SMEs represent a tremendously large market for banks. According to the BankingCircle, in Europe, small and medium enterprises make 99% of all businesses and create more than 85% of all new jobs in the last five years. In the US, there are 30 million SMEs. They generate about ⅔ of jobs in the private sector and have $46 trillion of annual spending power.

SMEs represent a tremendously large market for banks. According to the BankingCircle, in Europe, small and medium enterprises make 99% of all businesses and create more than 85% of all new jobs in the last five years. In the US, there are 30 million SMEs. They generate about ⅔ of jobs in the private sector and have $46 trillion of annual spending power.

While digital transformation in banking successfully facilitates the life of retail banking customers, SMEs are still underserved by incumbent banks in Europe and in the US. According to market analysts, the problem is they are offered banking solutions that are created with the retail customer in mind.

To fill in a gap between the needs and offers, some international networking platforms that gather business bankers appear. They provide relevant and reliable data on what banks and fintechs create for SMEs now, and what opportunities the future holds for them. Such initiatives are gaining momentum because bankers are aware of the trend: 7 out of 10 SMEs are ready to look for third-party financial services if their banks fail to offer them. More than half are ready to switch banks if they don’t find the services they require.

Good news for banks’ competitors

The beginning of the Open Banking era provides new opportunities for businesses to connect with banks-challengers, multi-bank platforms, and fintech companies.

