The mobile wallet market continues to grow rapidly, offering users convenient solutions for payments, storing funds, and international transfers. Its value amounted to $47.53 billion in 2024 and is expected to grow to $56.92 billion in 2025 at a CAGR of 19.8%. The industry is projected to grow at an average of 20% per year as more people switch to digital wallet payments.

What Is a Digital Wallet?

A mobile wallet app (often referred to as an electronic wallet) is a digital tool that allows users to store and manage their payment information through their smartphones and other mobile devices. It serves as a convenient alternative to physical wallets. The most famous digital wallets are Apple Pay (for iOS devices), Samsung Pay, Google Pay, and others. E-wallet account opening enables users to make financial transactions with greater ease, speed, and security.

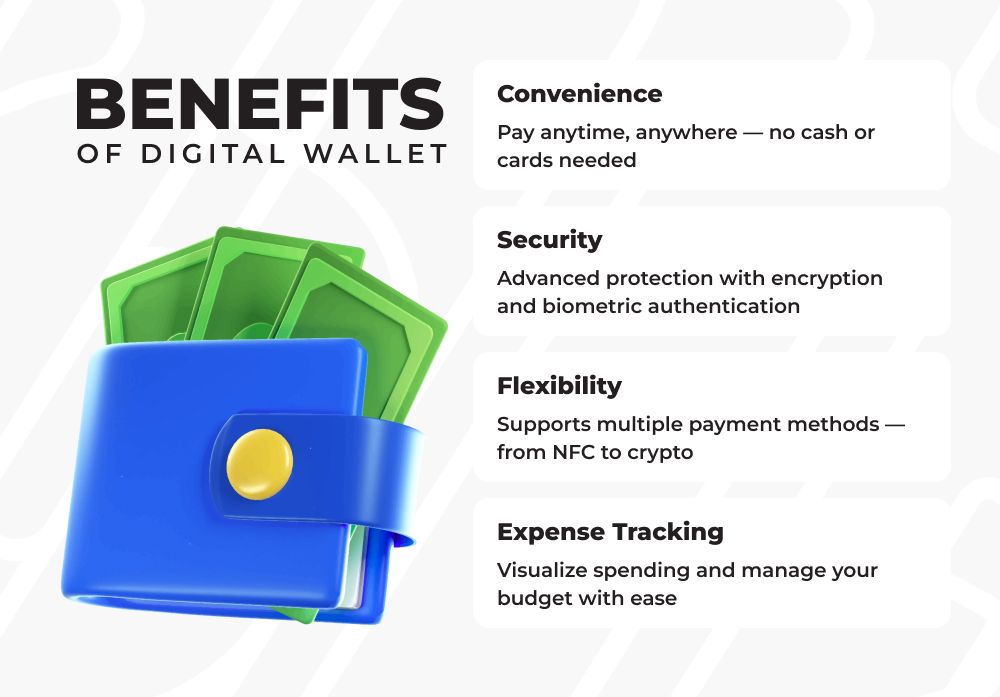

What Benefits Do Mobile Wallets Provide?

Before we tell you about the mobile wallet development, let's see what advantages digital wallets offer to customers:

Thus, digital wallets have become an important finance management tool nowadays.

