Is implementing blockchain a good idea? See for yourself. According to Buy Bitcoin Worldwide, “the global blockchain market will be worth $1,431.54 billion by 2030, growing at a CAGR of around 85.9% from 2022 to 2030.” The same source states that blockchain can reduce 30% of banks' infrastructure costs, i.e., more than $10 billion every year. The statistics prove that blockchain really knows its way around money: it attracts investments because it allows businesses globally to both save and earn more. And that's not to mention its other fantastic benefits!

Without further ado, let's take a look at cases of blockchain implementation across industries and explore how you can navigate this process.

written by:

Alexander Arabey

Director of Business Development

Contents

Implementation of Blockchain: Who Has Been There, Done That?

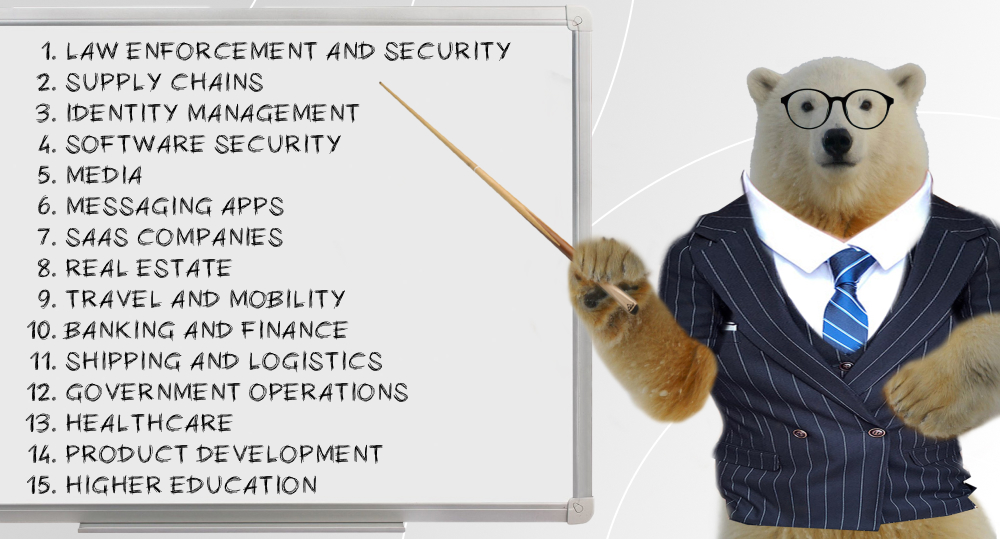

Do we traditionally associate blockchain with the finance sector? Yes, and for a reason: as CompareCamp notes, this industry holds a leading position in blockchain development, with a 46% share. This is huge and not surprising, considering how drastically the technology helps battle money laundering, decrease cases of fraudulent behavior, and enhance transparency, speed, and security of transactions. But does blockchain serve just the realm of finance? Absolutely not: in contrast to a popular opinion, blockchain is a multipurpose little fella. Deloitte writes that “there are only a few industries that are not either excited or worried about the [blockchain] concept”, and Forbes confirms the statement with a nod of approval and a list of 15 fields that can benefit from this technology:

Blockchain is just one of those things: when the technology steals the scene, it steals it for good and instead of upgrading the rules reinvents the game. Yet now it is us who believes that. To prove to you how sensational and transformational its presence is, we're inviting you to dive deep into the blockchain application in a few very contrasting industries.

#1. Media and Entertainment

It may come as a surprise, but media is one of the industries that actively applies blockchain. To find the answer to the question “why?”, let's turn to the Deloitte research on the field. This is how they elucidate the state of affairs, “Media users are largely accustomed to having free access to a wide variety of content, and most of them are still reluctant to pay subscription fees for “premium” content behind paywalls. In addition, all media segments have suffered significantly from digitization, since content can be copied and distributed easily and without loss of quality.”