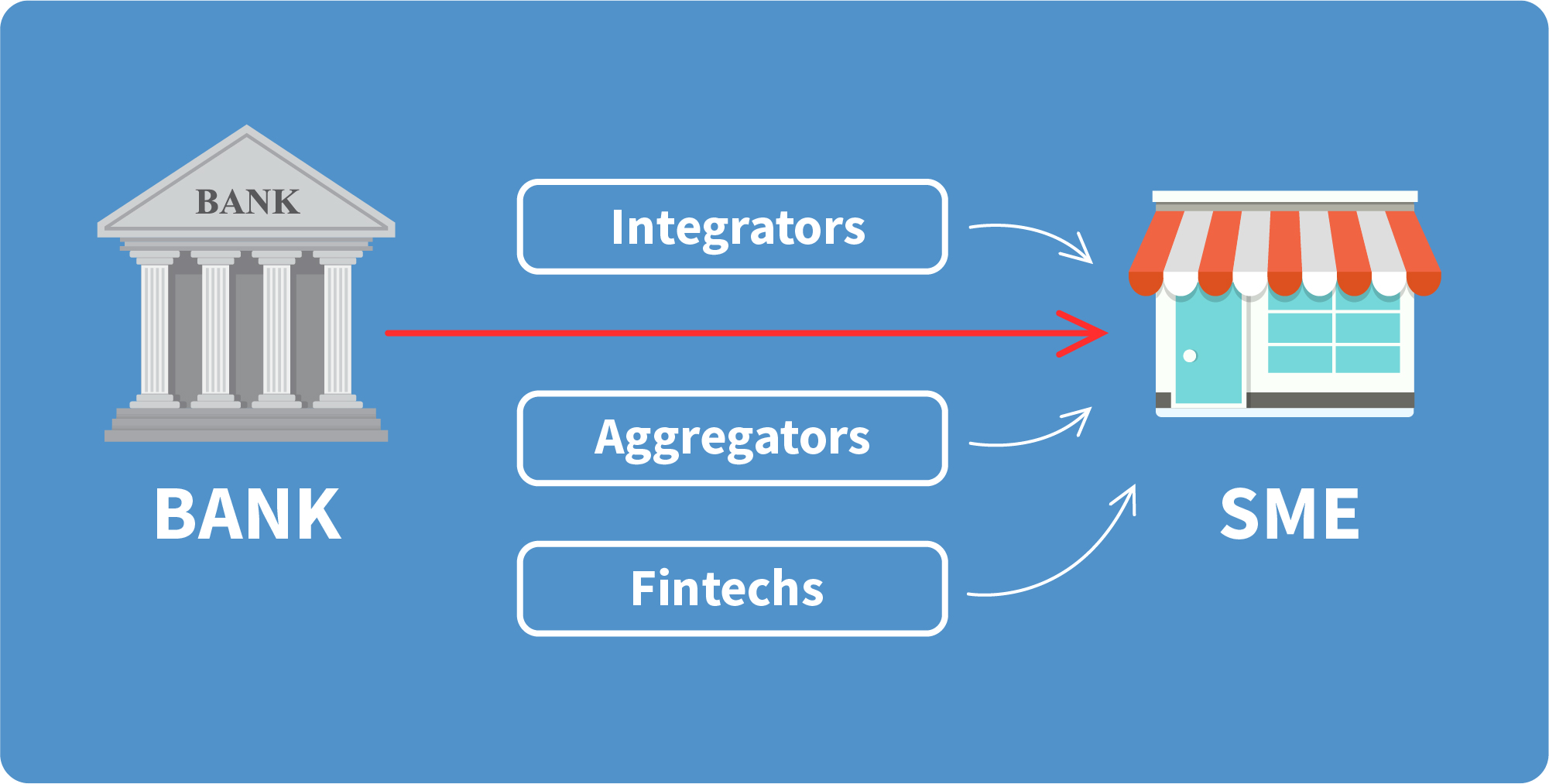

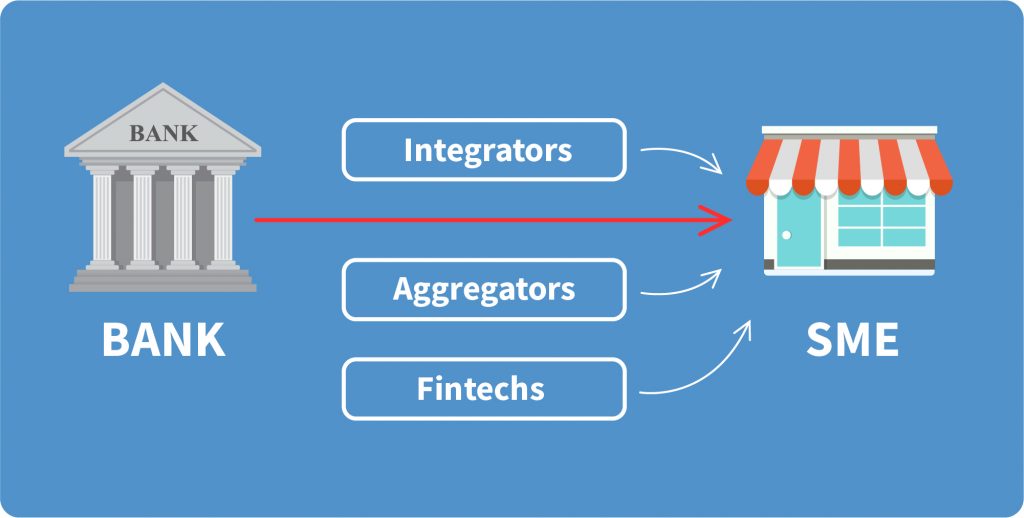

What does the market of digital financial services look like today? Separate entities provide corporate customers with innovative banking apps full of financial and non-financial services they need. There is a battleground appearing as the open banking strives:

Banks go digital

Many banks are transforming and leveraging top-notch technologies to expand their digital presence. Here is what they tend to do:

- Improve UI/UX;

- Work on building omnichannel customer experience;

- Implement new security features;

- Create modular architecture;

- Invest in valuable content for users;

- Offer value-added services.

The strategy is viable but can be not enough. Let’s see what other market players do:

Integrators address the pain points in the value chain

Integrators may vary from e-commerce providers (Amazon or Alibaba) to accounting platforms (SAP, Oracle, Intuit), or procurement platforms (again SAP, Tradogram, TradeGecko). They tend to push banks against the wall in the digital channels by providing financial services directly to clients, including them into their integrated offering.

