More than a decade of gathering insights in the field of fintech and banking helps us to reach out to other spheres: for example, to digital financial services ecosystems. In this article, we will focus on how e-invoicing solutions can build competitive advantages in SME banking. Also, we will answer the question of why multi-banking services have great potential.

More than a decade of gathering insights in the field of fintech and banking helps us to reach out to other spheres: for example, to digital financial services ecosystems. In this article, we will focus on how e-invoicing solutions can build competitive advantages in SME banking. Also, we will answer the question of why multi-banking services have great potential.

Firstly, we believe that OpenAPI is something that all ambitious banks should invest their resources in. Banks should be all set for the growing number of cooperation offers from third parties.

Trend: Ecosystem

Instead of reinventing the wheel every time, we suggest considering the format and the implementation of partnership opportunities in advance. If the bank refuses to open up for fintechs and potential partners from other industries, it may lead to losing positions in the mid-term perspective.

Get ready for partnerships

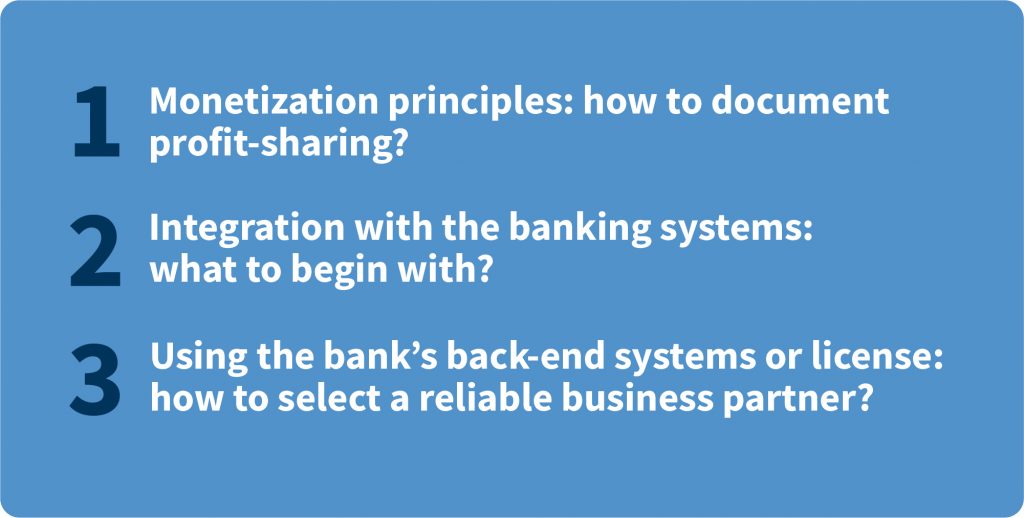

Building a digital banking ecosystem is a challenge. It requires the involvement of third parties, mostly fintechs. At the same time, fintechs are all different, and not all partnerships are equally good. Asking yourself the following questions can help you set the bar for priorities and expectations:

Another aspect to consider is that the potential of digital financial services ecosystems is immense. At the same time, it is usually challenging for banks to add financial and non-financial services independently, and that’s explainable because it requires lots of resources.

What’s more, banks are simply not structured for this, so partnerships can be a possible way out.

