All businesses aim to boost the visibility of their products and services and draw in a broad customer base, employing diverse strategies to achieve this goal. One such strategy gaining traction across various sectors is gamification. From banking and the stock market to e-commerce, education, healthcare, insurance, and beyond, gamification has found its place as a potent tool for customer engagement. In this piece of writing, we'll delve into how financial institutions and banks leverage game mechanics to enhance customer interaction, offering up fintech examples of gamification in action.

Our intent is that this insight will assist you in making informed choices if you're contemplating integrating gamification elements into your own product.

written by:

Alexander Arabey

Director of Business Development

Every business strives to popularize its products and services and attract as many customers as possible using various tools. For example, gamification is one of these instruments that is widely used in many areas today, including the banking industry, stock market, e-commerce, education, healthcare, insurance, and others. In this article, we'll tell you how financial companies and banks use game mechanics to increase customer engagement and give gamification fintech examples.

Contents

Why Do Banks Need Gamification?

Gamification isn’t a new concept: the financial industry has been exercising it for quite some time now. Elements of gamification that users could have interacted with by now include accrued points, cash backs, bonuses, rewards, and so on. Such things encourage users to engage more with the app since in that case, they can keep playing, which is fun and literally rewarding. As a result, gamification not only improves the overall customer experience, but also helps generate profit and increases the volume of non-cash transactions. Consequently, we’re witnessing that more and more gamification solutions appear: the report shows that the global gamification market size was estimated at USD 10.5 billion in 2021, and it is expected to reach around USD 96.8 billion by 2030.

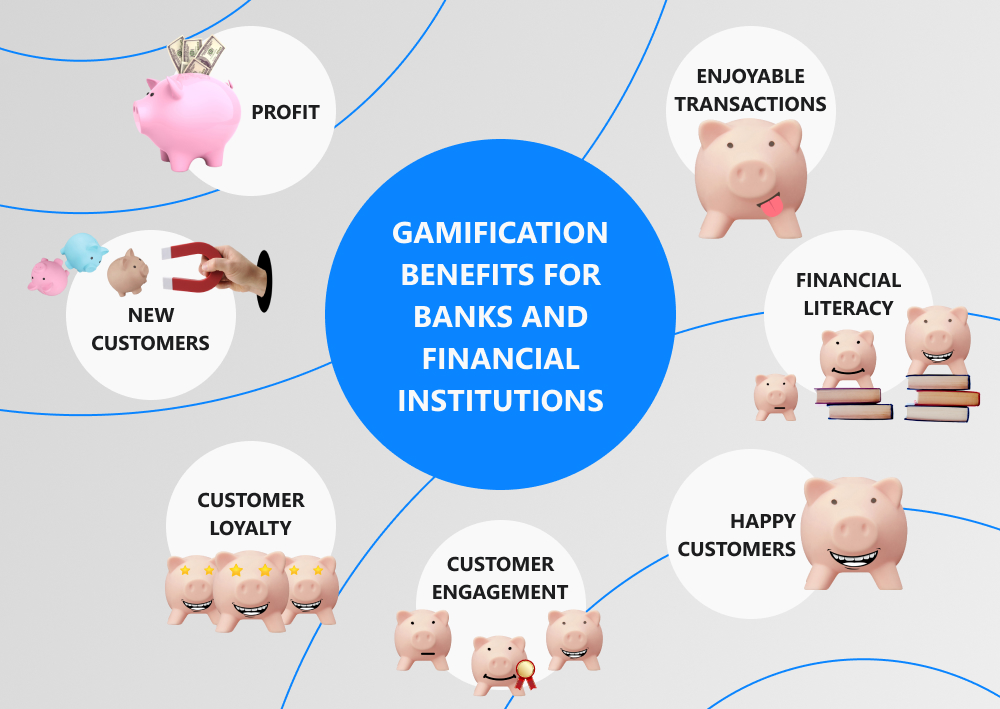

Financial services industry participants can gain the following advantages by implementing gamification and game design elements in their apps:

To encourage users to actively buy banking products and services

The Commonwealth Bank of Australia (CBA) has gamified the real estate investment process. It launched an online game where real estate objects could be bought and sold without the risk of losing personal finance. At the same time, the game provided customers with the actual data received from developers, economists, and investors. Being encouraged by the game, customers took about 600 loans to the total amount of $400 thousand over the year.

To attract new customers

Emirates NBD, one of the largest banks in the UAE, launched a fitness app to motivate customers to save more during training. The bank offered customers to open special savings accounts and sync them with their fitness trackers. If the clients achieve their savings goals every day (e.g. they walk 10 km a day), they earn rewards in the form of a 2% interest rate. The savings app helped users save $4.37 million, while the bank managed to attract new customers.

In general, gamification in fintech is very lucrative in terms of attractiveness for customers, especially for younger ones. Young adults of nowadays like fun, simplicity, interactions, competition, and entertainment in general. On the other hand, banking has become an integral part of daily routine for many. So why not combine them both and beat your competitors by becoming an innovative and fun banking partner for your customers.

To improve customer retention

Extraco Banks developed an online game to inform users about its new services. The bank asked customers to answer questions about their investing and spending habits. They were asked how much money they usually keep in their accounts and how often they use their payment cards. When answering these questions, customers received advice on how to spend less and earn more, how to open a savings account, how to invest more efficiently, how to reduce taxes, how to use one or another financial technology, and so on. As a result, the bank not only retained the old customers but also raised the client base by 700%.

