The development of financial technologies and the emergence of flexible digital solutions are changing the banking industry. End customers had to go to banks to get any financial services previously. The appearance of fintech startups with more innovative products has made financial transactions easier and more convenient. All this led to the development of a new model, known as BaaS (Banking as a Service), which involves the cooperation of tech companies with financial institutions.

The BaaS market value reached $356.26 billion in 2020 and is expected to grow to $2,299.26 billion by 2028. In our article, we will look at this new promising area, talk about the benefits for banks, non-financial businesses, and end consumers, as well as discuss an Open Banking concept.

written by:

Alexander Arabey

Director of Business Development, Qulix Systems

The development of financial technologies and the emergence of flexible digital solutions are changing the banking industry. End customers had to go to banks to get any financial services previously. The appearance of fintech startups with more innovative products has made financial transactions easier and more convenient. All this led to the development of a new model, known as BaaS (Banking as a Service), which involves the cooperation of tech companies with financial institutions. The BaaS market value reached $356.26 billion in 2020 and is expected to grow to $2,299.26 billion by 2028. In our article, we will look at this new promising area, talk about the benefits for banks, non-financial businesses, and end consumers, as well as discuss an Open Banking concept.

Contents

Banking as a Service: What Is It?

Banking as a Service, or BaaS, is the provision of core banking services and infrastructure to third-party service providers. This can be a product of the bank itself or service provided by non-banks based on the bank's open API. Banking products include payment processing, card issuance, factoring, acquiring, limit management system, cashback services, cash and settlement services, payments, corporate accounts, document recognition, loyalty programs, and other banking services. A BaaS platform offers customers the opportunity to choose the required financial products and services and use them according to their needs.

Simply put, non-bank businesses offer banking services without having to launch or acquire their own bank. For example, Shopify, one of the top e-commerce software developers, uses a BaaS approach to provide a range of financial services (payment processing, advance provision by merchants) as well. By the way, this activity brings the company more than 60% of revenues.

Neobanks also actively resort to BaaS solutions. Have you ever heard of Karat, Pockit, or Green Dot? These and many other fintech giants managed to succeed, when adopting a BaaS model. And we'll analyze the peculiarities of such scenarios a little bit later.

Traditional financial institutions are known for their severity and conservatism. They are too slow to apply new technologies, don't want to adapt to users, and don't hasten to implement changes in the industry. The market requires new services and flexible solutions offered by fintech businesses. They are ready to develop and bring innovative solutions to the market faster than banks. However, they need banking licenses to provide any financial service.

What’s more, startups often don’t have the money to maintain and upgrade the infrastructure. The most profitable and simplest way is to take a white label banking solution. So, the Banking as a Service approach helps a financial institution create new products, find new partners, enter new markets, attract more customers, and so on.

How a BaaS Solution Works: Examples in Action

As previously mentioned, the licensed bank grants access to its infrastructure to a service provider. A fintech company chooses the necessary financial instruments and integrates them into its business processes using modern technologies, such as distributed ledger technologies and smart contracts. APIs, or application programming interfaces, are usually used for integration. For example, to provide payment services, the British startup Bankable cooperated with the German Solarisbank and gained access to the banking infrastructure through the API.

