When was the last time you paid in cash? A decade ago, you would have answered “Yesterday” without hesitation. But today, digitalization has transformed our payment habits. McKinsey's study shows that over 90% of consumers have made a digital payment within the past year. Statista also points out how common mobile wallet apps are. They make up almost 50% of all e-commerce transactions, becoming the main online payment method.

Fintech companies are no longer questioning whether to venture into this domain. Instead, they’re focused on how to create a digital wallet and do it right. That's the question we'll tackle in today’s article. Are you with us?

Digital Wallets: What Are They?

Digital wallets, or e-wallets, are specialized apps that turn your mobile into a virtual purse. The major perk? They cut the need to carry cash or a stack of credit or debit cards. E-wallets keep the user's payment details safe and make it easier to checkout on various websites. Imagine sipping your morning Americano or snagging a rare NFT — all paid for with a single tap on the screen.

Beyond payments, the digital wallet app serves as a virtual repository for personal items and documents:

A mobile wallet app can also function as a personal security guard. For instance, it can verify your identity for online services that require a secure login. With options like biometric authentication, the days of annoying password resets are over.

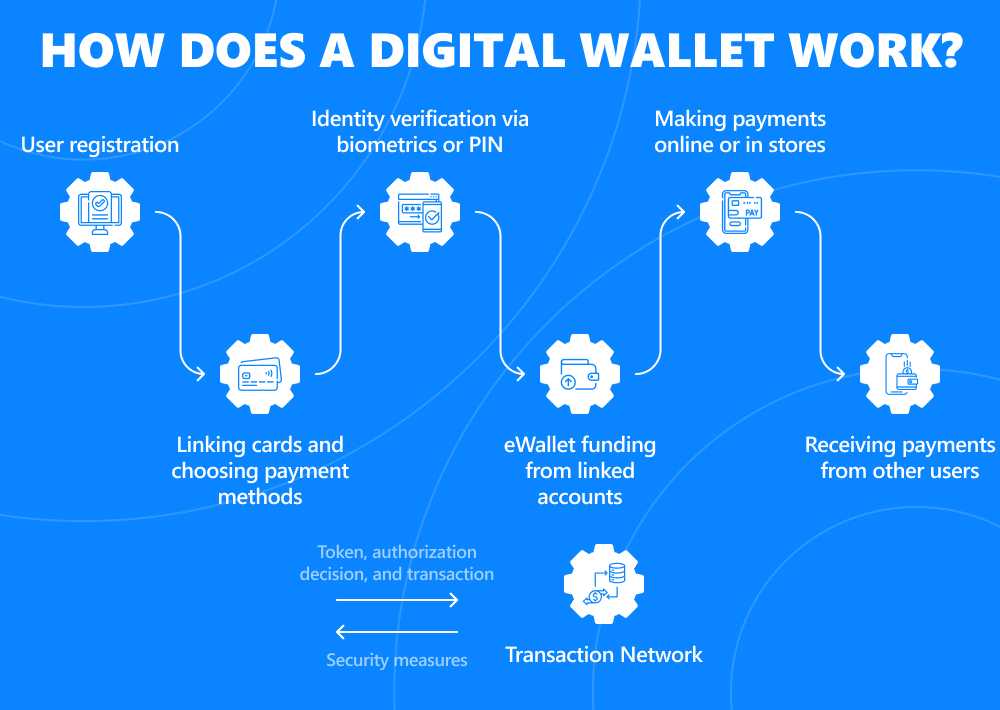

How Do the eWallet Gears Turn?

Exploring the Different Types of Digital Wallets

Like a physical wallet, its digital counterpart comes in many shapes. Below is a brief overview of the different types, each with its hallmarks:

Behind the Scenes of Digital Wallet App Development: Key Techs

What powers an e-wallet app? The ability to process transactions. How to make those digital wallet transactions fly? With certain technologies. Here are the key players:

1. Near Field Communication (NFC)

Usage: enables instant and contactless payments.

How it works: NFC allows two devices to exchange data. The technology transmits this information over a very short distance (typically a few centimeters) using radio waves.

Benefits: speed, convenience, and reduced physical contact.

2. Magnetic Secure Transmission (MST)

Usage: allows smartphones to emit an encrypted signal mimicking the magnetic stripe on traditional plastic cards.

How it works: when a user initiates a mobile payment, their smartphone generates a magnetic signal. The terminal interprets it as a card swipe.

Benefits: speed and convenience, support for new and outdated terminals, and security guaranteed by EMV-compatible tokens.

3. QR Codes

Usage: enable contactless online payment methods.

How it works: QR codes are two-dimensional barcodes. They allow users to make payments by scanning a Quick Response (QR) code a merchant displays. The user's smartphone decodes the arrangement of black and white squares and translates it into a specific form (e.g., a link or message).

Benefits: versatility, easy access from any smartphone with a camera, speed, error reduction, and damage resistance.

4. iBeacon and Bluetooth

Usage: arrange data exchange and P2P payments within a certain range (70 meters on average and up to 450 meters).

How it works: iBeacons are small Bluetooth transmitters. They emit unique identifiers (UUIDs) and send signal strength information to a mobile device. When a user approaches an iBeacon, the app responds with relevant actions.

Benefits: low power consumption, cost-effectiveness, scalability, and easy deployment.

5. Blockchain

Usage: provides secure, tamper-proof, and transparent transactions of digital assets without intermediaries.

How it works: users request a certain amount of crypto-assets. The system generates a unique address (like a bank account number) for the transaction. Then users can send or receive crypto-assets with these unique addresses.

