What were you doing on July 27th, 2017? While many of us were enjoying a quiet summer Thursday, a supernatural event happened in South Korea— the launch of the Kakao Bank mobile app. On its first day, the banking app was downloaded 652.000 times and the bank registered 300.000 new accounts. In August 2021, Kakao Bank went public and reached a market value of $29 billion. Now it is the biggest online banking company in South Korea, and its history started with a mobile app just four years ago. Not bad, hey?

In our new article, we will consider in detail how to create a banking app that can help you go better than Kim Beom-su, the wealthiest person in South Korea and the founder of Kakao.

WRITTEN BY:

Alexey Krutikov

PMP, Project Manager,

Qulix Systems

Contents

Examine the Mobile Banking App Market

Before considering how to start a mobile banking app business, let us have a closer look at the latest market stats.

According to Allied Market Research, the global mobile banking market is expected to reach $1.83 billion by 2026, growing at a CAGR of 12.2% from 2019 to 2026.

Meanwhile, according to the MX study, the COVID-19 outbreak caused a 50% rise in the banks' demand for mobile banking engagement. Moreover, 68% of their respondents noted that for the users, the most important reason for choosing a financial institution was a smooth and clear digital experience while using their mobile banking app.

The latest Statista research focused on the share of the US population who used mobile banking. The report showed that the largest group here were the Millennials: it is projected that 77.6% of them will use digital banking by the end of 2022.

We suppose that the growing demand for mobile banking services will also lead to even more app releases by smaller banks. That is why this is the right moment to find out what strategies are the best for excellent phone banking software.

Combine Must-Have Features of Mobile Banking Apps

The first stage of the mobile banking app development process is building the perfect set of options to attract your target audience.

Provide your customers with excellent payment services and account management. Help them save money, which is vital in our hectic times.

So, how to develop an online banking application to meet modern-day requirements? Make sure you include the following app features.

Authentication and Authorization

Start with building a robust mobile banking solution with easy and smooth authentication and authorization. It will ensure that all your users’ sensitive data is secure.

Moreover, it will help comply with regulatory requirements and fight fraud and cybercrime. Supply the multifactor user verification process with advanced biometric authentication features like fingerprints and facial detection or voice activation.

Account Management

Then think about providing your users with transparent access to their bank accounts just like traditional banks. But with one distinctive feature — they will not have to turn to their banks’ branches. All the financial details will be easily displayed right in the app:

- balance and transaction history are the cornerstones for mobile banking app development. These features are usually the first ones users want to see when they run banking applications.

- cards and bank accounts management is an essential feature nowadays. According to the Federal Reserve report, an average US citizen in 2021 had three credit cards. So, an online and mobile banking app needs this option to help your users keep all their cards and accounts under control.

- check deposit is the sought-after element of mobile apps to empower your users with the option to check loan offers and deposit interest.

Moreover, you may add features to analyze your users' spending habits. This way you may supply them with additional management plans for savings or investments.

Fast Transactions

Do not underestimate the importance of fast and smooth transactions for a mobile banking app. According to Statista, the total transaction value of digital payments is expected to reach $7.86 billion in 2022. And all those funds are expected to be transferred in less than no time.

In practice, a mobile banking app does not process any payments — it only shows real-time information about the transactions. So, the banking app development process involves implementing payment services from the bank's server.

So, make sure your users can transfer money to other accounts seamlessly. If there are any transaction fees, you should add special mobile banking app features. Let your users estimate an expense prior to the transaction and charge the price to the money sender or the receiver.

Today we also expect that a banking app is more than a mobile version of your bank account. That is why you should integrate the largest possible number of service providers to let your users quickly pay for all their expenses: bills, loans, and mortgages.

Customer Support 24/7

Build a system of comprehensive support for your customers. As your mobile banking app delivers financial services round the clock (one of the most significant advantages), the corresponding assistance on the part of the user support service should be available.

Alongside the helpline, you can adopt an artificial intelligence chatbot to enhance customer care. Indeed, the creation of a chatbot requires a dedicated development process. But it will pay off very fast and will also massively increase customer loyalty.

In addition, you can implement machine learning to predict your customers' behavior and meet their expectations most proficiently.

Keep Your Customers Informed

Create a mobile banking push notifications system for account updates on the go. On the other hand, these banking alerts should not be annoying for the users — push wisely.

It is a good idea to add an ATM or bank branch locator to make your customers' lives easier. Supply this option with info about operating hours, provided services, and directions.

Extra Features

Apart from the basics, create a system of exclusive options for your customers to stand out. Consider adding:

- an app for wearables — it is a great option to stay close to your customers;

- texting banking — your clients will use text commands without launching a banking app;

- bill splitting — this feature allows to divide bills and assign the cost to each person down to a cent;

- personal finance management — integrate budgeting and saving options to help your users achieve financial goals;

- advanced financial features — provide additional insurance, investing services, or other special features.

Moreover, consider empowering your users with some other exclusive features. For example, send them customized push notifications when they reach their daily or weekly expense limits or the limits for particular transactions.

Develop a Secure Mobile Banking App

What is one of the essential concerns for the mobile banking app development team? Undoubtedly, they must build a robust and secure mobile banking application.

We recommend focusing on these vital questions to guarantee top-notch security:

- strong passwords — ask your users to create a reliable shield for their personal data by setting strong passwords and changing them after a definite period;

- multifactor authentication — it is an absolute must-have feature for a good banking app; implement multilayer verification by a password, pin, mobile signature, smart token, or biometrics;

- KYC check — it is a process to confirm who your customers are, and it helps to assess and monitor risks; the users provide POI (Proof of Identity) and POA (Proof of Address) documents like a passport, national ID card, driving license, utility bills, and other documents; KYC compliance is required by the regulatory AML (anti-money-laundering) framework;

- regulations compliance — mobile banking apps must comply with standards, laws, and regulations (the GDPR, PSD2, the CCPA, and others); otherwise, it may lead to hefty fines and restrictions;

- payment blocking — fight fraud by limiting payments via suspicious channels or in particular situations; users will have to pass multifactor authentication to unlock these transactions.

