for parents was how much pocket money they should give, today the question is - how to give it. Piggybank starts looking outdated.

Another player on the market of financial apps for youth is Mitto: recently they raised $2M from investors. The startup provides e-wallets, a card with a fancy design and a mobile app for step-by-step immersion in digital financial management. With 150 registered users in Spain and half as many users from other countries willing to start using Mitto, the fintech showed a successful start: it is going to launch its services in Europe and Latin America soon.

Pixpay and Mitto are just examples of what fintechs offer for Gen Z and what kind of strategies they use to win in this lucrative and under-served market.

Here are a couple more of them:

Go, Henry

Go, Henry is a well-known fintech for kids and teenagers aged 6-18. It entered the market quite a long ago: in 2012 and became one of the first initiatives in the Card + App segment. The monthly fee of $3.99 per child, which is affordable for most parents. The relevant company value is £58M. In 2018 the company shared its objective to reach 15% of the market in the UK and the US. It can increase the number of customers to 6.6M, the value of their accounts - to $328M and increase the estimated revenue up to $10.6M.

It has a major educational focus: kids complete tasks to learn about the world of finance, the responsibility of spending and ways to attain their financial goals.

The startup is the UK leader in this market. It demonstrates an exponential growth in the last couple of years and shows that this market has a feelable potential to scale.

In the extended version of this article published at The Financial Brand we also consider:

and a few other banks and fintechs. Check it out not to miss anything.

Have something to add? Feel free to leave your comments below. Financial app development is our major specialization: about 60% of Qulix developers work on projects for banks and fintech companies.

For more information on our services, check out our website.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 781 135 1374

E-mail us at request@qulix.com