In other words, while users enjoy a great content feast, creators and businesses worldwide face unfair income distribution triggered by piracy and middlemen that interfere in deals. What helps battle them is blockchain technology implementation, more specifically, smart contracts. Those are programs that run on a blockchain and cannot be altered. They automate deals between two parties, which means they do not release funds (which can take any form) for either one of them until certain predetermined conditions have been met.

Integrating blockchain technology into the industry of media and entertainment leads both users and creators to the following benefits:

- Streamlined royalty payments. Without third parties, creators get the chance to receive a much more fair income transparently and securely. E.g., musicians can get payments each time their track is played. With smart contracts, it's also possible to specify the percentage that everyone involved in content creation should earn and distribute profit between them.

- Elimination of piracy. It was found that “the U.S. economy loses $12.5 billion in total output annually as a consequence of music theft.” Horrifying, right? Blockchains have the power to change the narrative: they eliminate the third party, so no one can access someone's content for free and/or distribute it. A creator sees who purchased their art, the number of its uses, etc. If the purchaser wants to share it with another person, they will be charged again. Thus, copyright stays intact, all stakeholders receive rewards, and content sharing occurs legally among those who do not want to pay regular subscription fees to streaming services.

- Peer-to-peer sales and content distribution. Costly platform subscriptions are slowly becoming a thing of the past, as progressively more users want to consume various content (news articles, videos, music, films, etc.) from separate platforms. Micropayments on blockchain make it possible, since they let users pay for its individuals pieces. For customers, this pricing model results in flexibility, cost-efficiency, and diversity, while for businesses, it's all about the opportunity to successfully meet the contrasting needs of multiple target audiences and earn on both subscription fees and sale of individual pieces of content.

Let's take a look at a few use cases of blockchain integration in media and entertainment:

Audius

A blockchain-based decentralized music streaming platform that returns the power to the hands of creators. They can upload and produce immutable records, decide on how to monetize them on the platform, and directly interact with their audience. AUDIO, a native cryptocurrency by Audius, secures the network and allows fans to get access to their favorite artists' exclusive content.

Mirror

Mirror is a publishing platform that pushes the boundaries of writing online: you log in with Ethereum, store your writing on Arweave, and publish using Mirror’s credibly-neutral protocol. You mint your posts as collectable , i.e., the platform allows a new form of patronage to writers and lets them build their community. Moreover, it is also possible to create Writing NFTs.

Live Bash

With the help of blockchain and smart contracts, the platform lets performers (musicians, comedians, dancers, etc.) book stage time, livestream, and swiftly create digital collectables and NFTs of their performances. Fans can almost instantly purchase these assets on the Live Bash marketplace, which features no gas fees and off-chain compatibility. According to Live Bash, their ecosystem creates “additional affordable opportunities for undercapitalized performers.”

#2. Healthcare

Grand View Research writes, “Blockchain technology in the healthcare sector globally is predicted to reach $231.0 million by 2023, with a 63% growth rate over the next six years.” These digits make perfect sense. While security is at the core of pretty much any field, it is absolutely crucial for healthcare: the industry deals with sensitive data, drugs, and big money.

Blockchain implementation can deliver that security right into the hands of healthcare providers, granting them the following benefits:

- Supply chain transparency. Since drugs have to be transported from labs and pharmaceutical companies to hospitals across countries, the risk of drug temperance is high. To decrease it, the transportation has to be transparent for both importers and exporters. This is what blockchain offers: each drug receives its own distributed ledger, and each transporting point is entered into the blockchain. In case of a force majeur, it will be easy to trace all the way back to determine culprits, vulnerabilities, and strengthen the system.

- Patient-centric EHRs. Healthcare systems globally struggle with the problem of data silos, i.e., medical professionals and patients have a very fragmented view of medical histories, which leads to faulty diagnoses, improper treatment, and deaths. A way to overcome this major issue is to store existing electronic medical records on a blockchain to provide a unified patient history to all parties. The patient data itself isn't saved there, but each new record about prescriptions or lab results is. The only real owner of such data is a patient, and medical professionals are able to view it only if the patient provides its consent. Adopting blockchain also lets the patient to receive a notification if their profile has been updated. This way, it is possible to both protect sensitive data and monitor patients' health a lot more accurately.

