The Client

The Challenge

For years, the worlds of cryptocurrency and traditional trade finance operated in silos, rarely intersecting despite enormous potential synergy. The trade finance sector, in particular, has long struggled with internal challenges:

Mitigate Risks

Obtaining trade financing like LC or SBLC is nearly impossible for SMEs due to excessive documentation and lengthy processing times.

Banking Barriers

Opening a business account with major banks is often cumbersome and bureaucratic.

High Costs

Both the application process and the financial instruments come with significant costs.

Commodity Risks

Obtaining trade financing like LC or SBLC is nearly impossible for SMEs due to excessive documentation and lengthy processing times.

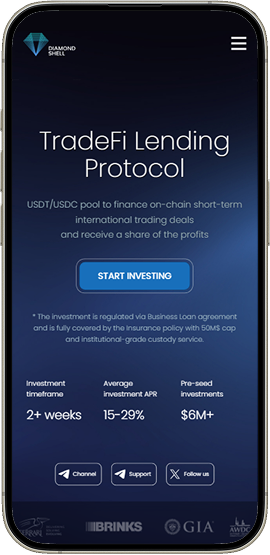

While new trade finance services have emerged to address these issues, many still operate in the real world and are not linked to cryptocurrencies. This disconnect leaves a critical gap: there's no adequate mechanism to provide crypto liquidity for trading.

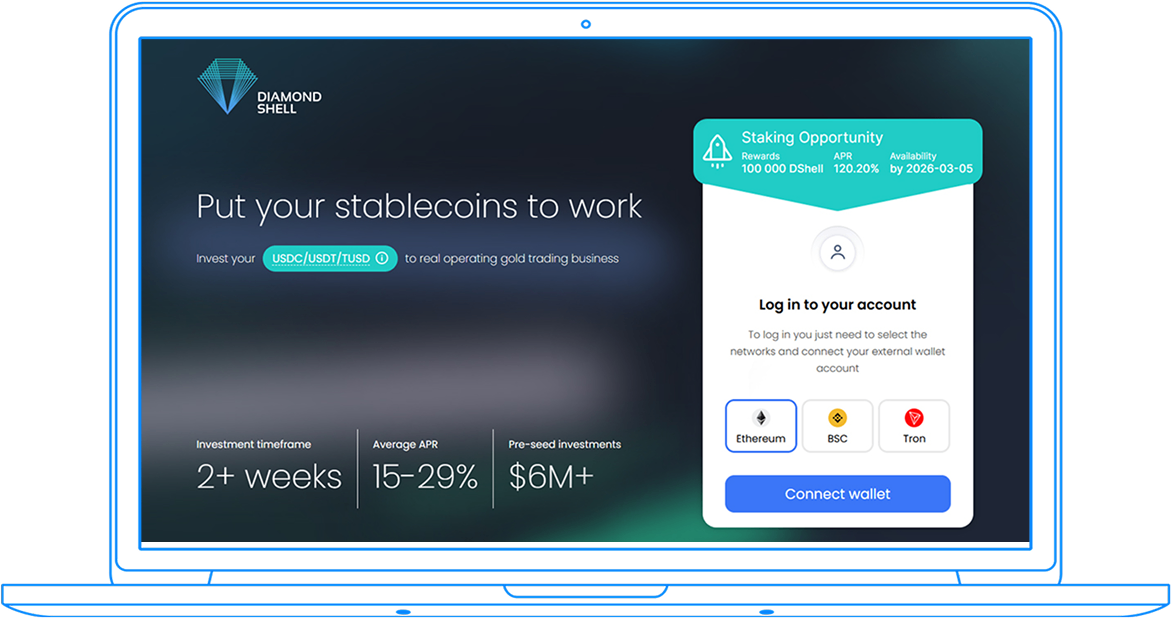

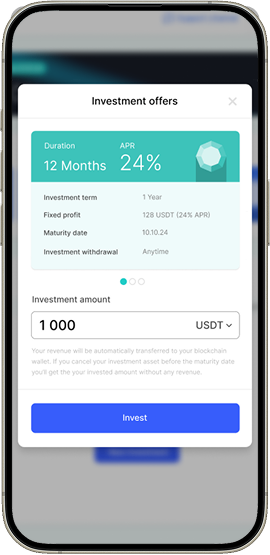

DiamondShell recognized this challenge and set out to fill the gap by establishing a much-needed connection between cryptocurrencies and real-world trade finance.