Big data analytics in the insurance industry is hardly news. The sector was one of the first major finance players to tap into the potential of information technologies, and it remains true to its original course. After all, what insurance providers do is they assess risks and hedge against financial losses. That requires a lot of data, and the insurance business understands its value like no other. Also, the research by McKinsey & Company found that data-driven companies are 19 times more likely to be profitable. Surely, that isn't news to insurance agents.

Our point is that insurance companies know what they're doing and like speaking the language of facts. We're going to match their energy and cogitate on how big data analytics is redefining the industry.

written by:

Alexey Kovsh

Senior Solutions Architect

Contents

The Modern State of the Insurance Industry

The global insurance market was worth almost six trillion U.S. dollars in 2022, but in the upcoming years, it is expected to grow significantly, Statista reports. They also discovered that climate change and cybercrime are the two top risks of modernity that challenge the insurance business (i.e., extreme weather conditions aggravate health issues and increase the number of property-related incidents, such as wildfires and floodings). At the same time, as Deloitte writes, these risks intensify “focus on the insurance industry’s capacity and readiness to react as society’s 'financial safety nets'.”

Still, insurance comes with a price, and insurers are failing to raise it fast enough to compensate their expenses, especially in the face of such a brutal and unpredictable calamity as climate change. The same report by Deloitte states that 2022 was the 8th year in a row with at least 10 US natural disasters, which caused over $1 billion in losses. That made property-catastrophe reinsurance costs skyrocket by a staggering 30.1% in 2023, while in 2022, it was only by 14.8%.

These reports boil down to two obvious things:

- Many insurance companies have the opportunity to do more than just risk assessment and turn that activity expansion into an industry game-changer. Risk prevention and loss mitigation are just a few things they can excel in to adapt the field to the terms and conditions of the world. A huge part of that shift lies in the customer-centric approach, which is something every finance-related industry lacks. Apart from elevating customer satisfaction rates and deepening consumer trust, it is also financially beneficial. A report by McKinsey & Company found that “the likelihood of generating above-average profits and marketing earnings is around twice as high for those that apply customer analytics broadly and intensively […] The effect on sales is even greater: 50% of the customer-analytics champions are likely to have sales well above their competitors’, versus only 22% of the laggards.”

- Insurers have to reinvent their positioning in the market. Risks do seem to become gradually more unsupportable, but still, there are ways to overcome the challenge. The real trouble — and its cause — is that many participants of the insurance industry don't have a clear pricing strategy. As yet another Deloitte study suggests, firms that provide insurance services “do not have a clear view on how to position themselves in the market, how to differentiate themselves from their competitors, and what portfolios, products and segments to focus on. As a consequence, pricing does not necessarily contribute to an insurer’s strategic objectives”.

There are no immediate suggestions on how to defeat global risks and avoid drastic financial consequences. But we do have a few industry insights that can give insurers some perspective on the ways to transform their relationship with customers, as well as to increase their profitability and relevancy. The key to that turnaround is rooted in big data technology.

Without further ado, let's explore in detail how it can add some bright colors to a grim-looking circumstance.

Why Use Big Data in Insurance?

Insurance heavily relies on statistics that derive from relevant customer information. Yet, they tend to limit data sources to financial transactions and medical records. On the other hand, big data analytics in insurance introduces new settings where you can extract patterns of customer behavior, market trends, and hidden correlations. Internet clickstream data, social media contents, customer satisfaction survey responses, web server logs, sensors spreading with the rise of the Internet of Things — our modern informational treasury offers these findings and more for the benefit of the industry.

