You want to launch an eWallet, but are unsure where to begin? Development from scratch seems to be leading the way, but then ready-to-use solutions step in and steal the show?

We get the dilemma — and that’s exactly why the Qulix team has prepared a detailed overview of the two distinct approaches to launching your eWallet. We share pros and cons and talk about our product — a wallet MVP that will allow you to hit the market in a fast and hassle-free way, without compromising either product quality or performance. Ready to learn more? Then keep reading.

written by:

Alexander Arabey

Director of Business Development

You want to launch an eWallet, but are unsure where to begin? Development from scratch seems to be leading the way, but then ready-to-use solutions step in and steal the show? We get the dilemma — and that’s exactly why the Qulix team has prepared a detailed overview of the two distinct approaches to launching your eWallet. We share pros and cons and talk about our product — a wallet MVP that will allow you to hit the market in a fast and hassle-free way, without compromising either product quality or performance. Ready to learn more? Then keep reading.

Contents

Development from Scratch vs. Ready-to-Use: the Details

The global software market is doing better than ever. According to Grand View Research, it was estimated at USD 730.70 billion in 2024 and is projected to reach USD 1,397.31 billion by 2030. Two major contributors to this dollar-producing machine are solutions developed from scratch and ready-to-use products. But how exactly do they differ?

The Basics

Development from scratch refers to the creation of a unique product, specifically designed to meet the objectives of a particular client. The result is a solution perfectly tailored to the niche target audience and business processes of that organization or individual.

Ready-to-use solutions offer a different approach. They are built to meet the needs of a broader, more generalized demographic. Their functionality reflects that — the feature set doesn’t aim to solve the unique challenges of a specific user group; rather, it enables users to perform operations that are commonly in demand.

This is why products like ready-made eWallets are considered universal: a single build can work equally well for an eCommerce business and a fintech startup.

But that’s just a quick overview of the basics. In reality, the nature of these two approaches is far more complex, with pros and cons on both sides. To better understand the nuances that await businesses choosing between them, let’s delve deeper into the specifics of launching an eWallet — from scratch or ready-to-use.

Let the Comparison Begin

#1. Cost

- Development from scratch. Requires significant spending on project management, development, design, and infrastructure.

- Ready-to-use solutions. An affordable way to launch your fintech product: either arrange a one-time code purchase or pay a monthly subscription fee.

#2. Complexity

- Development from scratch. Although custom projects promise flexibility, which is a smart long-term investment, assembling a product of this caliber is challenging. The stakes are high: your tech vendor must have a proven record of handling similar fintech projects, as much depends on their expertise and project management skills. Taking ownership of the result after implementation isn’t easy either: whether it’s you or your vendor, the team maintaining the product has to be top-notch.

- Ready-to-use solutions. These eWallets are already built and tested — all that’s left is tailoring them to your business, turning versatility into exclusivity. As a result, there’s far less pressure on both your team and your tech partner’s team: maintenance is much more hassle-free than with custom products.

#3. Customization

- Development from scratch. Allows you to tailor the solution to your company down to the smallest detail. Businesses turn to these products when they need unique features and design. This software can also be modified as your business requirements evolve.

- Ready-to-use solutions. There’s a risk of you ending up with a one-size-fits-all fintech platform that hinders your growth. However, depending on the service provider, you might still access rich customization options.

#4. Scalability

- Development from scratch. This type of product is highly scalable, as it’s built around your specific needs, using the latest technological advancements and a suitable architecture. It can support your business growth effectively without compromising functionality.

- Ready-to-use solutions. Although integrated scalability is present, it might not be the best fit for your business: often the number of users and/or the volume of data you can store in ready-to-use applications is limited. Hence, such eWallets might fall short when it comes to supporting expansion — potentially affecting performance, efficiency, and overall reliability.

#5. Time-to-Market

- Development from scratch. The process might take months or even years, depending on the complexity of the task and on-the-go alterations. Poor planning, unclear requirements, ineffective communication, and other factors may negatively affect the timeline of your project, causing you reputational damage and monetary loss.

