Due to PSD2, 2018 has become a game-changing year for bank customers, fintechs, and the entire banking sector in Europe. The implementation of the new directive enables bank customers to use third-party providers to manage their finances. Thus, companies like Google, Apple, and Amazon gain access to consumers' bank accounts and are able to build financial services on top of the data and infrastructure of banks. Opening up banks sounds good for consumers. But what does it mean for competition? It’s exactly the time to have a look at current statistics on the banking sector in Europe.

written by:

Alexander Arabey

Director of Business Development, Partner

Due to PSD2, 2018 has become a game-changing year for bank customers, fintechs, and the entire banking sector in Europe. The implementation of the new directive enables bank customers to use third-party providers to manage their finances. Thus, companies like Google, Apple, and Amazon gain access to consumers' bank accounts and are able to build financial services on top of the data and infrastructure of banks. Opening up banks sounds good for consumers. But what does it mean for competition? It’s exactly the time to have a look at current statistics on the banking sector in Europe.

Facts & Figures

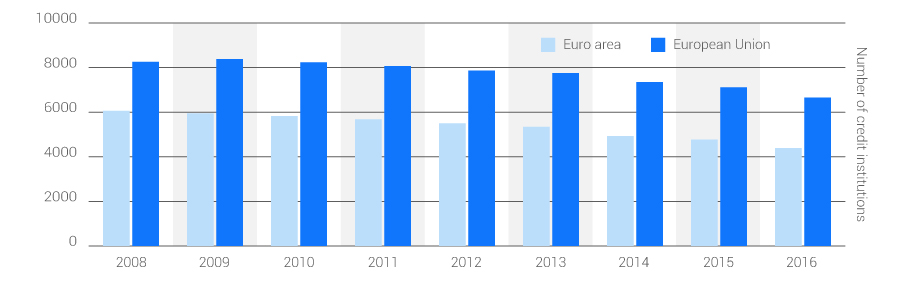

From 2008 to 2016, the overall number of credit institutions in the EU and Eurozone countries decreased.

A decline in bank branch numbers has also been noted. It is frequently linked with the growing popularity of new digital banking methods. However, only 15 percent of European mobile device users were inclined to favor social media in communication with the bank. Eastern European and Benelux countries have the highest share of consumers who already use social media to interact with their bank.

Relevant Open API for 'Open' Banking

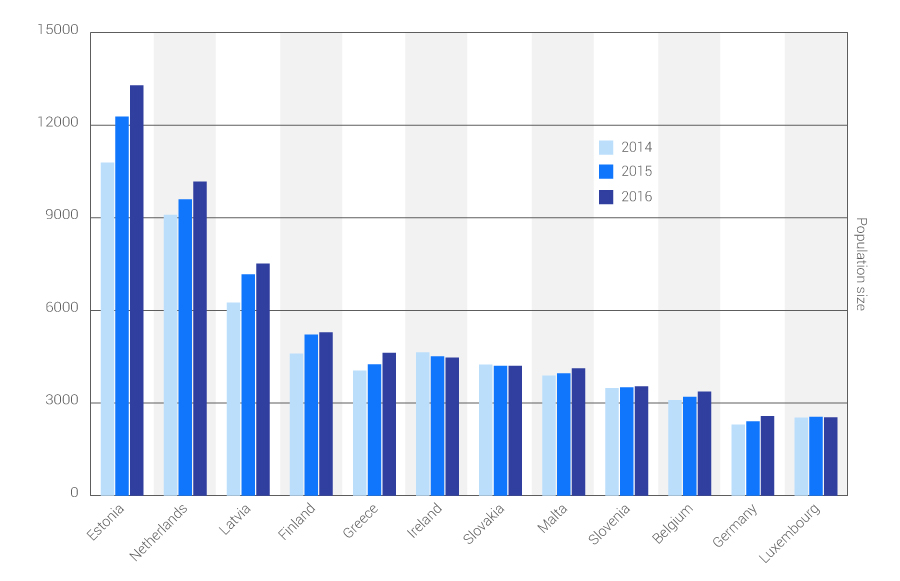

According to statistics presenting the average size of the population per local bank branch among all eurozone countries from 2014 to 2016, Estonia has had the highest share of local population per bank branch.