Aggregators provide price transparency

Aggregators are multi-bank platforms, which act as intermediaries mostly in retail banking and the insurance market, but are becoming more popular in SME banking as well. Some experts say that aggregators have enough potential to stand against the integration model. Giants like Oracle and SAP already developed digital products aggregating data, which can be used by corporate treasurers of large companies in order to find the most lucrative foreign exchange options. The time of multi-bank marketplaces for FX or payments is coming. As for now, the trend reflects the needs of large corporations, not SMEs, but it is difficult to make predictions.

Fintechs build direct interaction with customers

Fintechs entered the market in such areas as payments, FX, and capital finance almost completely disintermediating banks, which is quite frustrating for them. Due to simple and intuitive UX, competitive pricing and a clear focus on niche services, fintechs become a tough competitor for banks to beat.

How to re-engage with the SMEs?

To win back SMEs, banks should face their real needs. For example, unlike large-scale companies, smaller businesses feel greater pressure when undertaking their administrative and financial activities (like payments to suppliers, payroll and paperwork) on their own. Owners and managers struggle to navigate several platforms for banking, ERP (enterprise resource planning) and human resources trying to gather important data in one place.

What digital banking strategies are potentially winning on the SME market?

Instead of being just a “financing pipe” for businesses and see their market share is gradually shrinking, banks can become something more. However, it requires a transformation. Banks need to slowly turn into strategic advisors, who speed up the workflow and empower small and medium-sized enterprises with a wide range of tools beyond financial ones (becoming a one-stop-shop). SMEs look for recommendations and support at turning points, for example, when they start to export or make an acquisition. By providing value-added services to meet the broader needs of small businesses, banks can re-engage with their corporate customers.

What does it take to reinvent the SME digital banking strategy?

First banks need to engage in the issues, create a viable action plan and decide on the role of software development vendors in this plan.

Here are some helpful questions to ask:

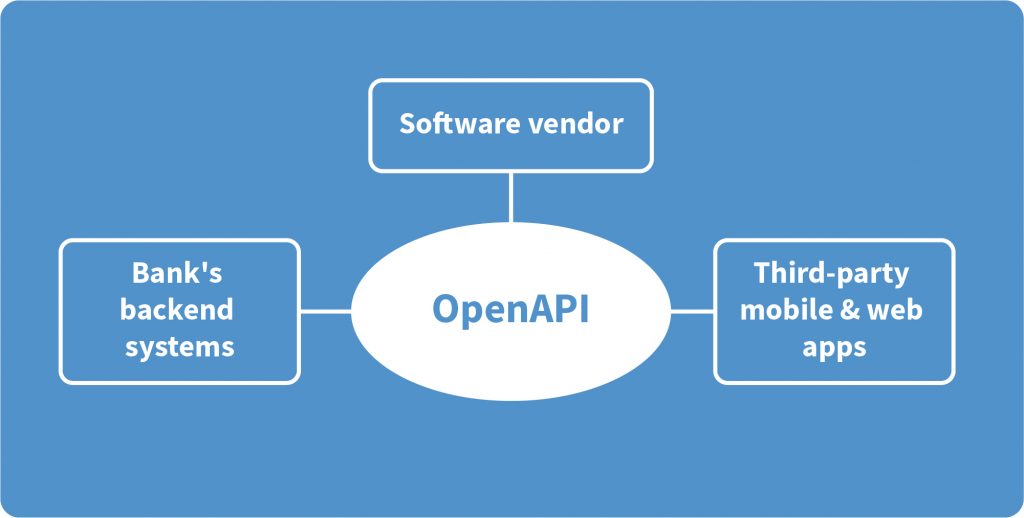

- Is the bank ready to distribute third-party products and services via open API?

- Vice versa: is the bank ready to have its products distributed via other digital financial platforms?

- What is the value this bank provides to its SME customers today? What value it is willing to create? What are the priority ways to build added value?

For example, to launch a highly functional corporate portal, which offers financial and non-financial services for SMEs (consider the example of Russia’s Tinkoff Bank or Modulbank). Investing in technologies for targeted customer relationship management is another good idea. It helps banks address the major pitfalls of small and medium-sized businesses and become their technological partner (not only financial).