- Ready-to-use solutions. A fintech platform in MVP format can be launched in as little as 90 days. Here, the risk of delays or budget spikes is minimal.

#6. Security

- Development from scratch. These eWallets can offer stronger, more tailored security, but only if built by vendors well-versed in data protection and regular audits. Once the solution is yours, you’re responsible for maintaining its compliance with regulations like GDPR, and that is no small task.

- Ready-to-use solutions. Providers of such applications typically have streamlined processes for fast vulnerability detection. They continuously update their products and ensure ongoing compliance with security standards post-implementation — letting you cross the cumbersome task of maintaining those standards off your to-do list.

The Results

Criteria

Development from Scratch

Ready-to-Use Solutions

Cost

High

Significantly lower (monthly subscription or code license)

Complexity

Highly complex — quality depends heavily on the tech vendor’s expertise

Pre-built and tested — only requires customization, which is a lot easier to implement

Customization

Highly customizable

Limited (depends on the tech vendor)

Scalability

Highly scalable

Limited (depends on the tech vendor)

Time-to-Market

Months to years

As fast as 90 days

Security

Potentially very strong — but relies heavily on the development team’s expertise and audits

Not as niche, but benefits from regular updates, audits, and vendor-level security oversight

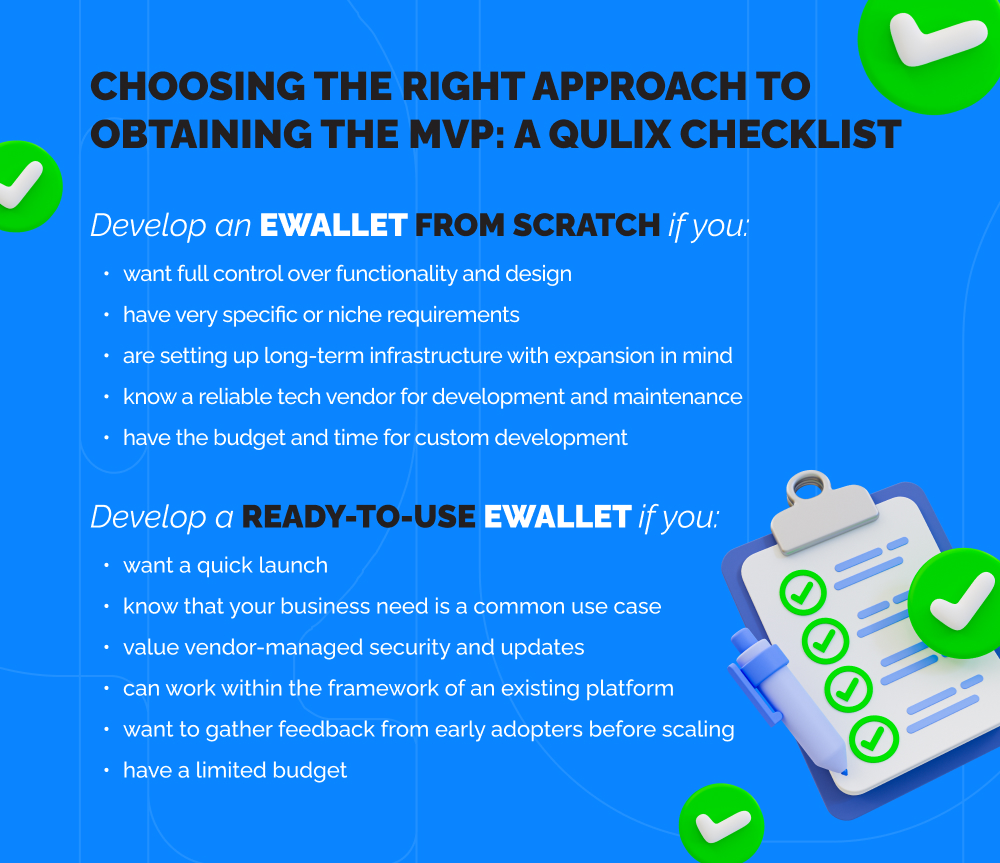

Which Approach Is for You? A Qulix Checklist

At Qulix, we’re strong advocates of rapid launches, well-tested products, and a personalized approach to every client. Our choice? Ready-to-use solutions — enhanced with rich customization options delivered by a seasoned team of fintech developers. If this approach resonates with you, let us introduce you to our wallet MVP.