- Fraud elimination. As McKinsey & Company reports, “an estimated 5 to 10 percent of all [insurance] claims are fraudulent. According to the FBI, this costs US non-health insurers more than USD 40 billion per year.” And we're talking just about insurance! But whether it's that, or prescription manipulation, or patient and medical professional identity verification, the risk of things going terribly wrong is high. The good news is blockchain-based smart contracts enable businesses in the healthcare sector as well as patients to fix that. They authenticate identities, log in contract details, deal with payment settlements, and more. Whatever the case, all parties use the same shared contract stored on a blockchain ledger. There is simply no room for misunderstandings. Nobody can alter, counterfeit, or duplicate the info. Such strict conditions lead to security, transparency, and high speed of operations because the possibility of disputes over claims or ID checks significantly decreases. Also, there are no intermediaries that slow down the process.

Now, we invite you to explore the benefits that healthcare companies gain due to blockchain implementations.

Medicalchain

The company uses implemented blockchain technology to establish a patient-centric way of managing health records. Their goal is to battle the siloed approach to collecting and handling patient data and eliminate inaccuracies. As the company writes, “patients have the ability to grant access to their electronic health records (EHR) to other users and revoke access by setting up a time limited gateway, thereby improving their experience and guaranteeing data security.”

Nebula Genomics

The leading privacy-focused personal genomics service. The company aims at making direct-to-consumer DNA testing secure and wants to create technologies that will enable users to “benefit from biomedical research [i.e., understand their health and ancestry better] and contribute to future discoveries without compromising their privacy”. Users have full ownership of their data that stays intact thanks to blockchain. It keeps hackers and genetic testing providers away and prevents unauthorized government access.

Chronicled

Chronicled is a custodian of the MediaLedger Network, a blockchain-powered network within the life sciences industries. Chronicled helps pharma companies manage supply chains, regulatory compliance, contracting relationships, and track suspicious activity, such as drug trafficking. The company automatically settles all kinds of transactions in the realm of life sciences. This helps prevent manual processing, revenue leakage, and cash flow delays.

#3. Fintech

Last but not least, let's talk about fintech. After all, this is the area of our utmost interest and expertise: 80% of our projects lie in fintech product development. Additionally, here are some figures for you: according to Global Newswire, the global fintech blockchain market size is expected to grow USD 8.7 billion by 2030 at a CAGR of 43.8%. These billions are easy to explain: blockchain completely transforms the very essence of the finance industry, both for businesses and customers.

Financial institutions have long been known as highly conventional establishments that are difficult to deal with, especially for people without an in-depth knowledge of the subject. All transactions and all operations are lengthy, highly bureaucratic, and have middlemen present each step of the way, which makes service fees skyrocket. And just like that, the need for a clearer, much simpler way of dealing with financial matters has occurred. What turned the idea into the feasible reality was technology, specifically, blockchain, that allowed to exclude the risk of human error through the introduction of self-executing smart contracts.

The most common use cases of blockchain implementation in the finance industry include:

The blockchain introduction has led financial companies willing to step onto the road of digitalization to the following benefits:

- Improved customer experience. No more one-size-fits-all solutions: blockchain implementation allows financial institutions to offer personalized services to customers. Now, it is possible to find a neobank or a digital bank* that will serve your specific needs or have you as its target audience: there are businesses that work with a certain demographic, profession, or ethnicity.

- Decreased transaction costs and speed. Blockchain is essentially a peer-to-peer network: transactions occur just between two parties, so no middleman cuts into profit and overcomplicates the process. Bookkeeping, database management, labor costs and other spendings that are so common for large established financial institutions are also nonexistent in the realm of fintech.