Benefits: extra security, decentralization, transparency, no reliance on third parties.

How to Build a Digital Wallet: Your 6-Step Blueprint

Armed with the chosen technology, you can get down to digital wallet development.

#1. Start with the Discovery Phase

Here you've got three critical steps to follow:

Key questions to answer:

#2. Pick a Platform and Tech Stack

Choosing the right platform involves deciding between native and cross-platform development. Native apps are exclusive to a certain mobile OS — Android or iOS. They offer robust features and stability at a higher cost and resource requirements. Conversely, cross-platform software runs on many operating systems with a single codebase. Despite sacrificing some device-specific functionality, it ensures cost-efficiency and easier maintenance. What will be right in your case? Only your business goals and technical specifications can tell.

As for the tech stack, factor in your project's size, complexity, and timeline to ensure the technology can accommodate it. Remember about flexibility and scalability. As the chosen tech stack must adapt to the growth of your business.

Key questions to answer:

#3. Build a Prototype

Prototyping is an essential phase of product visualization. During it, UI/UX specialists craft wireframes to outline the app's flow. Prototyping aids in addressing design flaws early to avoid costly revisions later. Once approved, the team switches to refining the user interface and experience.

During this design phase, your team aims to forge a user-friendly and aesthetically pleasing interface. Adding distinctive branding elements like logos and icons makes your product more marketable.

Key questions to answer:

#4. Show Off Your MVP

Upon realizing your concept, the next step is to launch a Minimum Viable Product (MVP). Your team will present this initial version to early adopters. What should be inside? Some core functionalities like basic payment options and smooth transaction processes.

Once the MVP is ready, gather valuable user feedback. The process should be cyclical:

MVP → user feedback → enhanced MVP → feedback → further improved MVP.

This iterative method allows for continuous app refinement. How exactly? It’s an endless source of user-driven improvements and feature suggestions.

Key questions to answer:

#5. Test Your eWallet Solution

Before launching your solution, conduct extensive testing to identify bugs and usability issues. Gather feedback from beta testers to fine-tune the software for a hassle-free launch. Continuous Integration/Deployment (CI/CD) and systematic testing are two ways you can confirm the quality of your app.

Key questions to answer:

#6. Launch and Promote

For mobile wallets, listing on top app stores like Google Play and the App Store is the prime goal. A successful launch on these platforms significantly boosts software visibility and user acquisition. Just make sure your app complies with all the submission guidelines.

The final and crucial phase is marketing. It's not only about the product's quality; it's about visibility. Start a strategic PR campaign to generate pre-launch buzz. How about collaborating with influencers to amplify your reach?

Key questions to answer:

Successful Mobile Wallets in Action

Most of us are familiar with Google Pay or Apple Pay. These two giants boast 507 million and 150 million global users, respectively. But what’s the secret behind their triumph, and how can emerging digital wallet providers follow suit?

Apple Pay: Outsmarting Google Pay

Type: open eWallet;

Presence in the digital wallet market: 10 years;

Annual revenue: $1.9B (2022);

Success factors: strategic partnerships with major banks, payment processors, and card providers.

Apple Pay, by Apple Inc., stands out as a user-centric, secure platform, fortified with NFC technology. Revenue-wise, this service thrives on transaction fees from merchants and interest earned on Apple Pay Cash accounts. Financial institutions pay fees to join the service network. While card-issuing banks contribute a percentage of transaction values. Apple's strategic diversification includes in-app purchases and the Apple Card. It generates income through interest, interchange, and late fees.

PayPal: Competing the Titans — Apple and Google Pay

Type: open eWallet;

Presence in the digital wallet market: 25 years;

Annual revenue: $29.7B (2023);

Success factors: cross-platform compatibility and freedom of integrations.

A pioneer in mobile payments since 1998, PayPal has earned a positive reputation for its compatibility with both Android and iOS. The digital wallet company promotes a unified transaction ecosystem, linking with other eWallets like Samsung Pay. This creates a cohesive user experience across different services, from e-stores to crypto exchanges.

Walmart Pay: How to Make a Digital Wallet for Multinational Retail Dominance

Type: closed eWallet;

Presence in the digital wallet market: 8 years;

Annual revenue: $100B in eCommerce sales (2023);

Success factors: integration with the Walmart app and its loyalty program.

Launched in 2016, Walmart Pay is an electronic wallet that offers a convenient and secure way for buyers to shop in over 10.5K Walmart stores.

How does the platform maintain its stellar reputation? Walmart Pay optimizes the checkout process for buyers by using QR codes generated within the app. It enables payments via mobile devices with no need for NFC or physical payment cards. This digital wallet accepts all major credit and debit cards, as well as Walmart's own prepaid and gift cards.

Three, Two, One… Launching Your Pocket-Sized Financial Hub

As technology rushes forward, global fintech is evolving at breakneck speed. Today, bank clients are abandoning paper currency. It's a trend that signals the future in which digital money displaces traditional cash and cards. Frictionless transactions — those with minimal barriers — are what people desire.

Digital wallet apps meet this demand. What is their potential? Juniper Research predicts a rise in digital wallet users worldwide to over 5.2B by 2026, up from 3.4B in 2022. This 53% growth marks that consumers prefer the convenience and ease of payments. eWallets serve exactly this purpose. They allow for instant transfers, essential for both local purchases and global commerce.

What's your role in this eWallet popularization? To develop solid software that guides your customers in organizing their finances. Intelligently and securely. Our mission? To simplify mobile wallet app development for you.

Get in touch with us, and let's collaborate to craft a secure digital wallet that turns your clients into savvy digital asset managers.