It’s not rocket science to answer the question ‘what is insurtech?’ from the perspective of the meaning of the word. A much more exciting issue is revealing how insurtech is improving and transforming such a historically conservative industry as insurance.

Our new article will focus on the current trends and prospects for development to make the community valuable industry even more helpful and supportive.

WRITTEN BY:

Alexander Arabey

Director of Business Development, Qulix Systems

Contents

Insurance vs. Insurtech

First, let us look at the core meaning of insurance in the modern world. Why do people need insurance? Basically, it is because it can provide fast, practical support in any emerging circumstances. Take a tornado outbreak that could devastate families' houses, shops, and other places. Insurers can help get funding for quickly restoring buildings and belongings and the whole pace of life. So, insurance is actually about supporting people, families, businesses, and communities. But what kind of service do people expect from insurance companies these days?

The undoubtful fact today is that COVID-19 has enormously accelerated the shift to a digital-first society, and the insurance industry cannot ignore this transformation. The pandemic has highlighted the gap between traditional insurance with numerous phone calls, tons of paperwork on the one side, and flexible and agile technological opportunities for the new generation of insurtech companies. The so much-needed support could be delivered faster and more efficiently.

The term insurtech stands for smart integration of the latest technology into the insurance business for better enrollment, underwriting, fraud detection, and a lot of other solutions. Insurtech is not taking over the traditional industry. It is not opposition or invasion. Progressive insurance companies are implementing the strengths of technology for the most beneficial and cost-effective solutions for their clients, for the people they support.

How Are Insurers Using Tech?

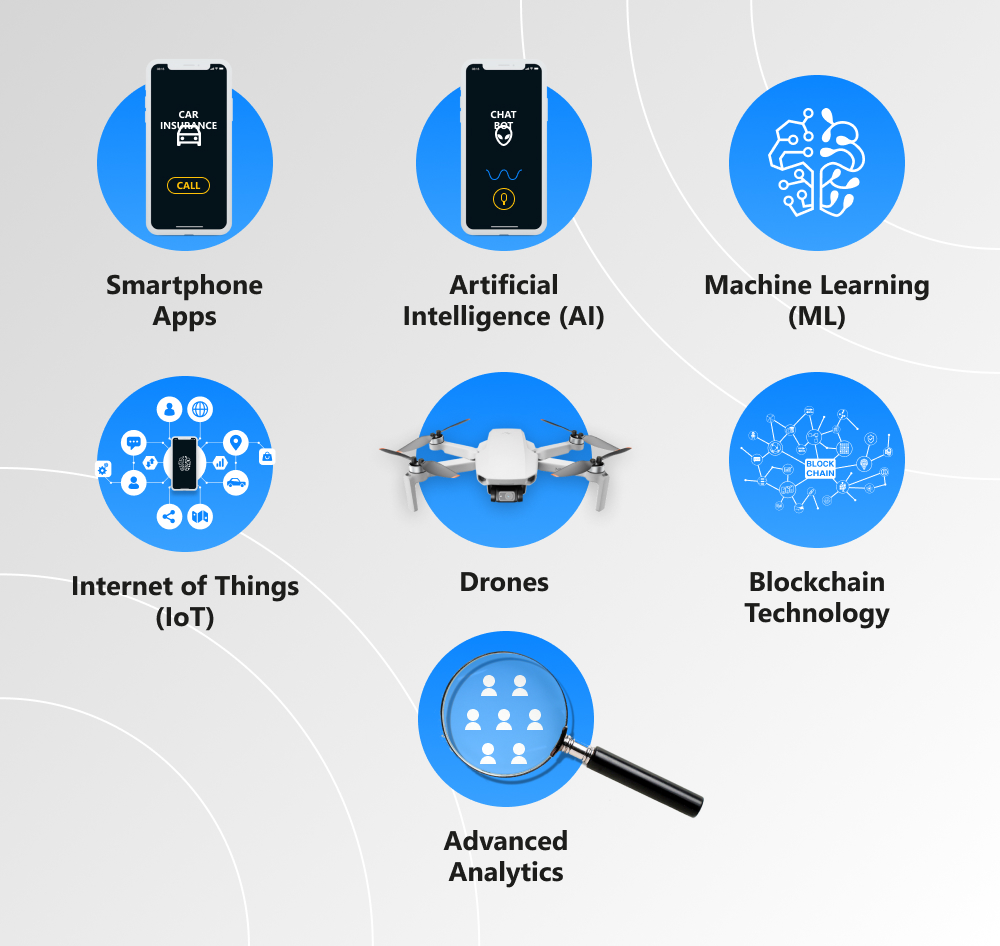

What technology moves the insurance value chain closer to their clients? We’ve handpicked the most compelling examples to change your view of the industry.

Smartphone Apps

Applications for smartphones bring the advantage of professional support directly into the clients' hands. No wonder that this technology is widely applied to intensify the insurance process. For example, Friendsurance, one of the pioneers in insurtech, introduced its application in 2010. This P2P platform enables clients to compare the best insurance products right in the app on their smartphones.

Artificial Intelligence (AI)

Broad functions of AI for insurtech can be illustrated by introducing chatbots into the flow of interactions between insurers and their customers. The chatbot service Maya by Lemonade, for instance, can communicate with a client using text or even verbally. It can answer any question through the sign-up process in an amicable and easy-going way at any time needed. It guides through the products and also provides immediate help in emergency situations.