To increase customer loyalty and user engagement

Moreover, gamification helps you establish close relations between your employees and customers. Banco Bilbao Vizcaya Argentaria (BBVA), one of the leading Spanish banks, created and launched BBVA Game to boost customer loyalty and satisfaction. Its gamified app encourages users to do various tasks and earn points that can be used to participate in various lotteries or download music and movies. The app contains educational videos teaching users how to perform simple banking transactions, use mobile banking, pay taxes, and much more.

To meet customer demand

The game mechanics allow financial institutions to receive feedback and understand whether customers are interested in their financial services and products. Thanks to this information, they will be able to make personalized offers based on customer preferences. Moven Bank launched the CRED service to monitor the financial behavior of its customers: how they carry out transactions, make payments, transfer money, and so on. This data allows the bank to learn the opinion of customers about banking products and create a unique offer based on their interests and needs.

To improve consumer financial literacy

Banks are especially interested in financially literate and loyal customers. They should be able to make reasonable decisions on financial transactions and wisely manage their personal finance. Unfortunately, only one-third of the adult population worldwide understand basic financial concepts. That's why it's important to create gamification solutions that will help people wade through financial issues.

By the way, Americans can take part in the SaveUp program that educates them to manage their income. Also, it rewards users for correct and efficient transactions. They receive points for depositing, paying off credit debt, reaching financial goals, and so on. These points allow customers to receive various prizes and bonuses. SaveUp runs financial education courses for consumers as well.

To make routine financial transactions more enjoyable and entertaining

For instance, SmartyPig, a digital piggy bank, is a great tool that helps users save money. Imagine that you want to make a big purchase and start raising money for it. Using the app progress bar, you'll see when you are able to buy the desired thing. Saving money is a boring process, but the app makes it more engaging because people have a chance to test their spirit and ability to go the whole way.

Forecasts suggest that by 2025, over 70% of the workforce will be millennials and zoomers, generations known for theirlove for the internet, social media, gaming, and new technologies. Naturally, they'll gravitate towards banking services that incorporate gaming elements, having grown up in the world of computer games.

In contrast to older generations, millennials aren't solely motivated by cashback and bonuses. Raised in the era of Instagram and TikTok, they thrive on showcasing their accomplishments and milestones to peers, making gamification an ideal avenue for such expression. A survey conducted by Businesswire among individuals aged 18-25 revealed that 27% of respondents engage with loyalty programs due to their competitive nature and the inclusion of gaming elements.

Gamification Principles

Gamification works when users perform certain actions. Your task is to motivate customers to be active. Implementing points, badges, and leaderboards is not enough to encourage people to use banking services and products. You need to think over the concept of gamification in fintech, which is based on four basic principles:

#1 Reward

If the user knows that he/she will receive bonuses for completing a task, his/her motivation will grow. For example, you can offer a customer to make 15 purchases with a payment card to get a 10% cashback.

#2 Competition

We always compete with each other at school, in business, in competitions, etc. Everyone wants to climb to the highest point of the pedestal. For example, different ratings will help banks to motivate their customers to take certain actions. As a rule, people hate to fill out profiles and forget to change their personal data when they move to another location or use another phone number. Promise your clients to increase their rating by 5% if they introduce the relevant information in time, and they will do it!

#3 Achievement

People love to showcase their success, and gamification gives them this opportunity. To do this, you can use various tools, such as bonuses, levels, medals, statuses, and others. For example, banks can offer customers various payment cards (gold, platinum, etc.) that give all kinds of bonuses.

#4 Feedback

The user should always be praised and rewarded for the results. For example, if a client has completed a task, he/she should immediately receive a reward in the form of accrued rating points or a raised status. This motivates them to take new actions and continue to use your services.

How Can the Fintech Industry Implement Gamification Properly?

Financial institutions must remember that gamification is not a game with money. The goal of this approach is to turn the routine into a fun activity for the client while maintaining a balance between the game and the fintech product. First of all, you must clearly understand what results you want to achieve by implementing gamification. Otherwise, even successful games won't help you achieve KPIs. For example, you can break down global goals into specific ones: how much do you want to increase sales of your products and services, how many new users do you want to attract, and so on.

Consider the interests and motivations of your customers when creating a gamified app. Users won't participate if they don't understand why they need it. Also, be careful when choosing the tools to reward or fine clients for their accomplishments or failures. We recommend you avoid material penalties as money doesn't motivate people. They will perceive your attempts to issue fines with money very personally and negatively.

The rules for participating in the game should be as simple and clear as possible. It will be difficult for people to remember too many rules, they simply won't want to understand them. Too many constraints will fail your strategy as well as no one likes to be constrained. Also, never force users to participate in the game. They should make the decision voluntarily, which will allow them to improve the user experience and increase loyalty.

Final Word

Gamification can help financial institutions improve customer interactions and make banking transactions less boring and more engaging. Through this approach, banks are increasing financial integrity and promoting healthy user habits, such as promptly clearing invoices and saving money. It becomes easier for clients to understand complex banking products and make smart financial decisions. You will create a way better service experience, which in time will transform into customer loyalty among your target audience and you, as a bank, will be able to collect precious customer insights hands down.

The goal of gamification is to motivate the user to use banking products and services more often and more productively through points, badges, prizes, awards, leaderboards, and so on. At the same time, banks need to understand that gamification is one of the elements of business strategy that helps them increase customer loyalty and build close relationships with them. This approach should be used in conjunction with other development methods and implemented taking into account the requirements and desires of users.

If you need a fintech gamification consultation or want to develop a banking application with game elements, our specialists will be happy to help you. For more details, please visit our website or get in touch with our support team.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 781 135 1374

E-mail us at request@qulix.com