The Client

Business Model

STATER funds short-term trading deals secured by tokenized physical commodities (RWA).

The key commodities include petroleum products, coal, gas, diamonds, cotton, wheat, corn, and meat.

STATER funds short-term trading deals secured by tokenized physical commodities (RWA).

The key commodities include petroleum products, coal, gas, diamonds, cotton, wheat, corn, and meat.

The STATER eWallet platform delivers a full-scale digital wallet solution that addresses all aspects of modern financial transactions.

Secure onboarding with multifactor authentication and document verification via integrated KYC APIs.

Dynamic FX conversion powered by integrated market data feeds and API-based services for flexible currency support and simple scaling.

A multipurpose dashboard for digital wallets, virtual cards, and linked bank accounts built on a microservices architecture.

Management of crypto and fiat assets with instant crypto-fiat conversion through blockchain APIs and reputable key management protocols.

User-centric functionality for transaction management and monitoring, contracting, automated reconciliation, and regulatory compliance.

This module supports a range of protocols — including SWIFT, SEPA, FAST, etc. — and integrates with external liquidity providers via high-performance APIs to regulate competitive rates.

A comprehensive dashboard with role-based access and granular permissions management, providing administrators with advanced controls, audit logs, and live analytics.

Expert BI tools and data warehousing deliver comprehensive operational reports, transaction analytics, and custom dashboards to guide strategic choices.

Challenge

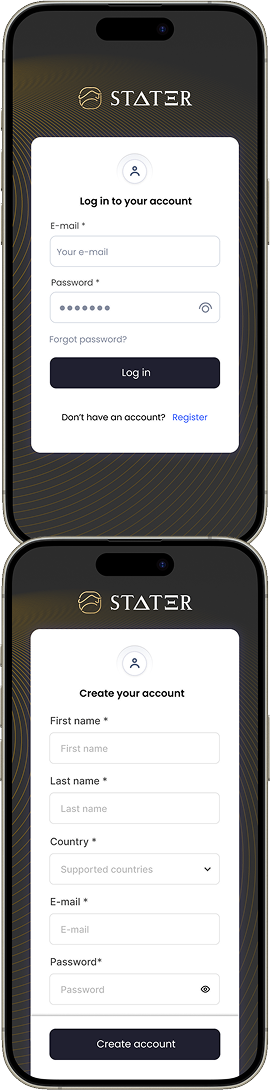

Our client needed a straightforward yet robust onboarding solution for individual and enterprise users. It had to guarantee secure and compliant access while minimizing friction during sign-up.

Solution

To address this, we engineered a convenient registration process featuring a clean interface integrated with a third-party KYC service. This integration allowed users to quickly gain access to the platform while ensuring they met identity verification standards. For the verification phase, we implemented a hybrid process. Initially, the system automatically screens the entered company data and documents to flag potential issues. Once cleared, each submission undergoes a focused manual review by our specialists, ensuring that only thoroughly vetted accounts are activated.

Outcome

This combined approach reduced manual intervention to a review step and strengthened security and compliance. The result was a frictionless, secure onboarding experience that significantly cut the risk of fraud and optimized the activation of high-integrity user accounts.

We engineered a frictionless transfer system that supports bank-to-bank, wallet-to-bank, and peer-to-peer wallet transfers on local and international scales.

STATER users can easily add funds through multiple channels — bank transfers (secured through manual operator confirmation), credit cards, debit cards, etc.

Clients can move funds from their eWallet to a bank account (manual processing on the operator's side) or a debit card.

The STATER eWallet solution enables consumers to pay for various goods and services, balancing ease of use with strict adherence to local regulations.

Clients get access to a detailed transaction history that records key details of payments and other spendings — date, time, amount, etc.

Every online payment triggers the instant generation of a digital receipt, allowing users to confirm and record their transactions immediately.

Integrated with DocuSign, our system facilitates secure electronic signatures for essential operations like wallet account opening, top-ups, etc.

To transfer funds with eWallets, users can scan a QR code. They don't need to request recipient banking details to make a transaction.

The STATER eWallet comes with a management portal that helps to control user data, enhance the security and safety of operations, and track performance. It includes such features as:

Business application verification to open an eWallet

Registration of inflows/outflows for money operations

Analytics and reporting powered by BI tools and data visualizations

Contract management with workflow automation and e-signature integration

Commissions & fees management

Role-based access & permissions

Content management

Integrations management

We’d love to hear from you!

Tell us about your project or the challenge you have, and we’ll get back to you soon.

Prefer direct contact?

E-mail us at request@qulix.com