The mobile wallet market continues to grow rapidly, offering users convenient solutions for payments, storing funds, and international transfers. Its value amounted to $47.53 billion in 2024 and is expected to grow to $56.92 billion in 2025 at a CAGR of 19.8%. The industry is projected to grow at an average of 20% per year as more people switch to digital wallet payments.

written by:

Anton Rykov

Product Manager

Many companies are interested in digital wallet app development as it will give them a serious competitive advantage. They strive to launch the product to the market as quickly as possible, which often leads to a chaotic development process, exhausted team, and compromised quality. Optimized processes, thoughtful architecture, and competent resource management allow you to reduce the time frame without compromising stability and functionality.

How to avoid chaos, support the team and meet the deadline? Read our guide on how to create a digital wallet in 90 days, while maintaining the productivity and motivation of the team.

Contents

What Is a Digital Wallet?

A mobile wallet app (often referred to as an electronic wallet) is a digital tool that allows users to store and manage their payment information through their smartphones and other mobile devices. It serves as a convenient alternative to physical wallets. The most famous digital wallets are Apple Pay (for iOS devices), Samsung Pay, Google Pay, and others. E-wallet account opening enables users to make financial transactions with greater ease, speed, and security.

What Benefits Do Mobile Wallets Provide?

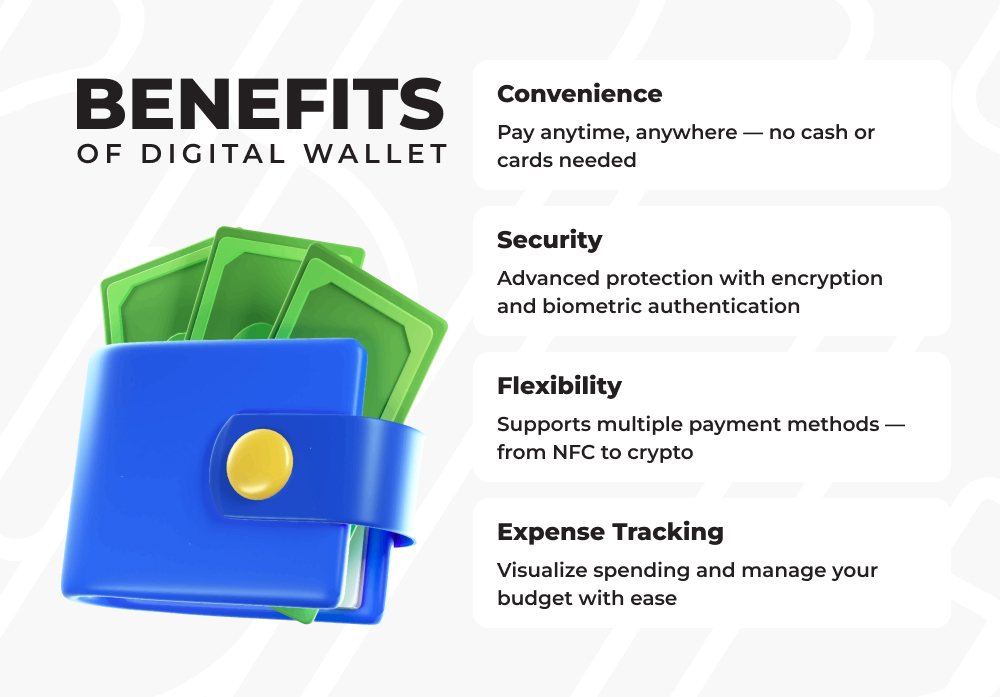

Before we tell you about the mobile wallet development, let's see what advantages digital wallets offer to customers:

- ConvenienceUsers can leave their physical payment cards or physical cash at home and make contactless payments or transfer money when and where they want. It takes just seconds to check the bank account information or monitor the payment process.

- SecurityAs a rule, digital wallet providers offer enhanced security features, such as point to point encryption, facial recognition, and other measures to protect payment information.

