E-wallets have become an integral part of digital life. Five million people use them to pay for goods, transfer money, store bonuses, and even manage loyalty programs. With the rapid growth in popularity of such solutions, more and more companies are considering creating their own digital wallet applications. But how much will it cost in 2025? Let's find out.

written by:

Anton Rykov

Product Manager, Qulix Systems

Looking at Digital Wallets

An e-wallet is a mobile app that allows customers to securely store payment information, payment cards, loyalty points, and other financial data. These applications provide a convenient payment method — one tap is all it takes to make a purchase. You don’t need to take a physical wallet with you; the only thing you can bring is your smartphone. Popular digital wallets include Apple Pay, Google Wallet, PayPal, and others. Consumers choose them for their user-friendly interface, security, and functionality.

Why Should You Consider Creating Your Own E-wallet?

Building your own digital wallet platform isn't just a trendy idea but a strategic tool that can radically transform your company's financial processes. Let's explore the benefits of launching your own e-wallet.

- Control over Your Payment Infrastructure

You won't be dependent on third-party payment systems like PayPal or Stripe, and you'll be able to manage all aspects of your transactions yourself, from fees and limits to currencies and processing rules. This control allows you to flexibly adapt to the requirements of different markets and quickly implement changes.

- Reduced Costs

With high transaction volumes, you can save on fees, especially if you use internal tokens or points instead of external payment gateways. Furthermore, automating payment and refund processes reduces manual work and the risk of errors.

- Increased Customer Loyalty

An e-wallet becomes a powerful tool for enhancing customer loyalty. It allows you to implement cashback, bonuses, and rewards programs, as well as offer personalized discounts and offers based on purchase history. The simpler and more enjoyable the payment process, the more customers will return to your app.

- Analytics

You'll gain access to valuable data and analytics. A digital wallet allows you to track user behavior: what products they purchase, when, and how often. This data can be used to forecast demand, segment audiences, and optimize marketing campaigns. Integration with CRM and other systems provides even more insights.

- Security

From a security perspective, a mobile wallet allows businesses to implement advanced security methods, such as two-factor authentication, biometrics, or encryption. This reduces the risk of data leakage and increases customer trust, especially in areas where privacy is critical.

- Innovation and Scalability

Finally, a digital wallet opens the door to innovation and scalability. It can be integrated with blockchain technologies, cryptocurrencies, NFTs, and Web3 applications. Support for new payment formats like QR codes, NFC, and biometrics makes a business more modern and ready for international expansion thanks to its multi-currency and localization capabilities.

Key Factors Affecting the Digital Wallet Development Cost

The cost of creating an e-wallet depends on many factors, from the chosen platform to the set of features. Below are the key aspects that determine the project budget.

Functionality

The more functions, the higher the cost. Basic features like balance viewing and money transfers are cheaper than more advanced options like:

- Multi-currency support

- Bill payment

- Integration with loyalty programs

- Biometric authentication

- P2P transfers

- Cross-platform compatibility

Each additional feature requires time for implementation, testing, and support.

Platform

Developing your own mobile wallet app for both Android and iOS increases costs. You can choose one platform to save money, but this decision will narrow the target audience. An alternative is cross-platform solutions (such as Flutter), which can reduce your budget by 20-40%.

Security

Financial apps require maximum security. This includes:

- Data encryption

- Two-factor authentication

- PCI-DSS and GDPR compliance

Implementing such mechanisms requires additional resources and qualified specialists.

Design

The interface should be intuitive and user-friendly. Template solutions are cheaper, but a unique design with animation and custom elements increases user engagement and the cost of the project.

Integration of Payment Systems

Connecting third-party payment gateways (Stripe, PayPal, Square, etc.) is a separate item. The more payment methods you have, the more complex and expensive the integration is.