- Security and transparency. Traditional financial services are centralized, i.e., sensitive data is stored on internal databases, aka honey pots for hackers. Since people monitor every operation, the risk of human error and security breaches from within is also high. At the same, if something goes wrong, the majority of staff will stay oblivious to the matter due to the lack of transparency in the system. Blockchain is a great tool to avoid such bottlenecks: it is immutable, automated, and guarantees anonymity of its users.

*If you would like to know how to build your own neobank, and how these banks differ from digital and traditional banks, check out this article.

Let's take a look at a few financial companies that went for blockchain technology implementation and succeeded:

China Construction Bank

The bank has teamed up with blockchain-based private market exchange ADDX headquartered in Singapore to make it possible for domestic investors to invest abroad.

Commonwealth Bank Australia

CBA has partnered with one of the world’s largest crypto exchanges, Gemini, and a leading blockchain analysis firm, Chainalysis, to provide its customers with the opportunity to buy, sell, and hold crypto assets. These features are available to customers in the CommBank app.

AlphaPoint

A white-label software company and its award-winning blockchain technology help operate crypto markets globally and digitize a variety of assets: loans, currencies, private company shares, and more. They provide assistance in automating workflows and issuing smart contracts. One of their inventions is AlphaPoint Indexes, a platform that shows statistics on the crypto performance.

Nium

A modular platform for seamless cross-border business payments available in 190+ countries. They help companies expand, streamline local payments, improve customer experience, and more while making transactions and card issuance fast and simple. Users are free to customize their financial services on the platform and work with various currencies, including crypto. To explore how far blockchain opportunities can lead, Nium has launched the first global Crypto-as-a-Service platform for organizations willing to introduce crypto into their regular operations.

Salt

A lending platform that offers crypto-backed loans for businesses and individuals, as well as provides “scalable institutional-grade crypto custody and blockchain monitoring products”. On the platform, it is possible to leverage Bitcoin, Ethereum, Litecoin, Tether, and other cryptocurrencies for USD or stablecoin, and the process is fast and easy. Users can customize terms of their agreement with Salt and choose their rate. The Salt tool “Proof of Access” lets customers alter their loan conditions with the help of the SALT token.

The information we've gathered above says loud and clear that successful blockchain implementations are not a myth and take place in a myriad of industries. So if you own a company and want to give this technology a try, shoot your shot, because the field is booming and invites you to do the same. And we're going to back you up with our blockchain implementation guide.

How to Implement Blockchain Technology? 6 Steps to Turn Blocks into a Chain

#1. It All Starts with a Use Case

Blockchain solution implementation is a great idea, but you should have a clear understanding of why you need it. How can developing blockchain applications change your business? What problems will it solve for you and your customers? Do you know how to govern and administer blockchain? Ask yourself all these questions to find out the exact business objectives that blockchain will highlight and serve. This will also help you identify possible pitfalls and areas of improvement to take care of prior to the big step.

#2. Never Disregard a Proof of Concept

A proof of concept (PoC) is a way to make sure that a) your idea is valid; b) developers can realistically implement it; c) you become aware of potential risks and obstacles; d) you don't invest in a costly full-fledged development process of a product that will not work.

To build a PoC, follow these steps:

- Develop a set of guidelines that can deliver your vision to project stakeholders and show them the scale of the product.

- Code a prototype and implement 1–2 vertical scenarios involving all layers.

- Test the product.

- Analyze your MVP (a minimum viable product), which shows the minimum set of key features that your business project should have to attract early adopters.

#3. Aim for the Right Blockchain Platform

This is a strategically crucial step, since various blockchains offer different opportunities. See carefully what works for your project needs and budget best. Pay special attention to whether a platform that you have in mind is a private blockchain (open) or public (closed) since the terms on which people access a blockchain affect the security and speed of transactions. Although open blockchains are easier to set up for small businesses, they are not as fast as closed ones.

Let's take a look at a few blockchain systems available today. Select a relevant blockchain carefully.