- FlexibilityMobile wallets support various digital payment methods, including NFC-based contactless payments, QR code transactions, cryptocurrency transfers, bill payments, international remittances, and many others.

- Expense TrackingWallet apps allow users to keep financial transparency and make more reasonable decisions. They classify the digital wallet transactions by categories and show diagrams. Customers see the spendings and can plan out the budget.

Thus, digital wallets have become an important finance management tool nowadays.

A Full Guide on How to Make a Digital Wallet

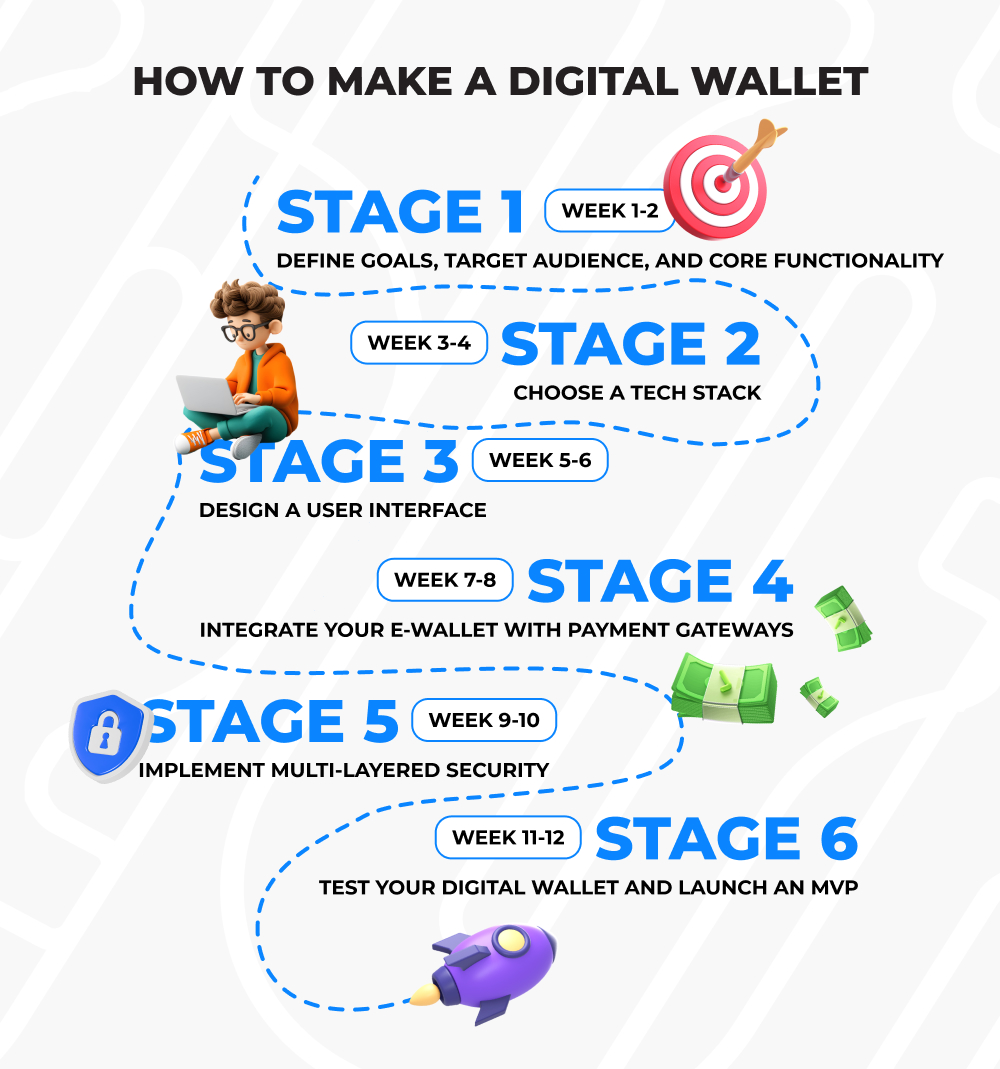

The digital wallet app development requires a comprehensive approach that covers technical, legal, and user aspects. Let's look at the main stages of building a digital wallet from idea to launch.

