Banking applications operate with customer funds and sensitive personal data, so no wonder that the testing approach, in this case, is completely different from regular software testing practices. Poorly and incompletely performed testing leads to serious incidents (such as unauthorized transactions, app operation errors, data breaches, and a high bounce rate) that a financial service provider may face. Keep on reading to have a better understanding of the banking domain testing, the challenges which you as an app owner will have to tackle, and find more about test cases for banking applications.

written by:

Anastasia Borodinets

Banking applications operate with customer funds and sensitive personal data, so no wonder that the testing approach, in this case, is completely different from regular software testing practices. Poorly and incompletely performed testing leads to serious incidents (such as unauthorized transactions, app operation errors, data breaches, and a high bounce rate) that a financial service provider may face. Keep on reading to have a better understanding of the banking domain testing, the challenges which you as an app owner will have to tackle, and find more about test cases for banking applications.

Today the financial services domain is more dependent on technology-enabled products than ever. However, it is not only the sophisticated development platforms that give the public top-notch banking apps. To build a strong emotional bond between the brand and the users, there should be a solid guarantee that the products delivered are stable and well-performing. Only thorough software testing can ensure that.

Banking domain testing, which implies a process of evaluating all aspects of banking software operation, helps development teams and QC specialists determine whether a banking app is capable of performing millions of transactions seamlessly and error-free, guarantee high ROI and retain old and attract new clients.

Things you need to know before testing a banking app

To test a banking app, though, is not the same as testing a calorie calculator or a music app. So, what exactly are they – the extensive functionalities that make banking apps especially challenging to test? See below the essential characteristics of a banking app that the testing engineers run checks for:

- Concurrent user sessions (an average banking app should serve for about 3000-5000 concurrent users)

- Various banking services (balance checks, money depositing, and withdrawal, currency purchase, statement of account, etc.) should be provided in real-time and without delays

- The app should track each transaction detail and report them immediately to the users

- All payment transactions are performed in a secure and confidential manner

- There is a reliable data storage system where users confidential data are stored

- The application can integrate with several third-party services or internal bank systems

- The app has a disaster recovery management system to ensure the recovery of data in case of data loss due to hacking, malware, software corruption, etc.

Now as you know what app functionality the QA engineers have to test, let’s find out what stages banking domain testing projects are usually divided into.

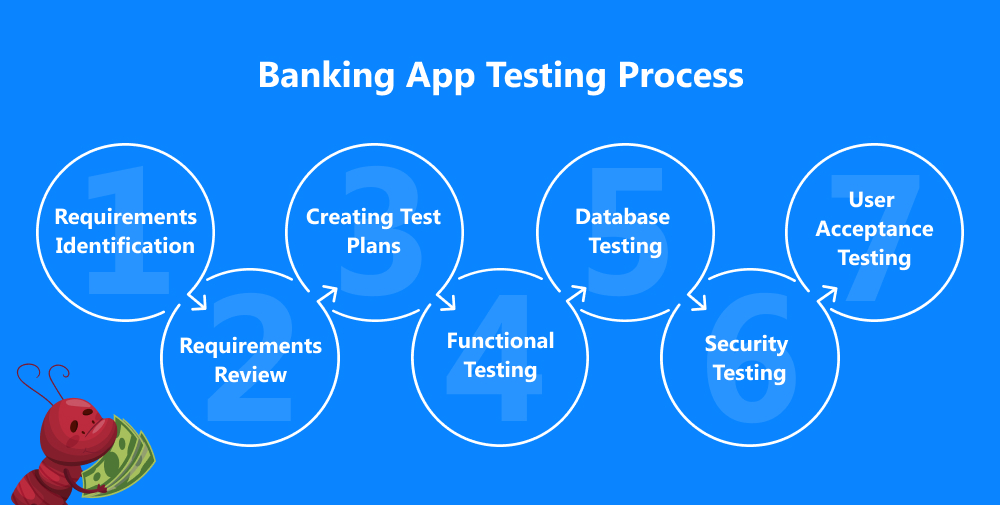

Banking app testing stages

As a rule, the banking domain testing process looks like this:

- Requirements identification

In this phase, a testing engineer analyzes all requirements to classify them as functional specifications or use cases. Generally, each specific set of requirements belongs to each specific banking app module — money transfers, mortgage loans, bill payments, and so on.

- Requirements review

To polish up the list of application requirements stakeholders organize meetings where workflows and scenarios are discussed.

- Creating test plans and suits

During this stage, automation engineers pick test cases, determining which of them fit for test automation. The phase also implies creating custom scripts.Ф

- Functional testing

A QA specialist executes tests to make sure user workflows work correctly.

- Database testing

At this stage, testers run tests to ensure app data integrity and also analyze database schema, types of data, speed of data loading, etc.

