The last decade has become a strong momentum for the insurance industry. Just ten years ago, insurance digital transformation challenges seemed to be something like file backups support with a new server. While today, service-oriented architectures open the way for innovative data-driven solutions and empower the shift to new digital prospects for insurers.

However, this transformation is not a royal road. So, let us uncover what digitalization challenges the insurance sector has to overcome.

written by:

Alexander Arabey

Director of Business Development, Qulix Systems

The last decade has become a strong momentum for the insurance industry. Just ten years ago, insurance digital transformation challenges seemed to be something like file backups support with a new server. While today, service-oriented architectures open the way for innovative data-driven solutions and empower the shift to new digital prospects for insurers.

However, this transformation is not a royal road. So, let us uncover what digitalization challenges the insurance sector has to overcome.

Why Is Digitization Important in Insurance?

First, let us define the true meaning of digital transformation for the insurance industry. Today, it is more than infusing digital technology into all processes and areas of your company. It is the shift of your business culture when you are ready to face the challenges. You should be prepared to think and act proactively to deliver top-notch value to your customers.

According to McKinsey, insurtech is the main driving force in the industry. The investments in insurtech globally reached $14.6 billion in 2021 (they doubled compared to $7.2 billion in 2019).

Thus, the insurance sector is increasingly dependent on cutting-edge technologies to improve efficiency, reinforce cybersecurity, and scale capability across companies. Moreover, particular emphasis should be given to upgraded customer experience through streamlined processes and personalized services.

The three pillars of digitalization in insurance lean on the following principles.

#1. Omnichannel Customer Relationships and Distribution Models

Do you have a lot of chances in the modern insurance business if you still rely on traditional customer relationships with agents and brokers? PR Newswire expects the global mobile insurance market to reach $39.96 billion in 2022, and in 2027, it is projected to hit $39.96 billion with a CAGR of 11%.

That is why you should implement technologies and provide a sustainable choice of digital channels. They can be websites, mobile apps, comparison platforms, social media, and other comprehensive solutions to reach present-day audiences.

#2. Internal Operating Boost

Another level of new digital reality lies in transformed consumer habits. Today, our customers want immediate service responses at any time: without days off or limited working hours.

In view of this, insurers pay special concern to building innovative infrastructures and adjusting internal processes and capacities to address customer needs lightning fast. Tech surveillance during the whole customer journey optimizes operational and organizational structure, lowers costs, and helps offer profitable personalized products.

#3. Progressive Data Management

The key advantage of a successful insurance strategy lies in the perspective of understanding your customer as closely as you can. Data management systems that use advanced data analytics, sociodemographic criteria, and mass processing provide deep insights of your audience.

This valuable knowledge of your customer helps develop tailored insurance products. Such products take into account lifestyles, needs, and preferences of your clients. They are personalized and profitable.

What Can Be Digitized for Insurers?

Now we'll try to understand the roadmap for digitally tuned insurance vendors. Why not learn from Esurance — one of the pioneers of the online insurance business?

Esurance started its business in 1999 with an innovative idea to sell car insurance policies over the internet. The company cast aside traditional phone calls or in-person meetings.

Digital centralization allowed Esurance to become a recognizable front runner of the market and offer great and popular perks for its clients. For example, you can easily manage all your policies, file and track claims in one mobile app or online portal. Also you can use Rideshare insurance or coverage of custom parts.

Today Esurance expands rapidly and offers a set of attractive home insurance products. We have no doubts that the company will continue its development grounded in digital technologies.

Want to know what capabilities of digitally tailored infrastructure Esurance successfully uses? Here are three examples of digitalization from the company.