Machine Learning (ML)

This type of insurtech technology enables the industry to apply effective data research to look for valuable information. One of the essential features of the insurance industry is to collect vast amounts of data, and the implementation of machine learning can help to immensely improve a lot of business processes for insurers:

- underwriting — analyzing the applicant's data, verifying its accuracy, and flagging possible errors;

- modeling — building models for risk estimations and future demands to offer more flexible and adjustable products;

- detecting — analyzing data sets to search for any fraudulent or vulnerable activity that human adjusters can not spot.

Internet of Things (IoT)

How can the IoT improve insurtech? Connected devices and vehicles are a great example of unbiased assistants for insurers. For example, for logistics companies today, it is a norm to equip their vehicles with GPS-enabled devices. They provide valuable data for locations, driving speeds, acceleration, or braking patterns. That can be a good source for analyzing accidents, improving safety, and providing discounts for companies.

Drones

Property insurers, for instance, can use drones for inspection. Rooftops or disaster areas where it is too dangerous to send human inspectors can be thoroughly reviewed and photographed by drones. The same advantage is beneficial for causality insurers and inspecting motor vehicle accident sites.

Blockchain Technology

It may become an excellent solution for many issues in insurance. Some compelling use cases for blockchain in insurtech are:

- smart contracts — to verify and execute agreements between parties;

- claims management — to create the only version of claim documents that remains unchanged and can be quickly reviewed;

- fraud detection and risk prevention — to use the advantages of decentralization and the storied history of all transactions;

- customer identity approval — to create encrypted versions of clients' documents to meet KYC (know your customer) regulations.

Advanced Analytics

Do you remember that the insurance industry produces enormous amounts of data? It would be an undeniably dramatic waste of precious resources if insurtech did not use the latest technology to get the max out of this data. Data analytics provides a better insight into clients' needs, helps create competitive products and services, processes claims faster, and enables effective targeted marketing.

Insurtech Opportunities — Trends to Watch

When applied to the insurance industry, the technologies open new horizons for companies with a long history and move forward a lot of startups. We offer you our top 5 best insurtech startups — new unicorns that recently achieved the most significant results. Let us see what innovations helped them get to the top.

- Acko. It is the youngest unicorn on our list, which got the status in October 2021. This Indian insurance policy provider focuses on developing bite-sized products for auto insurance, gadget protection, and also healthcare policies for employers. Acko covers more than a million gig workers. It is a crucial transformation for one of the largest markets in the world where just a fraction of people can afford sizeable policies.

- Zego. It is the UK's first insurtech unicorn that specializes in commercial motor insurance. The company applies advanced technological solutions to multiple data sources, thus providing flexible solutions at competitive prices for companies and individuals. They offer customized annual policies and pay-as-you-go insurance — a smart option lately. More than 200,000 vehicles in five countries across Europe are covered by Zego insurance.

- Bright Health. It is a healthcare insurtech aggregator from the US. They offer in-person and virtual clinical care through affiliated clinics of primary care. They also sell Medicare and commercial health insurance. Bright Health provides unique solutions in telemedicine which came into such great demand in pandemic times.

- AInnovation. This tech startup from China specializes in advanced data research. It offers competent assistance for insurance companies in analyzing customer negligence. AI-based image recognition platforms and text analysis solutions of AInnovation support underwriting and claims management. Its insurtech technologies augment the entire value chain with innovative consumer, car, and housing loan strategies.

- SecurityScorecard. This New York-based startup offers innovative cloud-based solutions for many insurers. They automatically monitor risk factors in real-time, which is valuable for risk management, security ratings, and cyber insurance. The SecurityScorecard cybersecurity rating platform informs insurance companies about the possible vulnerabilities.

So, the main trends we see today are closely interwoven with customers’ needs. The companies mentioned above have improved their business to know their clients much better than ever before. They use the latest tech to offer personalized services to meet the demands of modern society.

Insurtech Industry — Steps Forward

So, what prospects of insurtech will continue transforming the industry? We believe that the following innovations are up-and-coming for insurtech.

- Improved user experience — smart solutions, such as chatbots, will continue developing. Here, we should notice that while the millennials and zoomers feel relatively comfortable with the existing technology, older generations still have difficulties with the tech.

- Cost reduction — flexible offers, cheap blockchain payments, and other solutions will make insurance more affordable for wider audiences.

- Remote and online products — smart contracts, telemedicine, and other products and services will continue to expand.

- Updated fraud detection and security controls — the process of implementing AI, ML, and data analysis will provide the rise in robust business models in the insurance value chain.

- Compliance with the growing amount of regulations — there will be an urgent need to follow technical and legal security regulations worldwide, and insurtech will have to offer highly adaptable products.

- Global expansion — with modern globalization tendencies, and the growing number of international and multinational businesses, insurtech will have to develop solutions for businesses without borders.

Take-Away

According to Statista, in Europe, there were 1003 active insurtech companies in 2021. And the global insurtech financial activity is seeing stable growth, especially after COVID-19 outbreaks. That is why we do not doubt that we will see some significant improvements to bring the support of the insurtech industry closer to people.

Keep up with our latest insights on our exciting blog. And you are welcome to contact us to learn about our unique competencies for your great projects.

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com