Automate Crypto Liquidity Allocation with Institutional Precision

A unified infrastructure for deploying and managing crypto capital across DeFi, DEXs, lending, HFT strategies and RWA platforms — with risk monitoring, automated rebalancing and full control on your side. Purpose-built for crypto funds and family offices.

Crypto Capital Is Growing. Managing It at Scale Is Not.

problems

Result: performance leakage, blind-spot risks, operational overload, and limited confidence from investment committees.

A Platform That Scales Capital Allocation Without Replacing Your Strategy

solution

For funds, the platform solves four critical operational constraints:

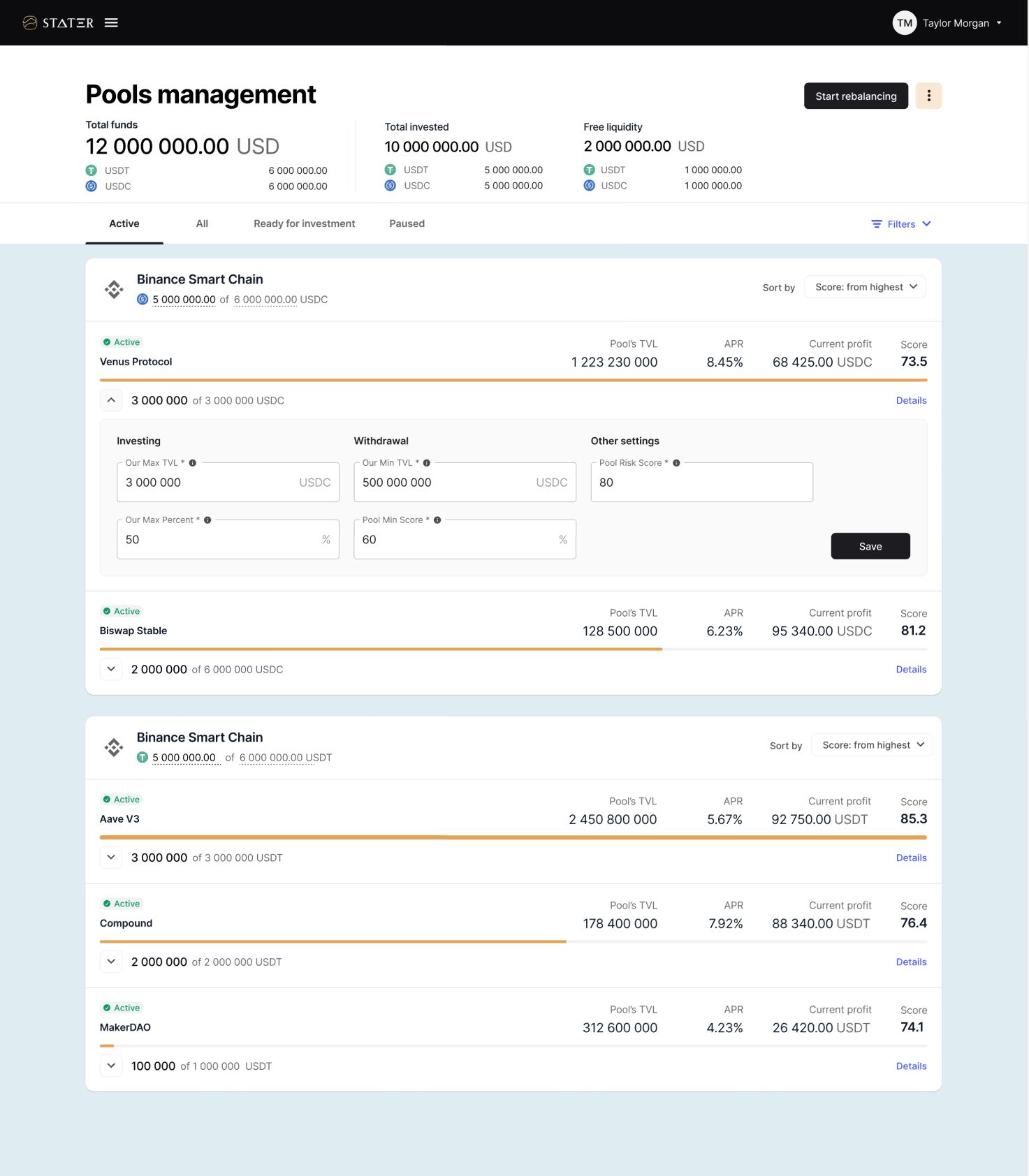

Faster, rules-based rebalancing

when yields or spreads shift.