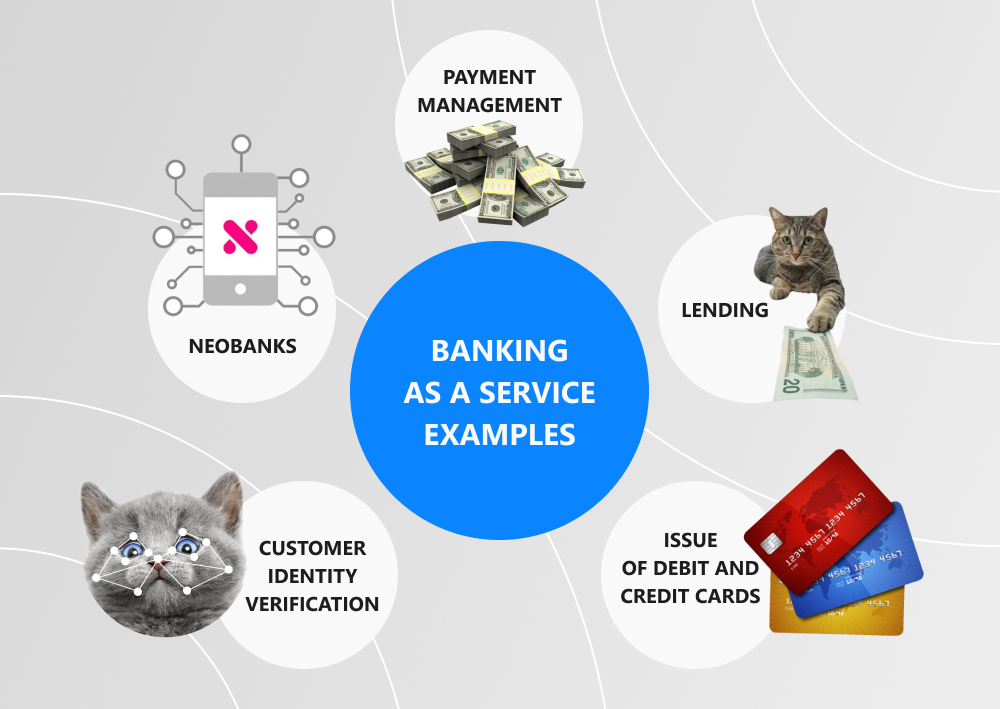

The BaaS providers can render the following services:

Payment Management

Non-financial companies can develop financial applications that allow users to make purchases, track transactions, manage savings, and so on. Based on innovative technologies, these apps ensure seamless and easy access to money and improve customer loyalty. US giant Uber and Mexican BBVA launched a platform that allows drivers to receive payments within minutes. Drivers can also use the app to take out a loan and get discounts on gas stations.

Lending

Other businesses actively use the BaaS models to offer loans to their customers. Major marketplaces and online stores like Shopify, Amazon, and Walmart have been taken this opportunity for a while. Amazon UK and Barclays launched a Buy Now, Pay Later (BNPL) product that allows buyers to pay for goods in instalments. The BNPL market is already valued at $100 billion. More than 5 million UK residents have used this payment method since the start of the COVID-19 pandemic. Similar services are widely used in other countries (for example, Klarna in Germany, and so on).

Issue of Debit and Credit Cards

Nowadays, not only banks can offer users debit and credit cards. Non-financial institutions try to attract customers by cashback and lower interest rates. For example, Amazon and Apple credit cards are currently available to people. Apple Card holders have a number of advantages, including 1% cashback when using a physical payment card, 2% when using Apple Pay, and 3% when using the service at company stores.

Customer Identity Verification

In addition to financial services, fintech businesses develop infrastructure to verify the identity of the customer and assess the risks. Today, it's impossible to distribute financial products without incorporating Know Your Customer (KYC) processes. Therefore, these solutions will be in high demand. Using BaaS, various companies will be able to connect to the banking API KYC to verify their identity quickly and at a low price. For example, Onfido offers a ready digital registration solution that helps customers open different bank accounts with only a few clicks.

Neobanks

One of the advantages of BaaS is that you can choose services when you launch your own neobank. Unlike traditional banks, the neobank is focused on 1-3 key services that are much more convenient and of higher quality. For example, Revolut is engaged in issuing credit cards, offering customers attractive conversion rates.

When using the BaaS model, you don't need to create the software from scratch, which significantly reduces the development and maintenance costs. Banks, in turn, use BaaS to modernize their legacy systems and transfer them to cloud platforms for ease of management and security.

Neobanks offer the same services as traditional banks. These are payments, deposits, loans, and finance management. Everything that customers need. But fintech businesses have the expertise to automate these services with the help of advanced technologies, such as artificial intelligence and machine learning. This makes financial services faster, cheaper, more interesting, and more entertaining. And the analysis of consumer behavior allows startups to understand what services will satisfy demand and bring new customers.

Benefits Provided by Banking as a Service

BaaS covers the needs of different categories of businesses, banks, and end consumers.

Benefits for Banks

Banking as a Service opens up new opportunities for banks to increase revenues. First of all, they charge commission fees for their services and APIs. Therefore, 43% of banks choose this model of cooperation. Secondly, through collaboration with fintech companies, banks will gain access to new markets and will be able to attract new customers, which will also allow them to find new sources of income.