Furthermore, the mobile banking application development team must follow global security standards and guarantee sensitive data protection on all production levels.

Boost Your Mobile Banking App Development Strategies

Are you still sure about launching your mobile banking app project? Numerous strict regulatory, industry-specific, and security requirements make mobile app development a complex challenge.

Nevertheless, an experienced fintech development company will help deliver your excellent banking app to stand out from your competitors. Here is what we recommend to devote your attention to.

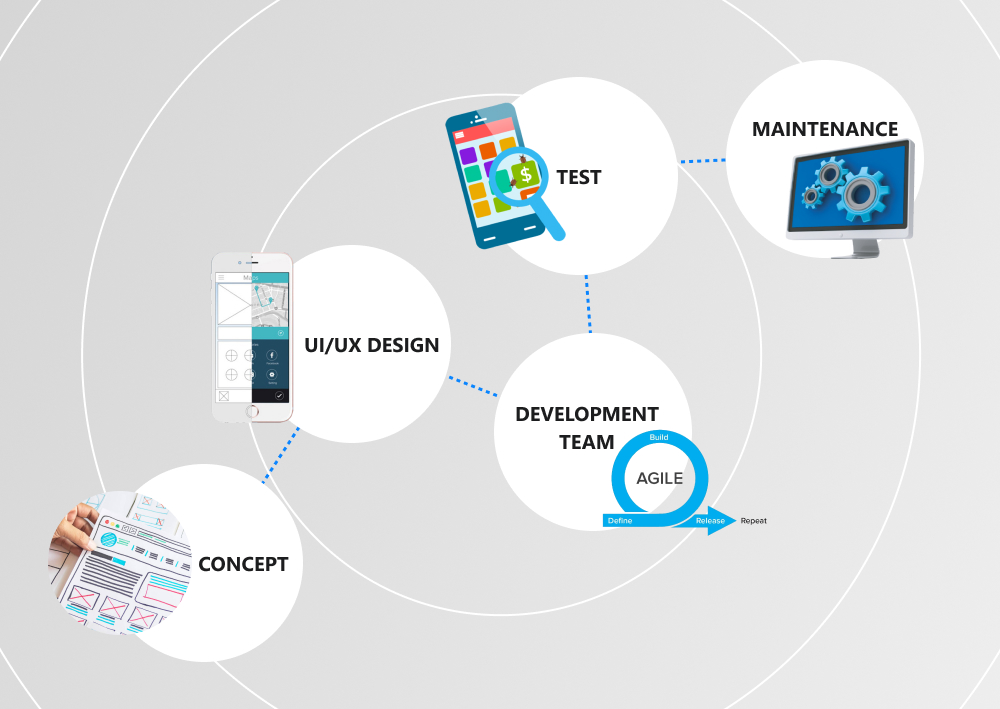

Specify Your Mobile Banking Application Concept

There is no need to reinvent the wheel, so start the development process with a thorough analysis of top banking services' mobile solutions on the market. Identify their strengths, weaknesses, opportunities, and threats (a SWOT analysis) to choose the best suitable features for adding into your mobile app.

Moreover, conduct careful research of your existing customer base and target audience. Segment the potential mobile banking app customers by their age, interest, education status, income level, or interests. Try to define their pain points to solve and meet the requirements of your users.

And do not forget to pack your mobile app with unique features like QR code payments or advanced account management options.

Design Your Banking App UI/UX

The following integral stage is implementing the best practices of UX/UI design. You should deliver simple, intuitive, and still sophisticated mobile applications.

Pack your banking mobile design with transparent and safe solutions to cover business requirements and meet your customers' needs. You may also consider adding some advanced features like gesture activation, including the swipe, rotate, or pinch.

Define a Technology Stack and a Development Team

Your banking app development will consist of two essential stages: building a web-based admin dashboard and mobile app development. That is why you will have to define a technology stack for each of them.

Your in-house team may perform the delivery process, but it is time-consuming and costs a lot. We recommend working with an outsourcing vendor who has relevant experience in fintech app development.

Do you want to shorten the development time, lower costs, and accelerate market entry time? Then choose an Agile development team as it is the best tried and tested methodology.

Test Your Banking Mobile App

It is pivotal to start testing your financial app form as early as possible. What should be tested? Lots of things. Ensure that the designs, technological solutions, security, and performance are flawless and most reliable.

Build an App Maintenance System

Your work is not finished with the application's final release. The maintenance system is a vital concern while developing mobile apps.

It is also a great idea to communicate with your customers to get valuable feedback and collaborate with review sources, opinion leaders, and influencers to get the best ideas for improving your mobile banking app.

Besides, it is impossible to predict everything. There can be new regulatory requirements, updated conditions from your partners, or other issues. That is why it is crucial to include maintenance and improvement features into your mobile banking app in advance.

To Wrap It Up

So, there is no denying that mobile banking has changed the way we avail of financial services. Today we are used to enjoying numerous benefits of mobile payments at the snap of a finger.

At the same time, mobile banking application development requires a lot of effort, creativity, and expertise. Be ready to determine your niche in this competitive market, build your perfect set of must-have features and add unique options.

Pay special attention to providing robust security and using the most effective development strategies. And, of course, find the best outsourcing mobile development company to deliver your customers a quality financial experience.

Why not launch your mobile banking app project without delay? Contact our specialists to get our best offer on app development.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 781 135 1374

E-mail us at request@qulix.com