Ethereum

One of the oldest and most established blockchain platforms. It's public, not as fast and cheap as other blockchains, but it is a great option if you need to develop innovative contracts, make peer-to-peer payments, or build decentralized apps. Uniswap, MetaMask, Compound — the list of DApps built there goes on and on.

IBM Blockchain

A private network that works best as an enterprise blockchain. Its developer tools are flexible, functional, and customizable. They simplify critical tasks like smart contract deployment. Financial services and banking, as well as supply chain management, are the most successful use cases of blockchain.

Stellar

This public blockchain platform works well with all kinds of DeFi apps. It uses its very own Stellar Consensus Protocol, which speeds up the processing time for business transactions on this public blockchain network. International trade and currency exchange are quite popular use cases for this blockchain-based solution.

Hyperledger Fabric

A great private foundation that permits to craft blockchain applications or solutions with a modular architecture. It is the result of a collaboration between Linux and Hyperledger, and it lets components like consensus and membership services to be plug-and-play. A great option for supply chain management.

R3’s Corda

A permissioned and extremely secure blockchain (or an alternative type of distributed ledger — the debate is hot and ongoing) perfect for financial services. As TechTarget reports, “it uses a novel consensus mechanism in which transactions are cryptographically linked but does not periodically batch multiple transactions into a block.” The blockchain efficiency allows for transaction process to happen in real time, which leads to improved performance. It was specifically designed for financial services.

Multichain

A private enterprise blockchain platform. As their website suggests, it lets cut development time by up to 80% and gives an opportunity to perform milti-asset and multi-party exchange transactions. It's customizable, developer-friendly, and offers flexible security (multi-signature, external private keys, cold nodes, etc.). Banking and finance, healthcare, human resources, e-commerce, education, retail — it works great with any industry.

Solana

Perhaps the most efficient blockchain technology out there. This public blockchain network offers high transaction throughput alongside low latency and fees. It is a perfect fit for DApps and tasks like running computations, storing data, or transacting at high speed and in high volume.

#4. Time to Pick a Consensus Protocol

As Blockchain Council writes, “a consensus mechanism is a protocol that is followed by all network participants in a decentralized network so that they can all reach a shared ledger state fairly. For instance, the most commonly used consensus mechanism, Proof of Work, helps Bitcoin miners agree upon a single ledger by employing the computing power of the miners.” In other words, a protocol of this sort dictates how a blockchain operates and creates an indisputable system of agreement between devices (not to mention its ability to protect against spam and hacking attempts).

All of the above are mathematical problems that are out there for you to solve if you want to implement blockchain technology. There 5 most widely used consensus protocols, or mechanisms, out there to help you deal with them:

- Proof of Stake. Random qualifications like age, wealth, performance, and so on define the developer of a particular block. The more coin stakes the user has, the higher their ability to add a new block.

- Proof of Work. The miner gets rewards if they find solutions to difficult problems. The protocol mainly deals with cyberattacks, like Distributed Denial-of-Service (DDoS) attacks.

- Byzantine Fault Tolerance (BFT). This blockchain protocol suggests that a network or a system will continue functioning even if several nodes fail to respond with correct information. As Geeks for Geeks writes, “The objective of a BFT mechanism is to safeguard against the system failures by employing collective decision-making (both – correct and faulty nodes) which aims to reduce the influence of the faulty nodes.”

- Delegated Proof of Stake. This is a variation of the PoS. Coin holders can use their balance to choose the nodes that might get a chance to add new blocks to the blockchain and vote on the change of networks parameters.

- Proof of Weight. A mechanism of this kind resembles the PoS, since it grants users a certain “weight”. However, it's not just about how much crypto someone has: here, the weight of the node depends on any measurable metric. It also solves the issues of scalability, as well as blockchain and energy efficiency that are present in the PoS.

