Beyond its commercial success, Raiffeisen Bank Aval is deeply committed to sustainable social development. The bank actively supports charitable and volunteer initiatives, as well as educational and cultural projects.

The Challenge

For Raiffeisen Bank Aval, a leading financial institute in Ukraine, modernization was both an urgent need and a complex challenge. Despite serving a nationwide audience, the bank's fragmented legacy systems and siloed processes hindered operational efficiency and customer satisfaction.

The Project

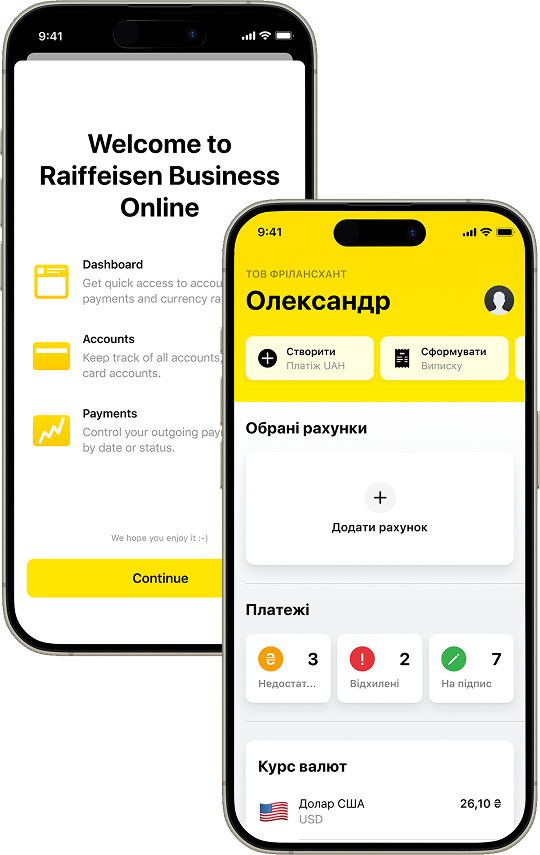

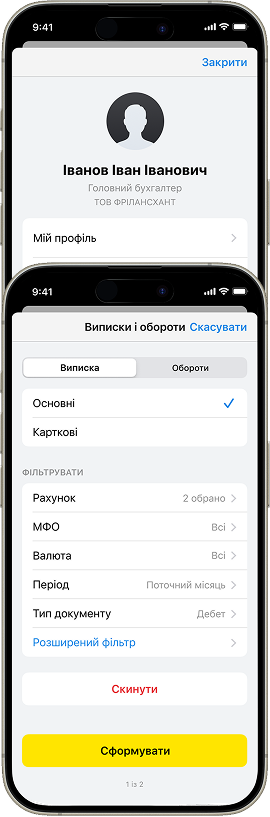

Raiffeisen Bank Aval approached Qulix with an ambitious mission: to renovate a complex legacy system and deliver a sleek, modern digital bank. With deep expertise in fintech system modernization, we partnered closely with the client to define clear objectives and chart a project roadmap.

Business Goals:

Accelerate Time to Market

Launch new banking services and products several times faster than the legacy platform permitted.

Expand Digital Reach

Set up additional online channels to attract and retain new clients.

Drive Revenue Growth

Implement cross-selling and up-selling strategies and generate maximum value for clients and partners.