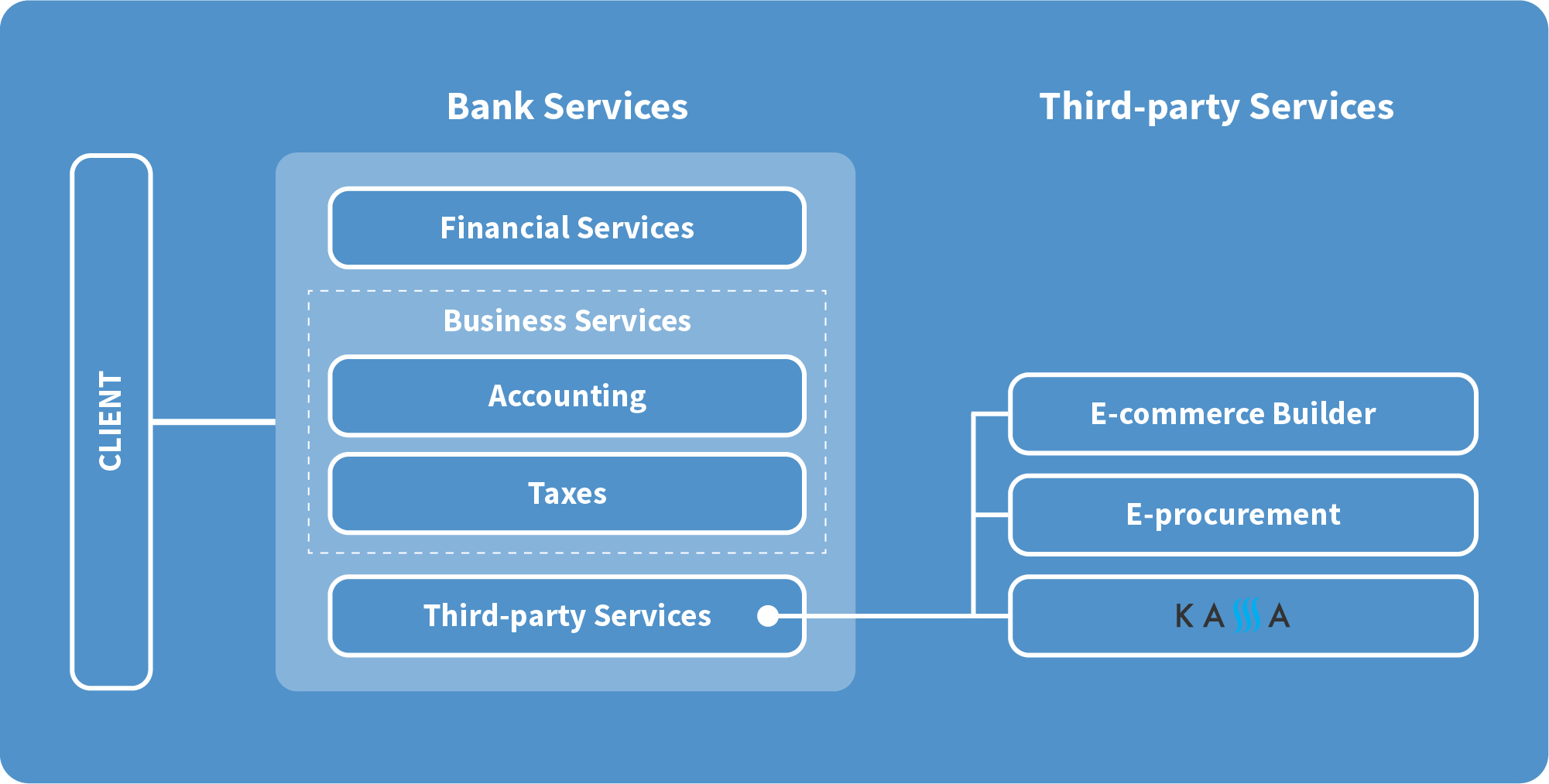

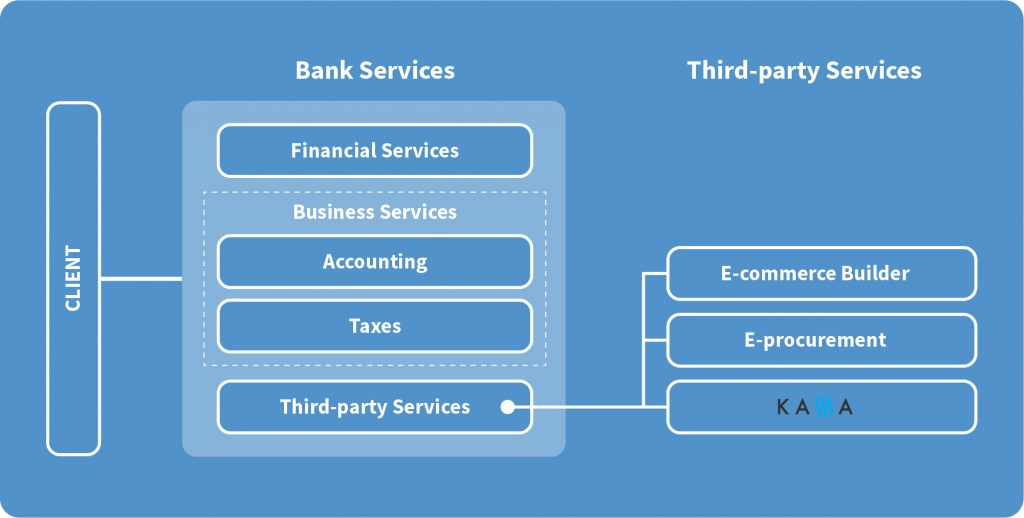

Digital Ecosystem + OpenAPI

What it looks like:

- financial and business services developed by banks.

