Crowdfunding Platform Development

A full-featured digital platform for building a modern investment crowdfunding service. We deliver it as a white-label solution, with full customization to your requirements and ongoing support.

Platform Functionality

features

Feature

Description

KYC for individual and business clients

Know Your Customer is a mechanism that verifies the identity of new users and ensures smooth onboarding.

Personal investment dashboard

An intuitive visualization of a client’s portfolio (a general view and a detailed representation of each asset).

Portfolio management

A client’s ability to conduct operations with assets displayed in an investment portfolio.

Investment project management

Creation, monitoring, and modification of the investment projects stored in a catalog.

Funds deposit and withdrawal

Providing clients with the ability to deposit funds in a platform and withdraw them through integrations with banks and manual transaction processing.

In-built wallets

The ability to open virtual accounts in multiple currencies (fiat and non-fiat).

In-built statements

Generation of detailed statements, both personal and regulatory (the latter can be limited by jurisdiction rules).

Management portal

Back-office panel for the product owners.

Project dashboard

Fundraising management and funds allocation functionality.

Our team can always adjust these core features to your business requirements or extend the solution’s functionality in compliance with your project vision.

Our Clients

customers

Our platform is well suited for:

In both cases, you reuse a proven platform instead of building a complex investment system from scratch.

Possible use cases

solutions

The same platform can be adapted for different business cases:

Investment crowdfunding for startups and SMEs

Charity and non-profit fundraising

Partnerships and associations that require regular capital contributions

Joint investment in trade deals (like the Stater case)

Joint investment in real estate and other alternative assets. Each use case can have its own onboarding rules, funding flows, and reporting logic, while sharing the same core platform

“

Alexander Arabey

Co-founder, VP Of Business Development at Qulix

Crowdfunding services are a mature fintech segment and can solve many practical financing tasks for both businesses and individuals. If you want to launch a Kickstarter-like service within reasonable timelines and budgets, contact us and we will outline a concrete plan.

TALK TO THE EXPERTTech Insights

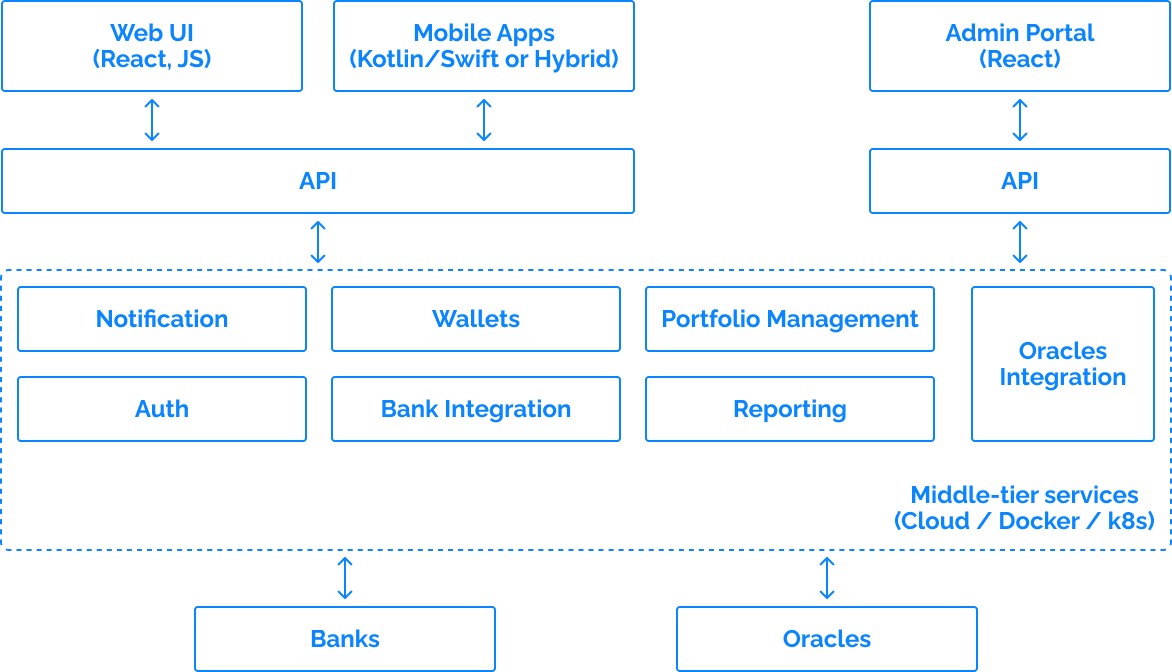

structure

Our platform has a microservices architecture at the core and contains a number of components, technical services, and functional features to streamline its further customization.

A solution based on a microservices architectural pattern consists of several relatively isolated components that can be built with different tech stacks and databases, adjusted without affecting the platform’s overall functionality and performance, and launched individually. The approach entails vast scalability potential and more frequent deployments.

When it comes to product deployment, two options are available:

Cloud deployment

(e.g., Azure, AWS, a private cloud)

On-premises deployment

(depends on a client’s strategy)

From a technical perspective, the solution may look in the following way:

Integration Options

potential

The platform includes pre-defined adapters for integrations with external data sources and financial infrastructure.

We have strong experience integrating with banks for deposits and withdrawals, using both OpenAPI standards and custom APIs.

If a required external service is not on our standard integration list, our team can design and implement the integration based on your requirements.

Investment performance monitoring

dashboard

A key question for every investor is how reliable, timely, and transparent the information about project performance will be.

Our platform provides several options for supplying and validating this data:

Manual data management

project owners regularly submit updates and reports using predefined templates for their project type.

External auditor integration

independent auditors (individuals or firms) validate project data in exchange for remuneration.

Automated data sources

integrations with third-party analytics or online data services that automatically publish relevant indicators.

You can combine these methods depending on your governance model and regulatory requirements.

MVP Approach

We go for the Agile methodology and MVP approach while customizing the platform to client needs.

An MVP (minimum viable product) is the simplest version of a crowd investment platform, with several features sufficient for its deployment. It is an excellent option if you plan to launch a funding solution, and here's why:

After finishing the MVP stage and rolling out the first product version, we get down to implementing more intricate features.

Project Roadmap

workflow

Why Cooperate with Qulix?

advantage

Rich FinTech Expertise

For over a decade, we’ve been devising breakthrough digital products to answer the demands of financial companies and institutions like UBS, Raiffeisen, Elinvar, Société Générale, BNP Paribas, and other fintech industry players. The list of our project cases encompasses banking systems, mobile wallets, tokenization platforms, investment solutions, and other digital products.

Client-First Approach

When hiring our specialists, we assess their tech knowledge and soft skills, so that our clients get the teams aimed at mutually beneficial collaboration. Before the project launch, we carefully analyze the client’s requirements, test the viability of the desired features, and try to define the best-fit tech stack, architecture, and roadmap. Moreover, we offer several payment options (hourly/daily rates) and cooperation models (staff augmentation/outsourcing).

Fast Deployment

We offer a fully-fledged solution ready for customization. Unlike from-scratch development that drains plenty of resources, our option ushers in reduced costs and accelerated deployment. Besides, thanks to the combination of the Agile methodology, a microservices architecture, and an MVP approach, we streamline the development process and help you enter the market within several months.

How to Get Started

guide

- Fill in the contact form

- Get your project analyzed

- Get the quote

- Sign the contract

- Launch the project

Contacts

get in touch

We’d love to hear from you!

Tell us about your project or the challenge you have, and we’ll get back to you soon.

Prefer direct contact?

E-mail us at request@qulix.com