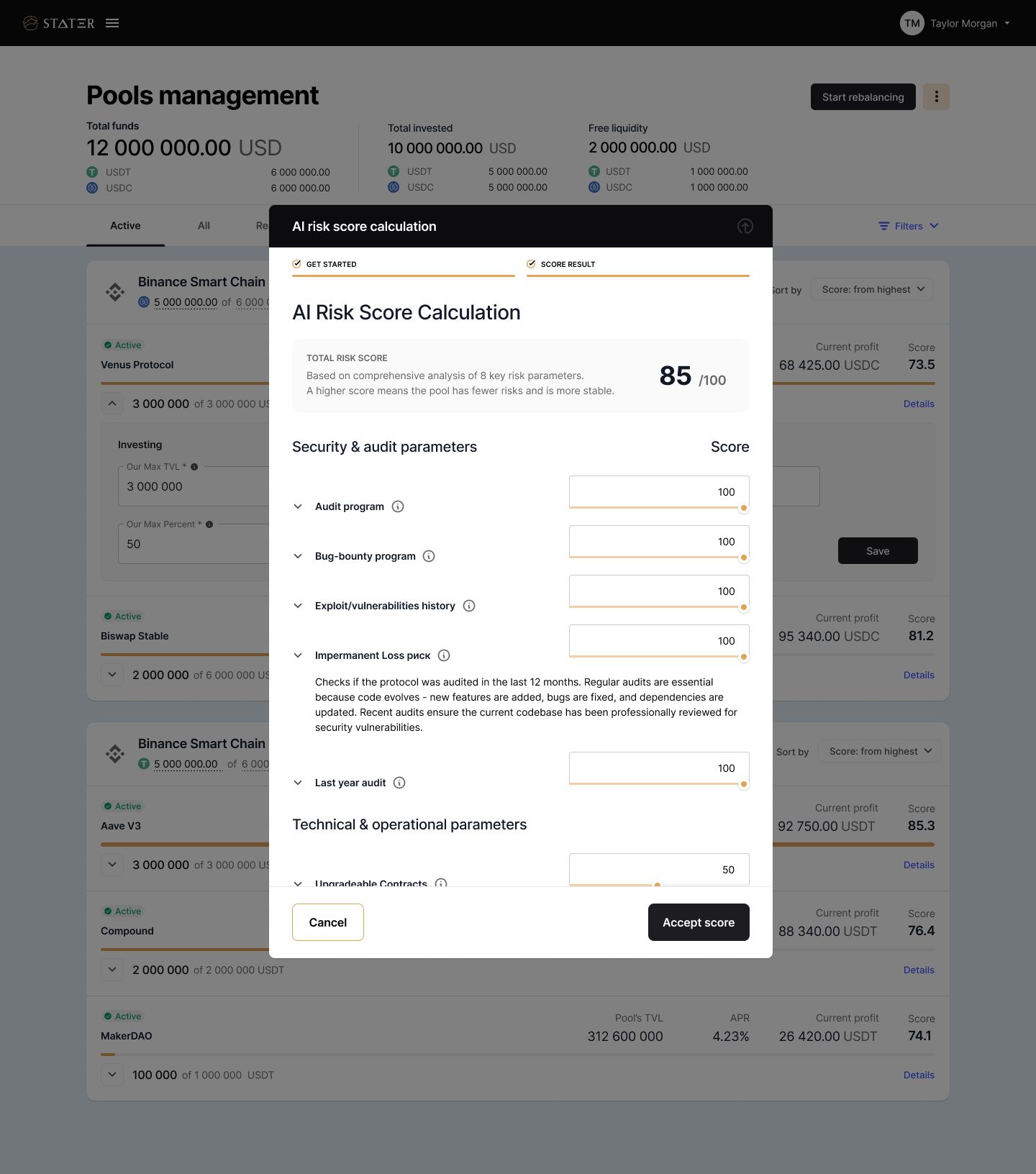

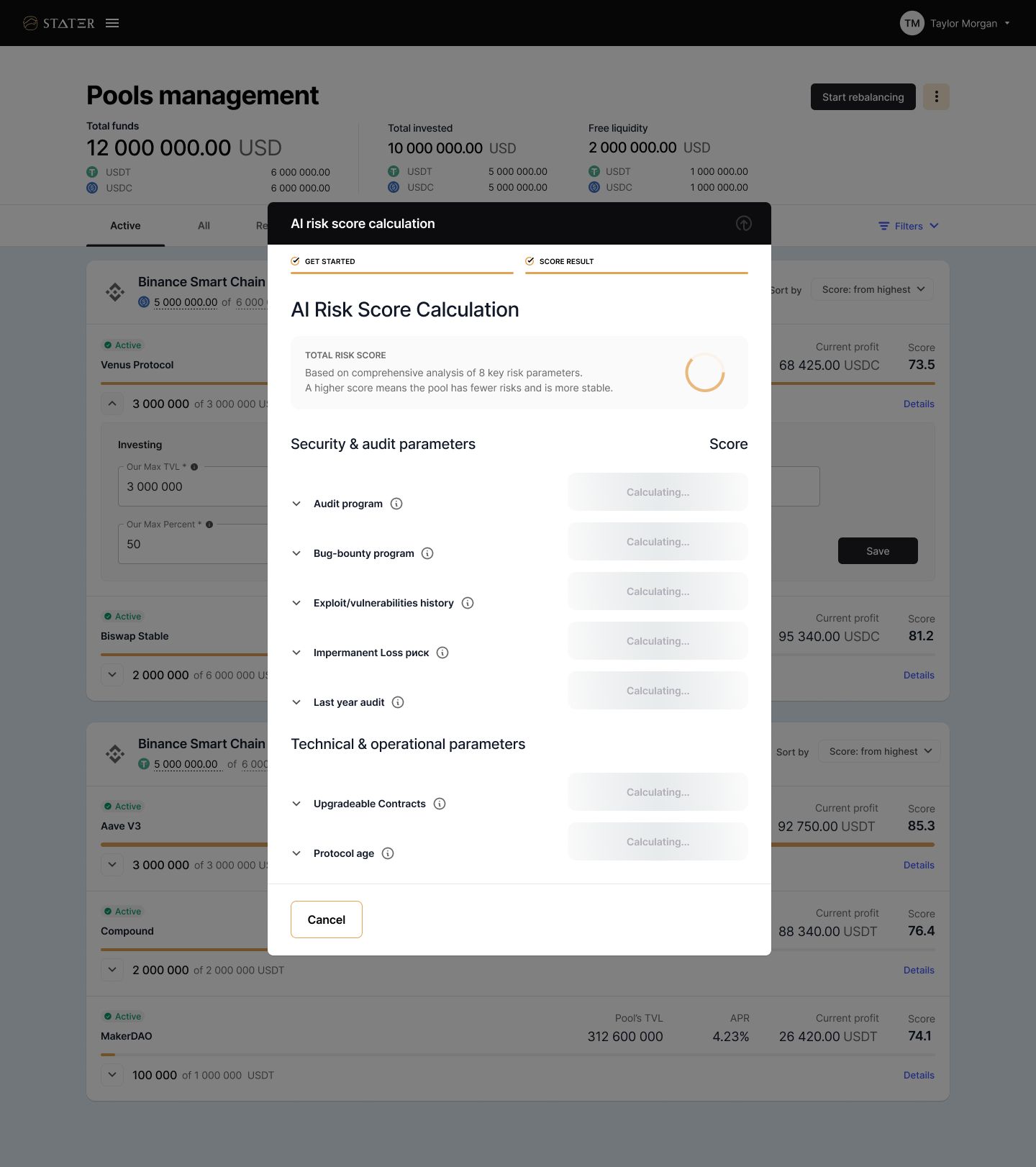

Tight exposure control

based on AI-driven risk scores (>50 parameters).