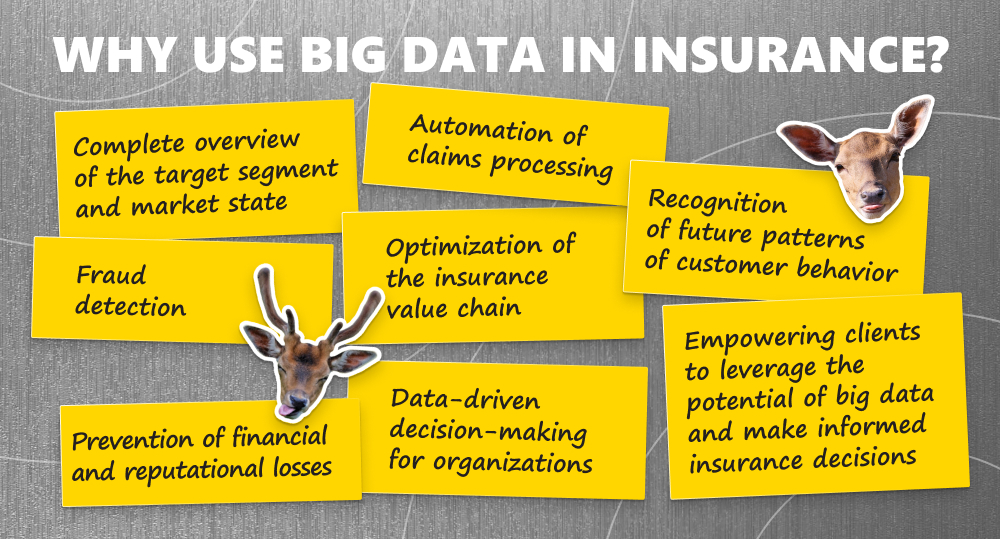

If you're still not convinced that those insights come in handy, here are a few reasons to give big data in the insurance sector a shot:

- Data analysis is a way to put to work both structured and unstructured data and extract valuable insights in bigger quantities (e.g., structured data is things like Spreadsheets, JSON, and XML files, while its unstructured counterpart is text documents, web pages, audio and video files). Such a panoptic coverage of historical data as well as data collected in real-time across a myriad of sources draw a bigger picture of the target segment and market state.

- Access to higher quality, in-depth information gives insurance industry players more space to study and optimize their insurance value chain. It also provides them with grander opportunities to apply data-driven decision-making.

- Predictive analytics and predictive modeling both utilize big data to identify fraud and assist with claims processing, highlighting high-risk clients. These data analysis types help recognize future customer behavior patterns to retain customers, and insurance companies aiming to increase customer satisfaction rates are 80% more likely to do so. Last but not least, these predictive guys decrease the undesirable prospect of significant financial and reputational losses and assist with tasks that are growing more complex and time-consuming.

- Big data doesn't benefit just one side — clients can take action, too. They have the opportunity to apply such data to extend their knowledge of the market and trace the most suitable insurance options at the best price.

*If you'd like to learn more about how big data might change your business, we're offering big data consulting services. Write to us, and we'll schedule a meeting to discuss your case ASAP.

Application of Big Data Analytics in Insurance: Use Cases

Use Case

Description

Key Benefits

Personalized services

Insurance industry players get to carve more comprehensive customer profiles. Businesses can perfectly match their propositions with the people who need them. E.g., they can offer an individual plan of insurance coverage that fits into a client's budget or works well for people with a certain lifestyle.

Meaningful customer engagement that resonates with client expectations; affiliation, competitive advantage, better sales.

Customer acquisition

Online behavior of users is a limitless source of insights. To seize the potential of such unstructured data means to acquire the ability to create targeted marketing campaigns. The outcome is warm leads and clients that fit the profile.

Expansion of customer database, new market opportunities, reduced marketing expenses, increased profits.

Customer retention

Customer data trends, historical data of client interactions with a company, and their customer journey let businesses understand customer behavior on a deeper level. They can promptly spot changes and react: provide support or update the pricing model to respond to the emerged needs and pains.

Continuous and solid customer-company relationships that results in a good reputation and steady profits.

Claims management

Data analytics allowed insurance companies to automate claims processing. Instead of spending excessive time and human resources to process claims manually, companies can analyze existing data and leverage the power of predictive modeling.

Lower administrative and claims costs, increased accuracy and speed of legitimate claims resolutions, quicker identification of fraudulent claims.

Improved risk assessment

Advanced analytics allowed to develop underwriting tools and automate the insurance underwriting process. Risk prediction has become more accurate and efficient. Businesses gain the ability to set premiums that reflect the policyholder’s level of risk. While advanced technologies handle the back-office work, insurers focus on the work with people rather than data.

Protection from financial and reputational losses, improved customer experience, less fraud.

Insurance fraud detection

Artificial intelligence and machine learning spot trends, patterns, and detect anomalies based on historical and real-time data. Companies take action much quicker, reducing the severity of consequences. Fraud prevention also becomes feasible: technology can pinpoint individuals who are more likely to submit a false claim report.

Protection from financial and reputational losses, proven trustworthiness and reliability, a positive effect on the branding.

*Explore what artificial intelligence and machine learning services we offer to our clients.

Wait, What about the Challenges?