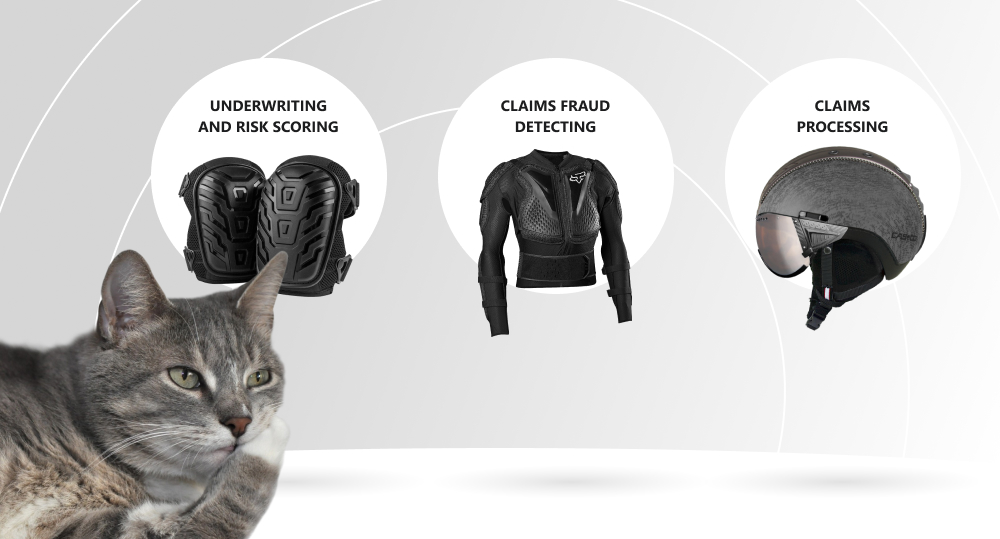

Underwriting and Risk Scoring

Core processes of risk assessment are far more effective when you implement AI and ML models. Automated underwriting drastically improves profitability. Today, you can gather data about your clients and their devices and get a clear view of all potential risks.

In car insurance, for example, you can utilize driving records and habits of the driver, value of the insured vehicle, burglary rate of the area, etc.

Claims Processing

Each layer of the claim (review, investigation, adjustment, and final remittance or denial) require loads of documents. Here, document automation tools are a great change.

You can automatically retrieve data from documents. What is more, you can use AI to interpret images of auto accidents or estimate repair costs in real-time.

Claims Fraud Detecting

The services get robust support of predictive analytics to detect fraudulent claims. For instance, it can use text analytics of the data from claimants' stories.

Mind the Challenges

However, process improvements and new technologies also have hidden agenda. To tell you the truth, many insurers today have to digitalize without lofty goals in mind. They are forced to adapt to the new reality of the modern market to be able to survive and continue operation.

In 2022, insurance leaders should be extremely careful to pave the way of their progressive digital strategy and fit into longer-term goals.

So what are the biggest challenges that digitalization sets for insurers in 2022? Let us get all this straightened out.

Combination of the Past and the Future

If your company is a startup, you will always have to introduce the existing processes into the upgraded capabilities. Your old systems can't just fade away. Otherwise, there is a threat of losing the customers.

What is more, when starting a new unit, prepare it for future changes as technology keeps on evolving. And our life is full of unpredictable problems such as the global pandemic.

The best remedy to this pain is to have your response team or a reliable insurance software development vendor that will master your company's continuous transformation.

Training Focus

Although your clients may be more than willing to start their upgraded digital journey on your new platform, it doesn't mean that they'll switch to it at the snap of a finger. That is why it is crucial to build easy and straightforward interfaces and adapt them to the range of available platforms, systems, and devices.

One more training perspective should be focused on your employees to help them effectively operate in an upgraded insurance environment.

Data Explosion

Digital solutions for insurers also mean new standards and exponential explosion of data. Let us take catastrophe models as an example. To manage risks, an insurance company will have to get information about homes and businesses that are potentially exposed. So, its writings will expand to cover a wider set of risks in the future.

Data and variable explosion will also lead to the upgraded standards of data quality and unified interpretation. Let us take, for instance, a single claim number that can be assigned to a car accident or to each party of the accident. If there are any variations in the interpretations, you could end up with inaccurate results and predictions.

Utmost Security

It is hard to underestimate the importance of robust security for all stages of the insurance process with two primary types of attacks here: target systems vulnerabilities and data stealing or manipulating. One day, you may find that your website is disabled or that there is a breach in your clients' private information storage.

In view of this, insurance companies have particular responsibilities in safeguarding their data systems.

Resource Limits

The problem of limited resources can be a huge obstacle on the road to digitally advanced insurance. When many companies are struggling to survive in rapidly changing markets, where can they find extra means to invest into innovations?

But let us face the reality: if insurers do not pick up the pace of global digitalization trends, there will come new players into the markets right the next day.

For this reason, a reliable digital transformation vendor with extended expertise in fintech software development will be a game changer for your business.

Wrap Up

As reported by Technavio, the insurtech market share is estimated to increase by $33.73 billion from 2020 to 2025, at a CAGR of 45.28%. It is another piece of evidence that insuranc5

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com