Since businesses will provide banks with their technologies and ready solutions, financial institutions will be able to significantly reduce their development costs. Also, banks will have a chance to invest in other, more promising areas and projects. Finally, fintech partners will help banks get to know their customers and their preferences better. Based on consumer behavior, banks will be able to create new personalized services and products that will help them outperform competitors and succeed in the market.

Benefits for Non-banks

Any non-banking company and fintech startup will be interested in BaaS if they would like to build financial functionality into their products but don't have enough money, experience, knowledge, and time for this. Purchasing a BaaS platform will allow the company to customize the interface and communication channels, as well as focus on their work processes. As a result, businesses will be able to release their products faster.

BaaS will also spare businesses from having to obtain a banking license and open access to new customers. According to Statista, 157 million people will use banking services in 2020. As a rule, banks collect and process tons of information about their customers. This data will help fintech to understand the preferences of the population, build a customer journey, offer them innovative products, and increase their trust.

Finally, BaaS will help businesses test their idea or product without spending too much money on it. Imagine a situation where a company wants to launch a solution with limited banking services or for a narrow segment. It will be too expensive to buy a banking license and infrastructure, especially if the hypothesis does not justify itself.

Benefits for End Consumers

Cooperation between fintech companies and banks based on the BaaS model is a win-win situation for the end-user. Customers will receive convenient products and services that will meet their requirements and desires. Millennials and zoomers want to use new technologies and digital banking to make quick financial transactions without leaving their homes.

The more companies enter the market with their banking offerings, the more options consumers will have. According to the law of economics, choice creates competition. Competition, in turn, makes companies create better and more affordable products. As a result, the audience becomes more loyal, and the customer experience grows.

Open Banking and BaaS

So, financial institutions provide partners with access to their infrastructure and account management via an API. This paves the way for the widespread use of the Open Banking concept, which has recently begun to be supported. For example, the European Union adopted the Second Payment Services Directive (PSD2) that supports the spread of open APIs. Open banking creates healthy competition and doesn't allow banks to become monopolists.

Open Banking is based on the implementation of both technological and regulatory components. Market participants can trust each other thanks to end-to-end identification, authorization of operations, and security standards. According to Business Insider Intelligence, Open Banking solutions will allow UK small and medium-sized businesses to earn up to $2 billion by 2024.

How Does It Work?

Let's look at the simplest scenario. Sarah has accounts in several banks. Earlier, she had to switch between several banking apps. Now, Open Banking allows her to track all the accounts in one application. Let's imagine that Sarah wants to make a large purchase and is going to apply for a loan directly in the store. The payment service connects to the bank through an open API to obtain information about the buyer (her income, credit history, transactions, assets, etc.) in order to determine the degree of risk. If everything is good, Sarah will be able to take out a loan in a couple of clicks and get the product.

The same scheme works with corporate clients that use IT infrastructure, including ERP or accounting systems. Thanks to Open Banking, they will see all the information on each financial institution with which they work in a unified system as banks will provide them with their APIs.

Nevertheless, many financial institutions don't hasten to open their APIs as they are concerned about security issues and data loss. To solve this problem and encourage banks to open their APIs, regulators are taking steps to ensure proper security. They include user authentication, monitoring of all financial transactions, tracking and identifying fraudulent schemes, a thorough assessment of a potential partner, and much more.

Final Word

McKinsey believes that the potential of Open Banking is only 10% realized so far, and it is too early to speak about the future adoption. It's clear that BaaS and Open Banking have firmly penetrated into the industry and opened up new opportunities for fintech companies and banks. Such cooperation helps them gain access to new sources of income, points of sale, and a wide pool of customers, as well as contributes to the development of innovative technologies in the banking sector.

The BaaS model is beneficial to everyone - non-banking organizations, banks, and consumers. Banks will share their large client bases, resources, capital, rich risk management experience and knowledge of the law with fintech. Startups will share their developments and technological solutions, while consumers will receive better products.

If you need additional information about BaaS platforms, providers, fintech services, and so on, our specialists will be happy to help you. For more details, please visit our website or get in touch with our support team.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com