- third-party services, for example, e-commerce builder, e-procurement, business finance management, factoring, and etc.

Here we will accentuate e-invoicing software using KASSSA as an example.

What about e-invoicing?

Qulix Systems is engaged in the development of digital channels and services. We set our internal processes in order to cooperate with large enterprises. Generally, we deal with banks (not with fintech startups). However, sometimes we find underserved niches at the financial market - as it happened with electronic invoicing services for SMEs.

Qulix decided to become an e-invoicing solutions provider by developing KASSSA.

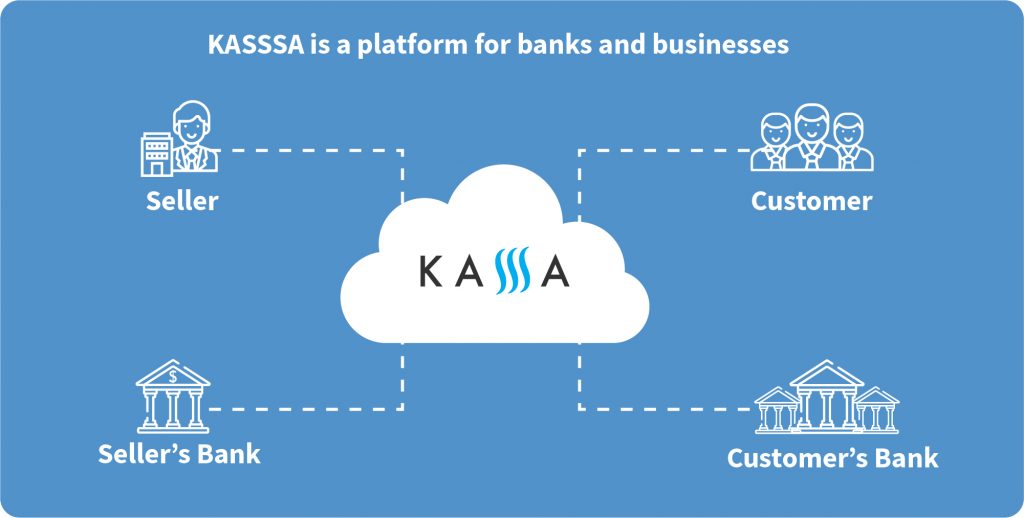

KASSSA is a multi-bank e-invoicing service for small and medium-sized enterprises. It makes online B2B payments faster and easier.

Why B2B Payments is a pain point for SMEs

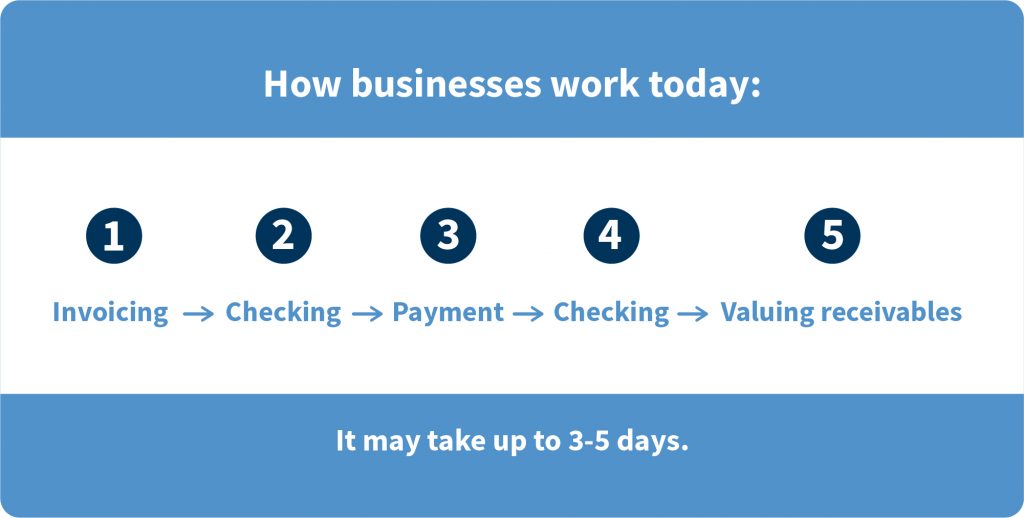

B2B payments take a lot of effort, and the procedure depends on the country. Let’s consider the example of Ukraine because this is the first market we are entering:

- It all starts with the invoicing: you need to request the payment details and input them in the documents. Double-check.