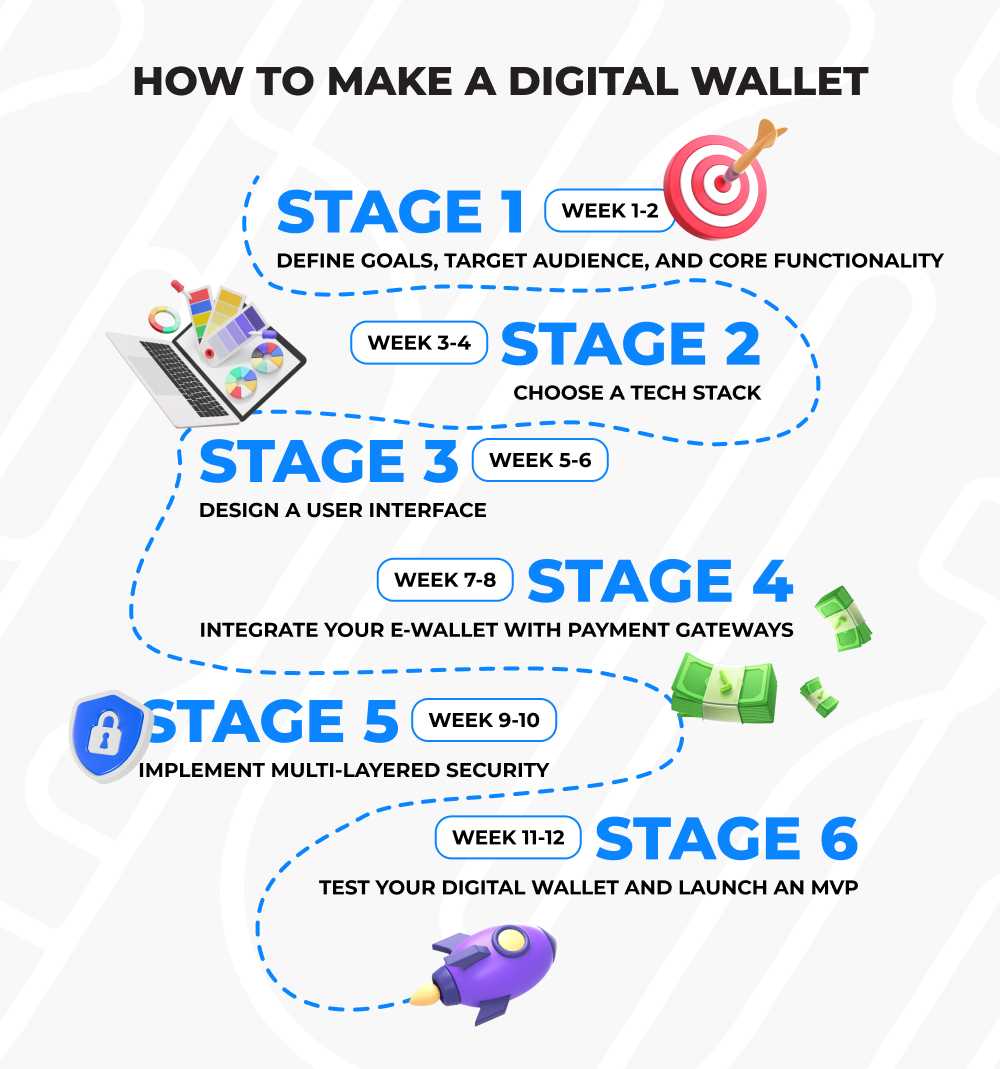

A Full Guide on How to Make a Digital Wallet

The digital wallet app development requires a comprehensive approach that covers technical, legal, and user aspects. Let's look at the main stages of building a digital wallet from idea to launch.

Stage 2: Choose a Tech Stack (Week 3-4)

Choose a tech stack taking into account your target audience’s requirements, project goals, and regulatory environment. If you want to quickly test your idea and bring the product to the market, use cross-platform solutions, such as Flutter or React Native with Firebase. It will allow you to launch the digital wallet app on both iOS and Android.

If you develop a scalable B2B solution, it will be better to choose a reliable architecture with customized backend (e.g., Kotlin or Swift for frontend, Java or Node.js on the server side, PostgreSQL or MongoDB for data storage, etc.). In any case, your mobile wallet must include encryption, biometric authentication, user consent management, as well as be compatible with the payment gateways.

According to the CoinLaw report for 2025, most digital wallets are developed using the following technology:

Stage 3: Design a User Interface (Week 5-6)

Once you’ve decided on the platform and technology stack, it’s time to create a user interface. It should be easy-to-use, secure, and adapted to everyday usage scenarios. Users should be able to immediately see their balance, transaction history, as well as transaction fees. Everything should be transparent and has credibility.