Stage 1: Define Goals, Target Audience, and Core Functionality (Week 1-2)

So, the development of a successful digital wallet app starts with a clear understanding of what tasks it should solve. It could be a simplification of transactions, multi-currency storage, making e-commerce payments, or integration with DeFi platforms. With a strategically sound goal you’ll be able to explain to users why they need your mobile wallet.

It’s also important to define a set of core functions. According to the AppsFlyer report, more than 50% of apps are uninstalled within 30 days after installation due to unmet expectations or false promises. That’s why you should decide on how much your digital wallet app improves user experience and who needs it - businesses, migrants, students, crypto enthusiasts, and so on.

At this stage, think about the compliance, such as the data minimization principles, purpose limitation and data processing transparency under the GDPR.

Stage 2: Choose a Tech Stack (Week 3-4)

Choose a tech stack taking into account your target audience’s requirements, project goals, and regulatory environment. If you want to quickly test your idea and bring the product to the market, use cross-platform solutions, such as Flutter or React Native with Firebase. It will allow you to launch the digital wallet app on both iOS and Android.

If you develop a scalable B2B solution, it will be better to choose a reliable architecture with customized backend (e.g., Kotlin or Swift for frontend, Java or Node.js on the server side, PostgreSQL or MongoDB for data storage, etc.). In any case, your mobile wallet must include encryption, biometric authentication, user consent management, as well as be compatible with the payment gateways.

According to the CoinLaw report for 2025, most digital wallets are developed using the following technology:

Component

Popular technology/solution

Comment

Mobile platforms

iOS, Android

More than 90% of users in Asia and 75% in North America make at least one mobile payment per year

Frameworks

Flutter, React Native

Accelerate the bringing of the digital wallet to the market thanks to the cross-platform development

Programming languages

Swift (iOS), Kotlin (Android), TypeScript, JavaScript, Python. Node.js

The choice depends on the architectural approach and development team

Databases

PostreSQL, MongoDB, Firebase

A balance between scaling, security, and flexibility

Infrastructure

AWS, Google Cloud, Microsoft Azure

Ensures the compliance with the GDPR/PSD2

Payment gateways

Stripe, PayPal, Braintree, Razorpay

Most popular and reliable providers that comply with the PCI DSS standard

Authentification

Biometric (Face ID, fingertips), two-factor authentication (2FA)

More than 75% of e-wallets support biometry

Monitoring and protection

AI-powered fraud detection, transaction logging, anomaly detection

40% of solutions use machine learning to detect suspicious activity

Stage 3: Design a User Interface (Week 5-6)

Once you’ve decided on the platform and technology stack, it’s time to create a user interface. It should be easy-to-use, secure, and adapted to everyday usage scenarios. Users should be able to immediately see their balance, transaction history, as well as transaction fees. Everything should be transparent and has credibility.

When a user performs key actions, such as transferring funds, the digital wallet app should display confirmation prompts to prevent errors. Provide simple navigation and quick access to key features. Your customers will appreciate simple design, plain language, smart visuals, and ability to make transactions in a few clicks.

Take care of the security and provide users with biometric authentication, real-time notifications, and prompts in case of suspicious activity. All these features will strengthen users’ confidence. Also, remember about localization - make sure that your secure digital wallet supports various currencies and languages and displays terms and transaction fees in familiar formats.

Finally, provide accessibility since contrasting colors, legible fonts, voice assistants and so on make digital payment apps comfortable for everyone. All these elements create a reliable and user-friendly experience that increases customer loyalty and helps wallets stand out in a crowded market.

Stage 4: Integrate Your E-Wallet with Payment Gateways (Week 7-8)

At this mobile wallet app development stage, your task is to choose a reliable payment provider. According to the NFC Forum Survey for 2024, people rank mobile payments higher because of security, ease of use, reliability, and convenience. That’s why it’s not just a technical decision but a strategic step, responsible for user experience.