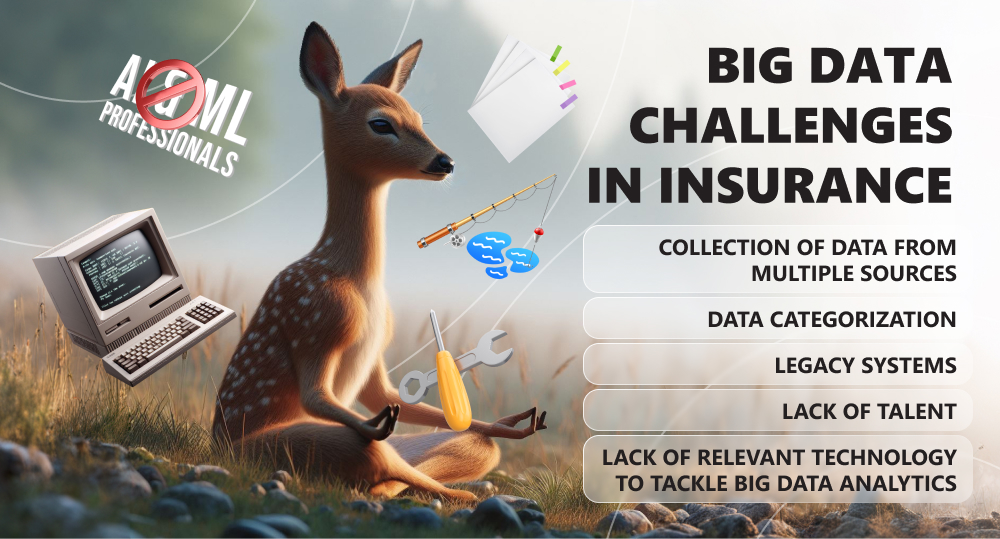

As you can see on the infographics below, there are three main challenges that the insurance industry has to deal with.

Big Data — Big Trouble?

Welcoming in new technologies and practices is never easy. When it comes to big data, that's even a more dramatic shift for any insurance company. As usual, there are two possible outcomes: you either excel and elevate your business, or you fall down the rabbit hole and crumble under the challenges. Nevertheless, with a clear understanding of your market positioning, target segment, and infrastructure readiness, you'll definitely nail it.

If you need iron tools to build a better future for your insurance company, contact us. Qulix has a vast experience with insurance and legacy systems.

Valuable Insights

In the insurance domain, big data is a way to achieve significant improvements in how the industry responds to the needs of clients, as well as optimizes its internal processes. Whether it's health and life insurance companies, travel agencies, firms that offer auto insurance, or agencies that cover other needs of the public, insurance data analytics is a game-changer for the industry as a whole. Predictive analysis, predictive modelling, and other applications of AI and ML make it possible to streamline workflows, welcome in automation that saves time and money, and enable business growth.

There are many ways to apply analytics. The real-world use of big data in insurance includes claims management, risk assessment, customer retention, customer acquisition, and many other instances.

The industry struggles with applying data analytics because of a few reasons:

- there are multiple data sources, which makes it difficult to assemble, cleanse, and classify the required information;

- data categorization is a very complex task, since many parameters like data value, location, usefulness timeframe, information type, retrieval rights, etc. have to be taken into consideration;

- legacy systems that many players of the insurance domain still use, alongside the lack of skilled force and relevant tools to work with big data, hurdle the progress, too.

If you analyze big data, you get the chance to automate many complex processes, such as underwriting and claims processing. Also, you can increase fraud detection rates, predict when customers are more likely to cancel their insurance and take appropriate action, and study competitors' offers to secure a more advantageous position in the market. Other benefits of big data in insurance include more meaningful customer engagement, better sales, and decreased marketing expenses.

In health insurance, big data refers to vast volumes of structured and unstructured information, such as data from electronic health records (EHRs), medical imaging, genetic data, wearable devices (IoT), and more. The utilization of the cloud computing infrastructure allows to collect such records in limitless volumes and safely store and process them.

Big data lets insurers tap into patient demographics, health conditions, treatment outcomes, and healthcare utilization patterns. This medical history helps to better understand risk factors like genetic predispositions, assess risk profile more accurately, predict healthcare costs, and tailor insurance offerings to individual needs.

Additionally, big data analytics in health insurance helps to detect fraud, optimize claims processing, and enhance care coordination efforts.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com