The Fastest Path to Launching an eWallet MVP: the Qulix Edition

Why Our eWallet?

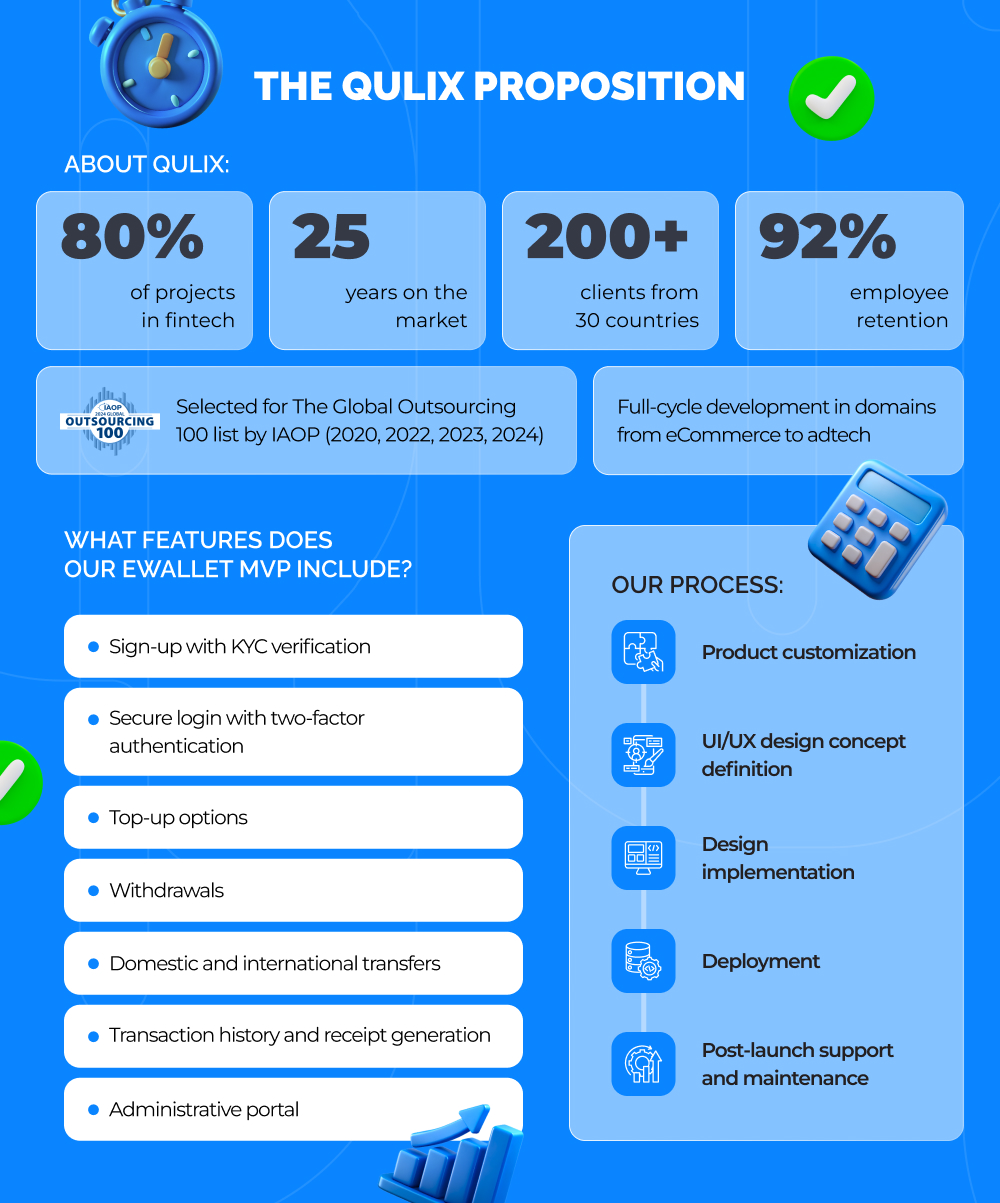

We’ve combined our hands-on experience with financial clients from around the globe to create an optimal schedule and feature set for a winning wallet MVP.