- Is the bank capable of becoming an aggregator itself? It may encompass the SME market as a whole or remain sector-specific.

The key question

What level of software vendor’s engagement is comfortable and affordable for the bank?

Banks can select between:

- buying readymade software solutions with minimum customization;

- partnering with a full-fledged software outsourcing company (on a turnkey basis);

- building their own software development teams and engaging in co-development with the vendor (a hybrid model);

- having an independent software development team.

Our company is aware of mobile banking trends and is offering IT services in the banking sector: like developing mobile banking apps for Android and iPhone. It’s up to the customer: to choose banking software development on a turnkey basis or to choose cooperation with the software vendor, which shares expertise and insights with the bank’s development team. One of the primary reasons to choose experienced software vendors is they can take a proactive position and implement complex projects for SMEs.

A separate platform for SMEs with the potential to become an ecosystem

It may start from Mobile Banking for SMEs, procurement, accounting and reporting, logistics, e-invoicing, references, payrolls, staff management, customer analytics, liquidity management, and more.

Business Finance Management (BFM) system

As far as the BFM is concerned: almost 4 million small businesses in the US alone would appreciate consolidated digital services. They include payments, cash flow tracking, invoicing, payroll and statistics. According to the same source, only 1 in 10 SMEs have organized financial data of any kind. BFM allows easily managing investments, operate the cash flow, monitor financial data, manage taxes, plan the budget and work with the financial calendar. AI-powered Business Finance Management system can help the bank build a competitive advantage without increasing software development costs a lot (in comparison to building an ecosystem).

Open API

Software vendors can assist in implementing open API projects of different kinds:

- Basic. Cooperation with the software development company starts with signing an NDA, studying the documents and bank’s digital infrastructure. The vendor prepares the system for the integration of third-party services, which are required by SMEs. The integration itself is carried out by the bank and its partners.

- Revenue share projects. Software vendors can build proprietary e-invoicing for SMEs, digital customer onboarding systems, and corporate mobile banking services.

They can either be developed on the vendor’s platform or be a custom development. The services are implemented into the bank’s digital infrastructure according to the revenue share model. The fees can be calculated per transaction, per customer, and etc. - API marketplace. It implies becoming a fintech app store by providing core financial infrastructure, staying in control over customer data. It can help banks grow their assets under management, offer deposits for capital requirements and get a chance to benefit from interest margins in credits.

- Collaborations. Banks are most often collaborating with fintechs according to the complementary principle - for example, recently Metro bank announced new fintech partnerships to boost SME offering. Another example is the collaboration of Nordea bank and Spiff fintech regarding savings. Some banks may go further and promote cross-industry collaboration. For example, Polish mBank cooperated with Orange (a telecom provider) to launch mobile banking aimed at SMEs.

- Multi-banking aggregators. By providing customers with a unified overview of their bank accounts banks get a chance to build a relevant user experience. The goal is to become the customer’s favorite bank instead of the customer’s only bank. Another option is to become an independent advisor including data from other sources to give a whole picture of everyday finances. The difficulty here is to be ready to include competitive proposals if they better match customer’s needs.

Final Takeaways

No matter, what strategy you choose to follow to be more helpful for small and medium-sized enterprises, our vendor’s opinion is that open banking has great potential in this regard. While banks get more actively involved in digital ecosystems (or even start new ecosystems), the delivery of banking products for SMEs is going to transform in order to become more valuable.

Qulix Systems offers digital banking solutions for SME based on its proprietary StandFore FS platform. Feel free to contact us at request@qulix.com to find out the details.

About the author:

Denis Novikov, Deputy Director of Business Development at Qulix Systems.

Denis is:

· A strategy development consultant for Digital Banking products;

· An expert in the field of software development and implementation for financial organizations;

· A representative of the StandFore FS intellectual banking platform.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 781 135 1374

E-mail us at request@qulix.com