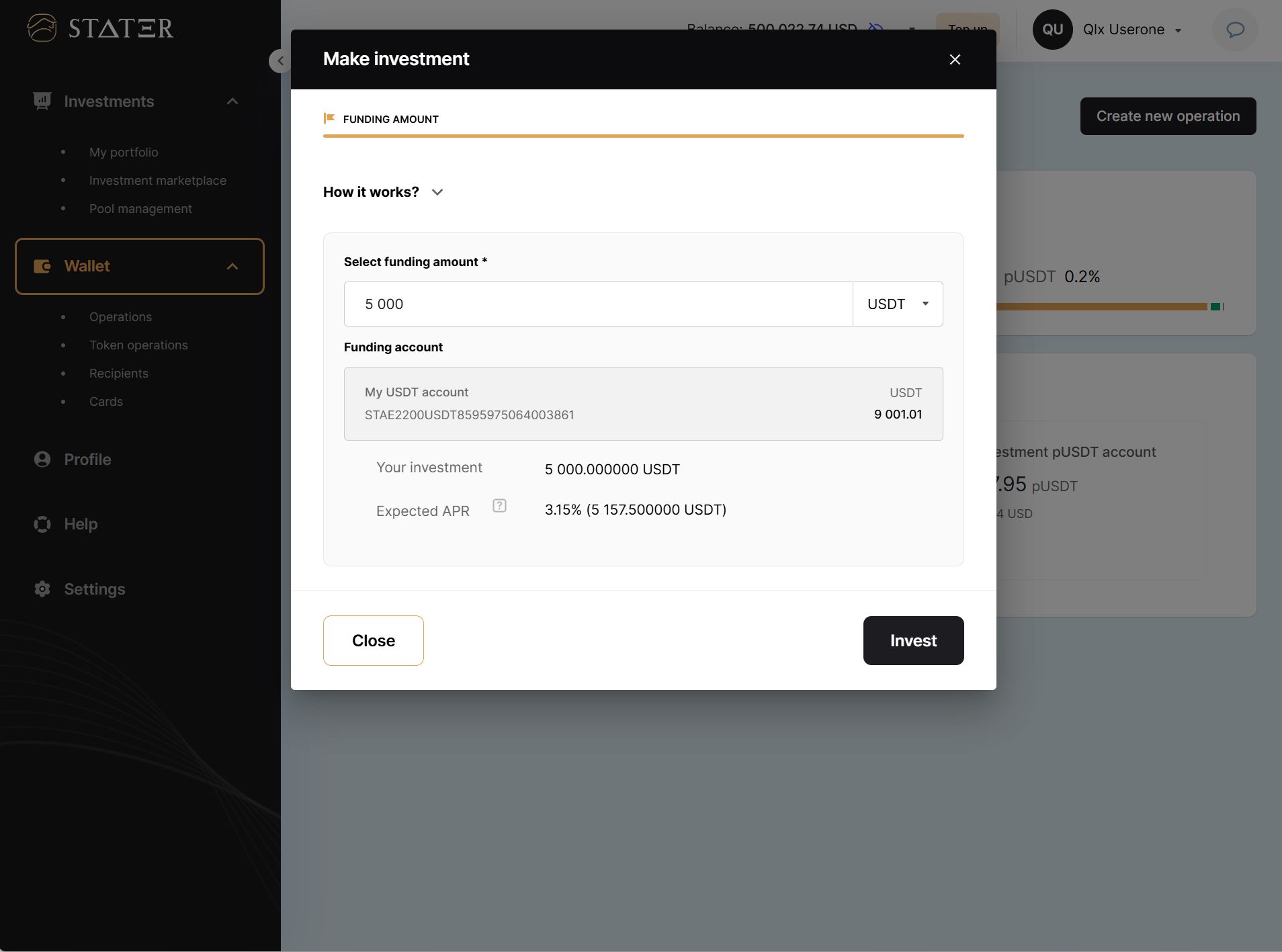

Lower execution friction

through gas-aware and stretched transactions.

Institutional reporting and governance

via unified capital views.

Increase Digital-Asset Returns Without Increasing Operational Burden

about

It becomes a digital-asset engine that supports wealth growth without requiring specialised crypto expertise internally.