- As a follow-up, the payment details are sent to the customer: for example, via email. Again, entering them in the documents and double-checking.

- Finally, you need to figure out if the payment was processed successfully for the valuation of receivables.

But that’s not what businesses want, they need a seamless process with timely notification about payments. They want to know, who already paid, who is going to pay and who is not going to pay at all. And this is the main challenge: in some cases, it takes up to 3-5 business days to receive the payment.

Just imagine: Elon Musk sends his car to space, while businesses get stuck in the past century with their invoicing, having to wait for days.

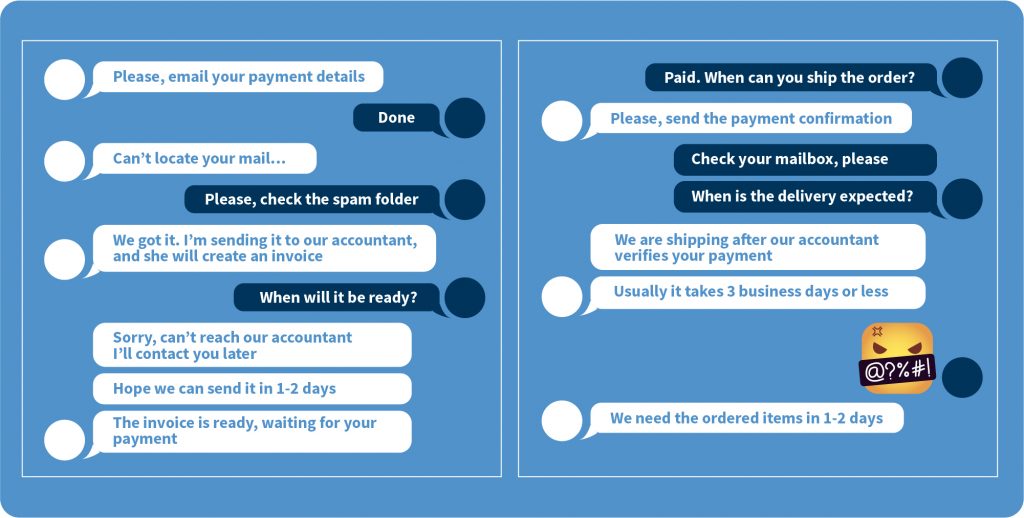

All that is followed up by miles of messaging history:

If businesses work with 2-3 business partners monthly, it won’t bring a lot of inconveniences. But just imagine if the business sells subscriptions, and there are hundreds or even thousands of B2B payments to be processed every month?

Benefits of electronic invoicing with KASSSA

KASSSA e-invoicing moves B2B payments to the next level. Now we need banks, which are ready to become our partners in order to launch it. At the end of this article, we will provide more details.

KASSSA allows paying and keeping track of payments in a few minutes. The service connects suppliers and their customers, as well as their banks. It’s an independent multi-bank service, acting as an intermediary between different users and different banks.

What can KASSSA do

- Create e-invoices and send them to buyers - manually or automatically

- Support payment plans (subscriptions), which are convenient for scheduled purchases

- Track payment status

- Prevents debts by sending notifications to contractors

- (soon) Support Direct Debit - a mechanism of receiving payments from customers, which is widely spread in Europe. Once the parties agree to carry out regular payments, the system does the rest.

Direct Debit is going to be the next stage. A year ago, we were planning to introduce it right away but decided to hold for a while. The solution is rather complicated, besides, we considered that our primary target markets are not ready for the introduction of this system. However, it’s going to be added soon.