- Security testing

During this phase of software testing, the QA team has to check whether the application is compliant with security standards and regulations, such as OWASP. Security testing is an absolute must in a banking app to guarantee that users' sensitive data is only accessible to authorized parties and properly protected.

- User acceptance testing

Since users’ satisfaction with the application’s functionality is critical, QA specialists use focus groups to investigate service quality.

Well, now you know which steps every QA team has to go through to deliver a nice-looking, properly-functioning, and reliable banking app for you. These steps can vary from company to company, however, we have listed above one of the most common and complete app testing scenarios.

Nevertheless, does the above path alone guarantee successful app testing in 100% of cases? Nope, as every stage of the STLC has its own bottlenecks. See them below to be ready to tackle them successfully.

Most common challenges faced while testing banking applications

Sure thing, finance domain application testing doesn’t come challenge-free.

Let's delve deeper into the most common challenges that QA engineers meet when testing products in the banking domain.

Third-party integrations

Testing third-party integrations are the major challenge for banking apps test teams as this type of apps usually integrate with 5+ third-party systems already at the start of the project. QA teams have to work hard on access problems or incompatibility of the systems since lack of access to some of the third-party products may seriously hamper the user experience.

Maintaining consistency across devices and systems

Operational efficiency is critical to users. That is why developers and testing teams have to ensure the product works consistently across multiple operating systems and various browsers.

Moreover, users should be able to enjoy the application on the latest iOS and Android software versions. Besides, the app developers must keep in mind that a good share of their audience is using next to the latest and even old versions of the mobile OS. This is especially true for Android users, so remember to run the corresponding checks before the app goes live.

Real-time data support

To ensure all users have real-time access to the application's features QA specialist must put in a lot of time and effort in testing network connectivity.

Performance failures

To ensure the required performance levels, the QA engineers should give proper attention to such factors as connectivity, infrastructure, and backend integration. Besides, the transaction spikes need to be controlled at regular intervals.

Additionally, to enable thousands of transactions at every point in time, the app test team should run proper load and stress checks.

Testing internet banking applications – best practices and cases

Now we would like to share with you some of the best practices and cases which we apply in our banking app testing projects. Follow the tips below to properly plan your banking domain application testing projects and get impressive results.

Best practices for testing banking applications

- To be certain that the application operates correctly, in every release, run testing several cycles for business-critical scenarios.

- After each release, the test team should carefully review and modify all test cases according to the new functionalities and changes.

- If any defect is detected in production, the scenario should be included in the test scenario – it will help avoid the issue in future releases.

- To make sure that the environment is stable, test engineers should perform shakeout testing after each build.

- The latest versions of internal banking tools should be tested properly across ALL platforms so that the banking application runs correctly on as many devices as possible.

- Logging and capturing bugs and issues makes it easier for test teams to determine the root.

- Keep all the specifications and any relevant project documentation to make it easier to work on upcoming releases. Document each release functionality in a common document.

- Store all test data in a common document.

Sample test cases for banking applications

Don’t know where to start your testing? Follow these simple rules that we apply when running checks on our banking apps.

- Start from simple actions: Is the user able to login using the valid username and password?

- After three or more unauthorized attempts (using an invalid username and password) banking app users must be blocked. See to it during app testing.

- Proceed with basic functionalities like balance checks or small money transfers.

- The user should be able to add a decimal number and shouldn't be able to add a negative number into the amount field.

- The user shouldn’t be allowed to perform money transactions if there is not enough money on the account. See to check it!

- Especial attention should be given to the user verification during money transfers – the app should ask for a regular password, or OTP, a code from an SMS/e-mail, etc.

- As long as the transaction is successful, the user must be given a supporting document. All the checks should be stored on a device and easy to find.

- Check if the user can change the password by him/herself or test the procedure to change it with the bank officer.

Bottom Line

What is banking application testing? What are its main features to test? What challenges will I have to face during banking app testing? Now you know it all.

As you can see, banking app testing is a comprehensive multistage process. It should be planned carefully and done thoroughly to ensure a bug-free, fully functional, and high-performing application to service millions of users. Such a complex process includes functional testing, database testing, security testing, and others from above.

Besides being multi-component, testing a banking app also implies many challenges such as maintaining consistency across devices and systems, performance failures, and etc. Especial attention should be given to third-party integrations, as no modern banking app operates in isolation.

Finally, to ensure proper banking app testing, follow our best practices, and try out the test cases above. Start small, keep an eye on details and your app is going to become a hit on the market!

However, if you need a deeper comprehension of the banking app testing process or are looking for a reliable banking app testing partner, do not hesitate to contact our team for advice!

Qulix Systems, with its powerful blend of vetted testers and efficient testing strategies, has already helped dozens of banking and financial clients successfully deliver their applications. Feel free to contact us to know more about our test teams and testing expertise.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 781 135 1374

E-mail us at request@qulix.com