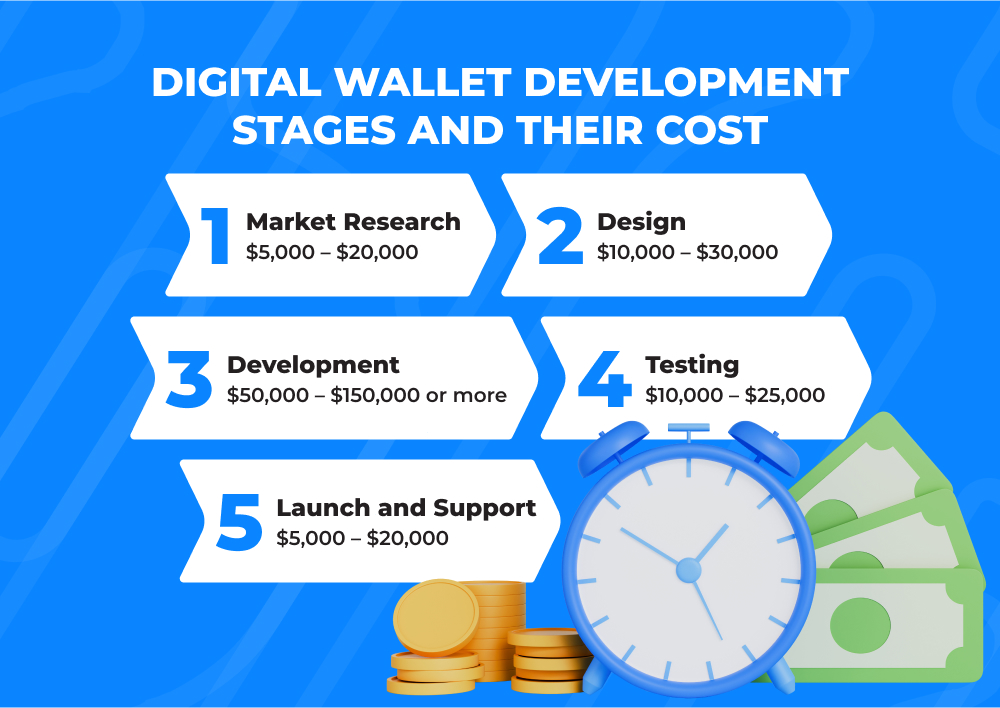

Digital Wallet Development Stages and Their Cost

Developing an e-wallet app goes through several key stages. Each requires time and budget. Let's take a closer look:

Stage 1: Market Research

During this stage, you should study the market, target audience, competitive solutions, as well as legal requirements. Then, develop the product concept and define the key features, architecture, and business model. The cost of the market research stage can range from $5,000 to $20,000, especially if you decide to attract external analysts and lawyers.

Stage 2: Design

The next step is to create prototypes, mockups, interaction scenarios, and the digital wallet's visual style. A well-thought-out design is critical to user trust and convenience. Depending on the complexity of the interface and the skills of the designers, this stage can cost between $10,000 and $30,000.

Stage 3: Development

This is the most labor-intensive stage, which is divided into backend and frontend. The backend includes dealing with server logic, databases, APIs, security, encryption, and integration with payment gateways and banks. This part is the most expensive and technically complex stage, especially if a high level of security and scalability are required. Its cost can range from $50,000 to $150,000 or more.

The frontend is what the user interacts with: screens, forms, notifications, and settings. The cost of this part depends on the number of platforms (iOS, Android, or Web) and the level of customization. On average, it ranges from $30,000 to $80,000.

Stage 4: Testing

During this stage, the digital wallet must be tested for functionality, security, performance, and compatibility. Data security testing is especially important because the slightest vulnerability can lead to information leakage and loss of trust. It can cost between $10,000 and $25,000, depending on the depth of testing and the number of devices.

Stage 5: Launch and Support

After successful testing, the mobile wallet is ready for publication in app stores. Remember the server setup, monitoring, updates, technical support, and marketing. Monthly support costs can range from $5,000 to $20,000, depending on the number of users and infrastructure.

How Much Does It Cost to Develop a Mobile Wallet App?

So, the minimum budget for developing a digital wallet with basic features can start at $100,000, while more advanced solutions with multi-currency support, cryptocurrency, biometrics, and analytics can exceed $300,000-500,000. It all depends on your ambition, scale, and security requirements.

Type of the Digital Wallet

Approximate Cost (USD)

Basic (just money transfers and balance checking)

$30,000 – $50,000

Middle (bonuses and multi-currency)

$60,000 – $100,000

Advanced (feature-packed, cross-platform, high level of security)

$150,000 – $200,000+

How to Reduce Digital Wallet Development Costs?

You can reduce mobile wallet development costs through proper planning, technology selection, and team optimization. For example:

- Launching an MVP

We recommend you start with a minimum viable product (MVP). This is a set of features without which your e-wallet can’t fulfill its core purpose. This allows you to avoid overspending on unnecessary features and focus on key scenarios, such as registration, balance refill, money transfer, and making payments. You will be able to test the idea, gather feedback, and gradually add new features.

- Using Ready-Made Solutions

Many payment providers, such as Stripe, PayPal, Adyen, and banking APIs, offer tools that can be integrated without having to write everything from scratch. This reduces development time and mitigates security risks.

- Outsourcing

Consider outsourcing a team from countries with more affordable rates while maintaining quality. For example, developers from Eastern Europe, India, or Latin America can offer competitive prices with a high level of expertise.

Bottom Line

Developing an e-wallet app is an investment in the future. By 2025, such solutions will become the standard, especially in e-commerce and fintech. For a successful project, it is important to:

- Clearly define goals

- Choose the optimal feature set

- Ensure security

- Consider the user experience

- Plan a budget that takes support into account

If you have any questions regarding digital wallet development, don’t hesitate to contact us. Our specialists are glad to answer all your questions.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com