- It includes all the functionality needed to address common user requests.

- The features we’ve developed are thoughtfully designed and perfectly align with user expectations.

- Qulix has been on the market for 25 years, with 80% of our projects being fintech solutions. Our team of seasoned professionals has delivered products for Kyriba, Raiffeisen Bank Aval, BNP Paribas, and many other well-known clients in the banking industry.

- We develop not only web platforms, but also mobile and desktop applications, helping you reach your target audience across all primary digital channels.

- Our eWallet comes with a well-documented API for effortless integration into existing platforms.

- We’re all in on a creative approach and deep customization. If you have a specific request in mind, let’s talk — we’re always open to discussion and ready to dedicate 100% of our energy to delivering a tailored, state-of-the-art product.

Want to find out more? See the steps we take to deliver your product in just 90 days.

The Process

To reduce the risk of delays, budget spikes, and gather real user feedback, it’s best to first release your product as a minimum viable product. It takes about 3–4 months to launch, and here is what we focus on to deliver you the solution on time:

- We customize the product to ensure it reflects your brand’s identity.

- Our team defines a customer-centric UX/UI design concept.

- We implement that concept, replacing the default white-label design.

- Qulix developers handle deployment-related tasks.

- We take care of post-launch support.

As the next step, we establish a continuous product development process — with regular updates that introduce new functionality.

Now, we invite you to explore the functionality that can secure your spot at the forefront of the competition.

What’s Inside the Wallet MVP by Qulix?

The solution we’ve assembled is built and pre-tested, allowing you to launch your product quickly without major upfront investments. This approach is ideal for startups, SMBs, and any company looking to kickstart or expand their business.

The functionality of our eWallet MVP includes:

- Sign-up with KYC verification (mandatory for standalone wallets). To ensure the safety and transparency of operations, users are prompted to verify their identity.

- Elaborate login system with two-factor authentication (2FA), aimed at shielding user accounts and sensitive data.

- Top-up options. Your audience can choose whatever suits them best and add balance to their accounts via credit cards, debit cards, or bank transfers.

- Withdrawals. Flexible functionality allows funds to be transferred from eWallets to any card or bank account.

- Transfers: the eWallet by Qulix enables swift wallet-to-bank, bank-to-bank, and P2P money transfers. Both domestic and international operations are supported.

- Transaction history and receipt generation. Our solution allows users to manage their finances with clarity, giving them access to an in-depth overview of their operations’ history.

- Administrative portal. Developed for an effortless oversight of user activity on the platform, this functionality helps businesses establish control over user data, monitor performance and security, and more.

Making It

In the world of finance, the ability to earn more, faster, while doing less, is often a key to success. It mirrors the Pareto principle: 80% of effects come from 20% of causes. Do you want to invest 80% of your efforts in custom development for a chance at 20% of the results, or is it better to sign up for a ready-to-use solution and extract more profit from fewer investments? You already know what we think. What’s your take?

If our visions align, contact us. We’ll schedule a free online consultation to discuss your case. Let’s get your eWallet MVP to the market!

Related Articles

Mastering AI Prompts: A Guide to Writing Effectively with Little Pain

Artificial Intelligence in the Hospitality Industry: Service at Its Smartest

Unleashing the Power of AI Outsourcing: Your Ultimate Guide!

Contacts

Thank you, !

Thank you for contacting us!

We’ll be in touch shortly.

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com

Thank you!

Thank you for contacting us!

We’ll be in touch shortly.

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com