When a user performs key actions, such as transferring funds, the digital wallet app should display confirmation prompts to prevent errors. Provide simple navigation and quick access to key features. Your customers will appreciate simple design, plain language, smart visuals, and ability to make transactions in a few clicks.

Take care of the security and provide users with biometric authentication, real-time notifications, and prompts in case of suspicious activity. All these features will strengthen users’ confidence. Also, remember about localization - make sure that your secure digital wallet supports various currencies and languages and displays terms and transaction fees in familiar formats.

Finally, provide accessibility since contrasting colors, legible fonts, voice assistants and so on make digital payment apps comfortable for everyone. All these elements create a reliable and user-friendly experience that increases customer loyalty and helps wallets stand out in a crowded market.

Stage 4: Integrate Your E-Wallet with Payment Gateways (Week 7-8)

At this mobile wallet app development stage, your task is to choose a reliable payment provider. According to the NFC Forum Survey for 2024, people rank mobile payments higher because of security, ease of use, reliability, and convenience. That’s why it’s not just a technical decision but a strategic step, responsible for user experience.

Stage 5: Implement Multi-Layered Security (Week 9-10)

According to Digital Bill Payments: Mobile Wallets Gain Popularity, But Hurdles Remain research study, 35% of surveyed users still prefer traditional payment methods. They don’t use mobile wallets due to security reasons. That’s why your primary task at this stage of the digital wallet development is to implement strong security measures.

These measures should include user authentication, such as biometric authentication (facial recognition or fingermark), two-factor authentication, PIN code, and liveness detection mechanisms. Other options are data encryption and tokenization when temporary tokens are used instead of payment details.

Enhance your security measures with behavioral analytics (e.g., abnormal activity detection), server-side limitations, configurable transaction limits, as well as push notifications for every transaction. Finally, remember about transparency and make sure that users understand how their data is processed and what happens during every payment transaction.

Stage 6: Test Your Digital Wallet and launch an MVP (Week 11-12)

Before you bring your e-wallet to the market, it should pass a number of technical tests and regulatory inspections. They include a legal analysis of user agreements, confidential policy, verification of cookie banner compliance, implementation of consent withdrawal mechanisms, and data export upon user request.

Check all necessary app’s features and user scenarios, such as registration, authentification, making transactions, account management, and so on. When you launch an MVP, your goal is to monitor user behavior, collect user feedback to make improvements and enhance customer engagement, as well as document everything related to data processing.

How to Avoid Burning Out of Your Dev Team during the 90-Day Digital Wallet Development

How to build a digital wallet for 90 days and keep your development team sane in the process? The State of Developer Ecosystem 2023 report showed that 73% of developers have experienced burnout. The digital wallet implementation is a high-load process with severe deadlines, intensive sprints, and numerous critically important decisions.

To keep your development team productive and involved, we recommend you to create an environment where your employees have recovery resources and ability to have an impact on the results. First of all, divide the project into clear stages with priorities. Secondly, implement two-week sprints with retrospectives and time buffers to allow your team to have a rest, discuss difficulties, and improve the working process.

Final Words

A 90-day digital wallet implementation is an ambitious task. However, it's possible to perform it under certain conditions, such as the right architecture, clear priorities, and experienced development team. Focusing on these aspects will help you avoid common mistakes and significantly simplify the development process.

Besides, it’s required to observe the regulatory requirements to ensure security and users’ confidence. A regular legislation analysis and implementation of the best practices in the field of regulatory compliance will protect your product against the possible legal consequences.

The development team is the basis of your project; so, you should take care of your employees. Effective project management and ensuring a sound working environment will help you avoid burning out and increase efficiency. So, the right combination of advanced technologies, compliance with the regulations, and attention to the development team will allow you to successfully create a digital wallet and achieve the desired results as soon as possible.

Looking for a reliable fintech app development partner? Our experts are ready to help you develop a powerful mobile wallet app or simply tell how to create an e-wallet account.