So, what you should take into account when choosing payment processors:

- Security and Compliance with the Requirements

It should comply with the security standards like PCI DSS, PSD2, GDPR, and others. Check whether the payment provider supports the tokenization or fraudulent patterns detecting systems.

- Coverage

Make sure that the payment provider operates in the countries where you’re planning to launch your mobile wallet. Check whether it supports international and local payment systems.

- Technological Compatibility

The payment gateway should offer easy-to-integrate API, SDK, webhooks, and have high-quality documentation. It will be cool if it supports Apple Pay, Google Pay, NFC, and QR payments.

- Reasonable Prices and Fees

Choose the provider that offers a transparent pricing model, including transaction payments, monthly fees, and so on.

- Transaction Speed and Stability

The provider should ensure high transaction speed and stable operation, especially during peak periods.

- Maintenance and Flexibility

It will be cool to have a personal manager that is 24/7 available and ready to customize the solutions in accordance with your needs.

Stage 5: Implement Multi-Layered Security (Week 9-10)

According to Digital Bill Payments: Mobile Wallets Gain Popularity, But Hurdles Remain research study, 35% of surveyed users still prefer traditional payment methods. They don’t use mobile wallets due to security reasons. That’s why your primary task at this stage of the digital wallet development is to implement strong security measures.

These measures should include user authentication, such as biometric authentication (facial recognition or fingermark), two-factor authentication, PIN code, and liveness detection mechanisms. Other options are data encryption and tokenization when temporary tokens are used instead of payment details.

Enhance your security measures with behavioral analytics (e.g., abnormal activity detection), server-side limitations, configurable transaction limits, as well as push notifications for every transaction. Finally, remember about transparency and make sure that users understand how their data is processed and what happens during every payment transaction.

Stage 6: Test Your Digital Wallet and launch an MVP (Week 11-12)

Before you bring your e-wallet to the market, it should pass a number of technical tests and regulatory inspections. They include a legal analysis of user agreements, confidential policy, verification of cookie banner compliance, implementation of consent withdrawal mechanisms, and data export upon user request.

Speaking about usability, ask the following questions as you were a user:

- Is it easy to create an e-wallet account?

- Is it easy to set up an e-wallet account?

- How do I access my digital wallet?

Check all necessary app’s features and user scenarios, such as registration, authentification, making transactions, account management, and so on. When you launch an MVP, your goal is to monitor user behavior, collect user feedback to make improvements and enhance customer engagement, as well as document everything related to data processing.

How to Avoid Burning Out of Your Dev Team during the 90-Day Digital Wallet Development

How to build a digital wallet for 90 days and keep your development team sane in the process? The State of Developer Ecosystem 2023 report showed that 73% of developers have experienced burnout. The digital wallet implementation is a high-load process with severe deadlines, intensive sprints, and numerous critically important decisions.

To keep your development team productive and involved, we recommend you to create an environment where your employees have recovery resources and ability to have an impact on the results. First of all, divide the project into clear stages with priorities. Secondly, implement two-week sprints with retrospectives and time buffers to allow your team to have a rest, discuss difficulties, and improve the working process.

Final Words

A 90-day digital wallet implementation is an ambitious task. However, it's possible to perform it under certain conditions, such as the right architecture, clear priorities, and experienced development team. Focusing on these aspects will help you avoid common mistakes and significantly simplify the development process.

Besides, it’s required to observe the regulatory requirements to ensure security and users’ confidence. A regular legislation analysis and implementation of the best practices in the field of regulatory compliance will protect your product against the possible legal consequences.

The development team is the basis of your project; so, you should take care of your employees. Effective project management and ensuring a sound working environment will help you avoid burning out and increase efficiency. So, the right combination of advanced technologies, compliance with the regulations, and attention to the development team will allow you to successfully create a digital wallet and achieve the desired results as soon as possible.

Looking for a reliable fintech app development partner? Our experts are ready to help you develop a powerful mobile wallet app or simply tell how to create an e-wallet account.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com