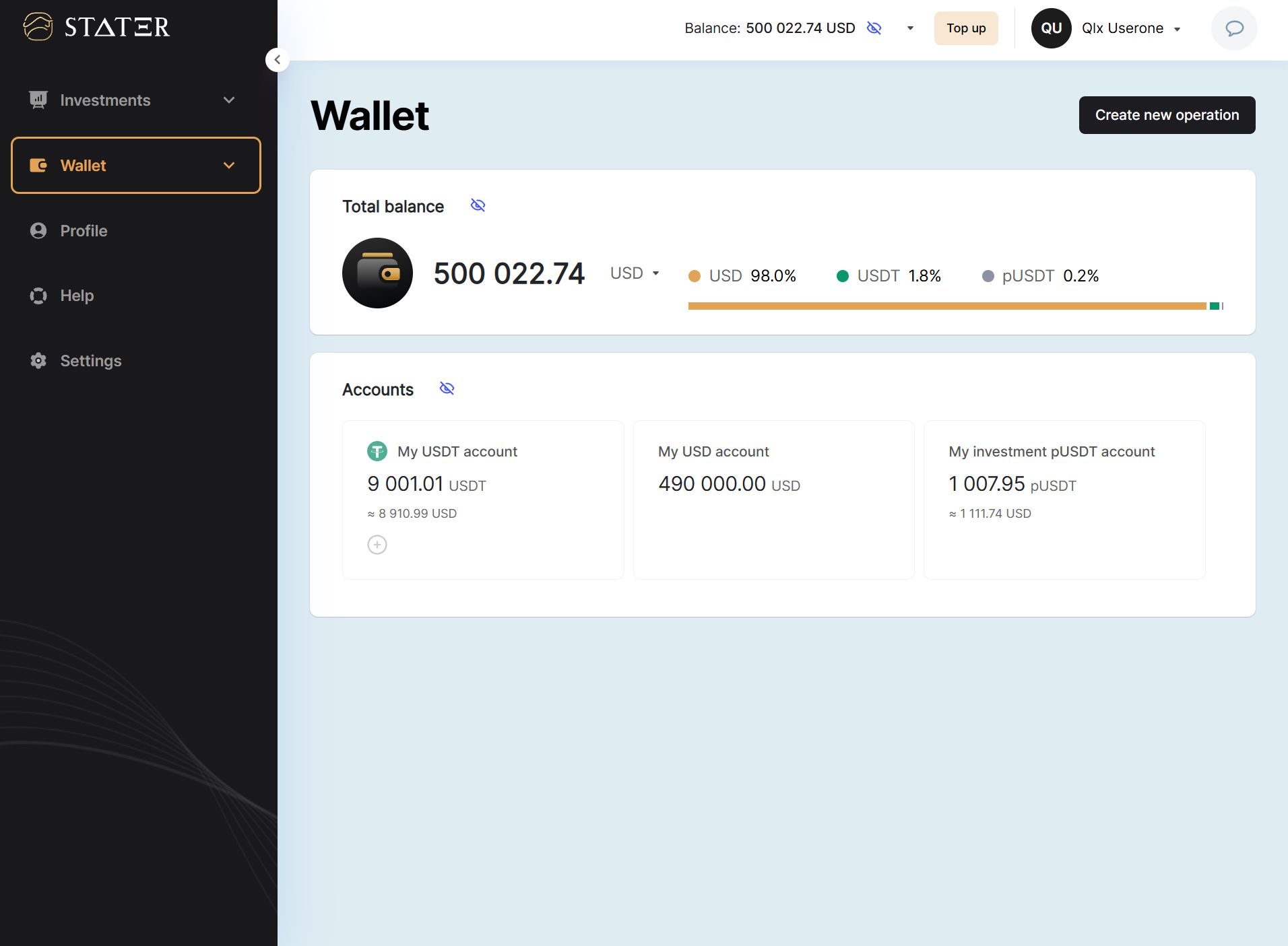

How the Platform Works

features

Deployment and Control

control

Deployed Fully on Your Infrastructure

The provider supplies the platform as an individual IT solution — not a shared service, not a pooled fund, not an asset manager.

Supports both omnibus funds and individual client portfolios .

Engagement Roadmap

engagement

- Phase 1 — Objective Definition (≈1 week)Capital size, constraints, lock-ups, approved venues, internal workflow.

- Phase 2 — Platform Deployment & Configuration (≈1–4 weeks)Environment setup, initial capital plan, KYB onboarding for selected DeFi venues.

- Phase 3 — Pilot Sandbox Run (≈1 month, optional)Controlled testing with limited capital and risk.

- Phase 4 — Full Launch & Ongoing OptimisationMonthly reviews, parameter refinement, integration updates.

See How Automated Liquidity Management Works in Practice

Request a private demo and explore how your fund or family office can structure, deploy and scale crypto capital with disciplined, risk-aware automation.

Why Qulix?

why us

25+

years delivering financial-grade software and digital banking systems

200+

institutional clients across 30 countries

500+

in-house engineers

Deep experience across blockchain, DeFi and AI risk modelling

Proven process of connecting new protocols, maintaining integrations and supporting complex operational structures

Contacts

get in touch

We’d love to hear from you!

Tell us about your project or the challenge you have, and we’ll get back to you soon.

Prefer direct contact?

E-mail us at request@qulix.com

FAQ

faq

No. The platform automates your internal process but does not manage assets on your behalf.

Only the client. Deployment is inside your cloud or on-prem infrastructure.

Risk scoring is continuous and multi-layered. Exposure limits and thresholds control allocations automatically; committees retain override powers.

No. It augments execution, monitoring and rebalancing, allowing teams to focus on strategy rather than manual chains of transactions.