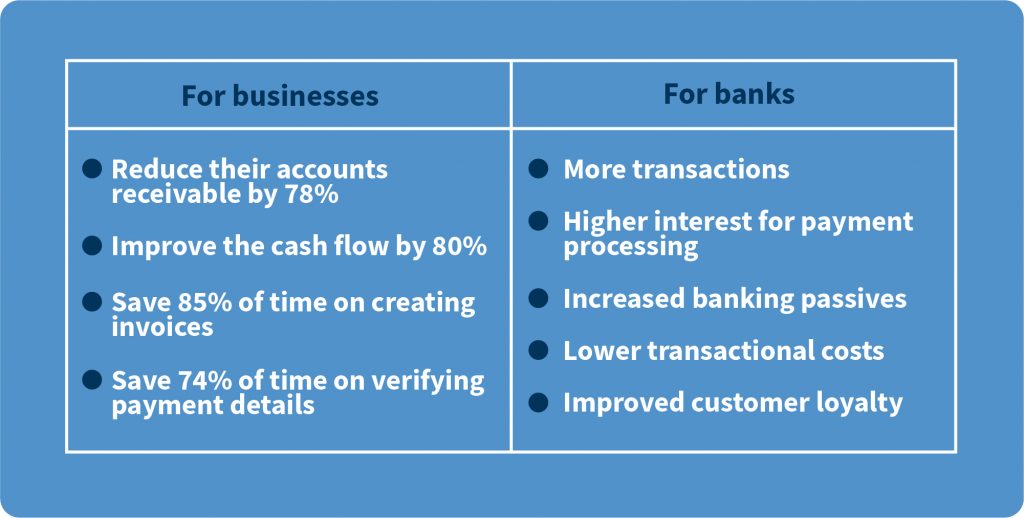

KASSSA e-invoicing: advantages for banks and businesses

Some banks will be able to benefit more than others, but it’s a great opportunity for all banks to make B2B financial operations faster and more convenient.

Customer advantages

- Flexible workflow: invoices and payments

- Access to detailed transaction history with the business partner

- Verification of legal entities

Customers are likely to appreciate flexible workflow: they can verify created invoices, payments, and partial payments. Also, they can easily deal with payment plans adding new customers on the list.

Another value that KASSSA brings is the opportunity to detect reliable and difficult customers based on payment history. The system also helps to verify legal entities: before starting to work with a new business partner, it’s a good idea to double-check, if the company really exists. To manage this task, the system asks the user to verify their digital signature (third-party services are used for the verification).

To pay the invoices, customers sign in their Online banking, integrated into KASSSA electronic invoicing service. They enter the beneficiary's account to let the system generate the payment order. This payment order is signed with the customer’s digital signature and is sent via the bank’s API.

The bottom line

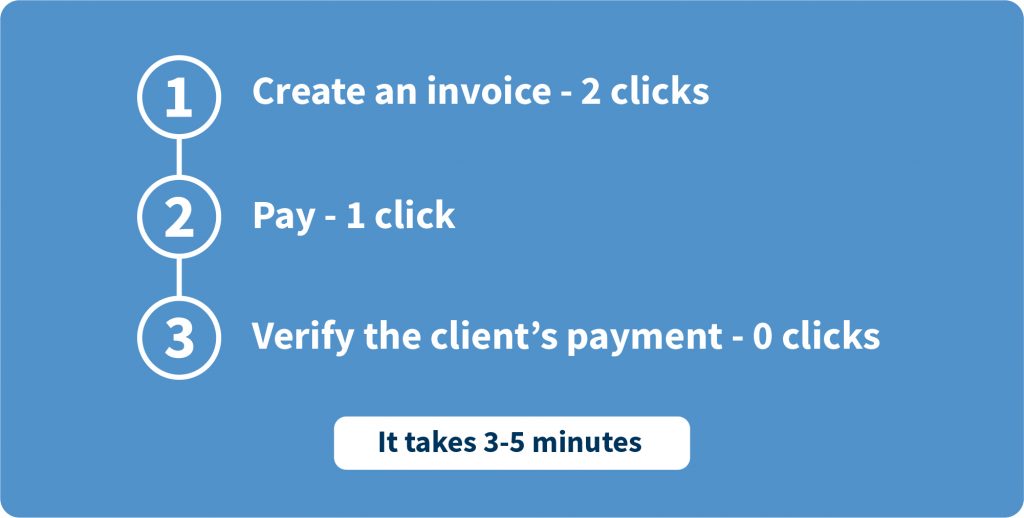

We would like to emphasize the importance of providing a comprehensive B2B payment service, which perfectly meets the needs of small and medium-sized enterprises. After signing up for the system, businesses can create and pay invoices in a few clicks.

Therefore, at this stage, we are looking for partners among banks.

We want you

To implement the pilot prototype service (to be able to carry out payment orders), we are searching for banks ready to provide open API related to:

- Authorization

- Accounts and transactions data

- Payment data

By the end of 2019, we plan to launch KASSSA in Ukraine. It will provide us with valuable statistics to share with other banks. In 2020 the project is going to be implemented in Estonia and Kazakhstan.

We are looking for banks ready for a revenue share project to implement this e-invoicing service. Contact us at request@qulix.com or visit our website.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com