#5. Time to Build an Ecosystem

The reason why Ethereum, Ripple, Binance and USD Coin are big is because they have a healthy blockchain ecosystem. Bitcoin Market Journal writes, “Most blockchain projects are started by geeks. They focus on the technology, and forget about everything else. This is like launching a new automobile, and focusing completely on the design of the car, but leaving out consumers, dealers, lenders — the entire auto ecosystem. Your car might make it to a few auto shows, but it will never reach the mass market.” This is exactly why you need active participation and growth of your project stakeholders: they have what it takes to improve the existing rules and standards of your solution and expand it, since they are aware of the business potential it holds and the intricacies of the blockchain industry experiences.

So, how do you navigate the ecosystem creation process? Make sure that both you and your stakeholders agree on:

- The terms of engagement that include battling risks, acting in accordance with current regulations, and consideration of privacy implications;

- Costs and rewards and the absence of bias in their regard;

- The mechanisms of governance.

FYI: What Challenges Should You Beware?

Implementing blockchain solutions has its pitfalls. To help you keep your balance and successfully finish the quest called, “How to set up a blockchain?”, we've gathered a few problematic topics that require your special attention:

- Lack of skilled blockchain development professionals.

- Constant alterations in blockchain regulations.

- Preservation of both scalability and high speed.

To face these challenges, be prepared to outsource certain tasks to blockchain developers outside your city or country: your chances for success are higher if you partner up with specialists globally. They have a diverse hands-on experience with blockchain implementation in a variety of fields, will help you avoid bottlenecks, and enrich the expertise of your in-house team.

*If you're looking for a reliable blockchain implementation partner, give us a call.

FAQ

#1. Why implement blockchain?

Implementing blockchain allows to increase trust, security, transparency, and data traceability across a business network.

#2. What resources are needed for successful blockchain implementation?

To integrate blockchain, you need servers, nodes, databases, blocks, miners, and security professionals.

#3. How could blockchain be used to improve efficiency?

“How does blockchain improve efficiency?”, “Is blockchain efficient?” — the list of these (quite similar) questions is quite long. The answer is simple: blockchain operates with the help of smart contracts that automatically execute deals once predetermined conditions have been met. This means all operations become cheaper, much faster, and more secure. The latter can decrease the time developers usually spend to battle cyberattacks. Therefore, blockchains like Multichain cut development time by up to 80%.

#4. Is blockchain energy-efficient?

All blockchain platforms possess this quality — more or less. However, it's hard to determine the most energy-efficient blockchain out there. For example, the Tezos blockchain has increased in energy efficiency on a per-transaction basis by at least 70%, while the Cardano blockchain network consumes only 6 GWh of energy per year on average thanks to the use of the PoS.

#5. How reliable is blockchain?

As Forbes writes, “While nothing is 100% secure, blockchain is designed to be immutable, tamper-proof, and democratic.” It utilizes decentralization, cryptography, and consensus to level up security and preserve anonymity of its users and their funds. In comparison to conventional financial mechanisms, blockchains are safer: the former use internal databases to store personal user data, and the risk of human error or fraud there is high since middlemen are part of every operation.

#6. Is blockchain really sustainable?

Blockchain has received criticism in regard to its negative impact on the environment, since chains like Bitcoin apply the Proof of Work protocol, known for its high energy consumption rate. However, Proof of Stake networks are a lot more energy-efficient. Additionally, this technology offers new opportunities to enhance sustainability by improving tracking and verifying carbon emissions.

#7. How much does it cost to implement blockchain?

The exact cost depends on your unique business objectives and functionality requirements, so for an accurate quote, please contact us directly. All in all, blockchain implementation costs from $5,000 to $200,000.

Everything Is Connected

If you decide that blockchain apps is what you need to do next business-wise, then no mountain is high enough for you. While implementing blockchain is quite a journey, with a good understanding of your goals and requirements, as well as thorough preparation, planning, and trusted stakeholders, you are good to go.

If you have any questions about smart contract development, blockchain networks, or blockchain implementation, contact us! We will be glad to offer you a consultation and a partnership!

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 781 135 1374

E-mail us at request@qulix.com