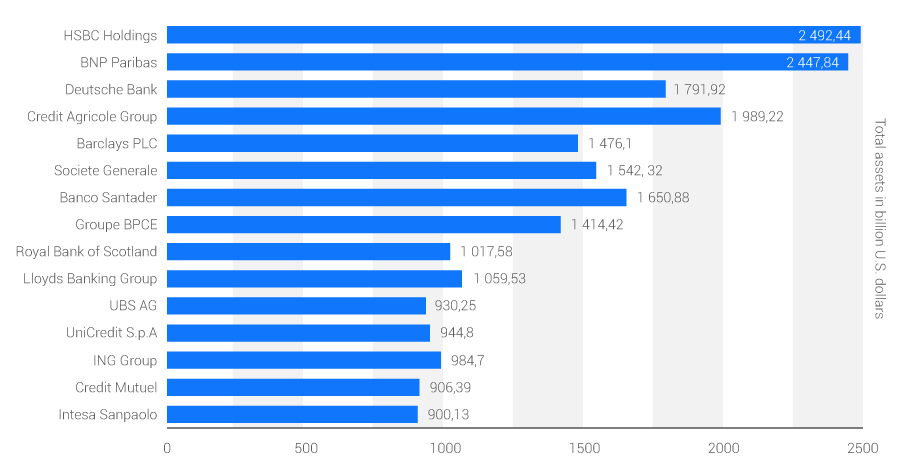

HSBC Holdings, BNP Paribas, and Deutsche Bank formed the list of Top 3 leading banks in Europe as of June 2017.

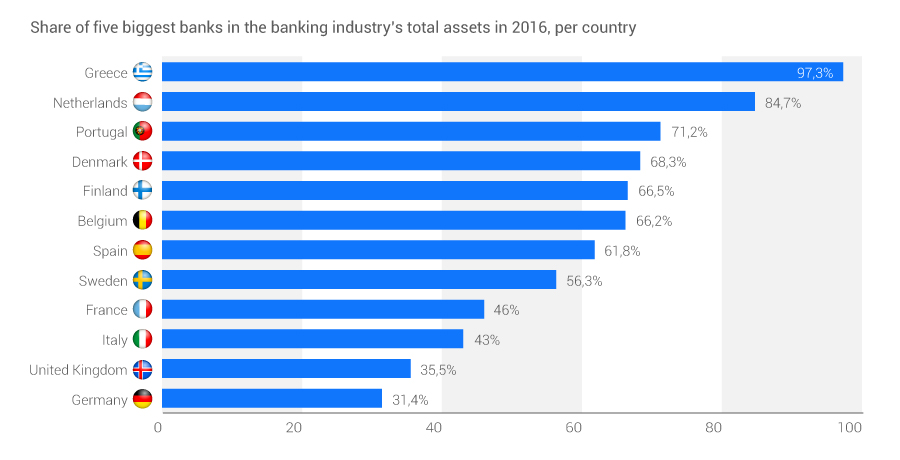

In 2016, Greece, Netherlands, and Portugal had the highest share of five biggest banks in the banking industry’s total assets.

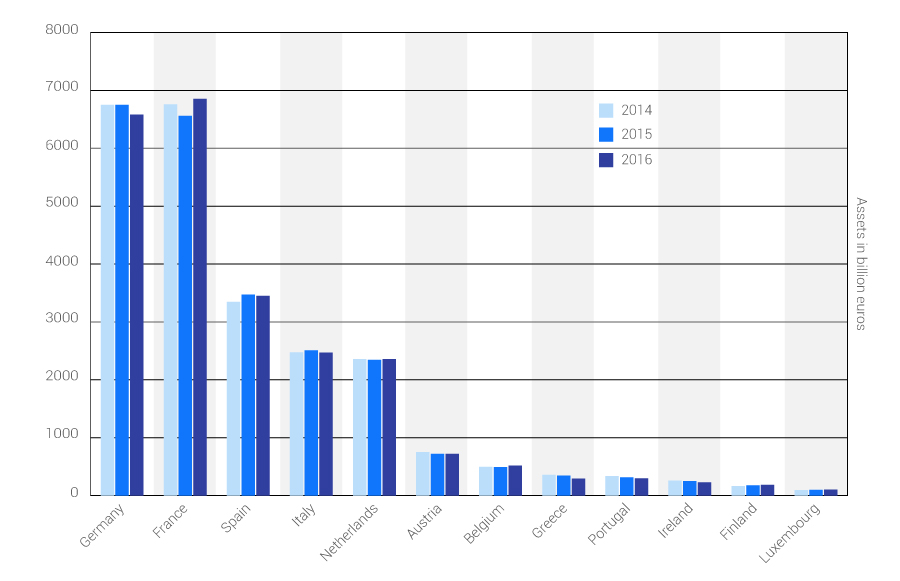

In 2016, the country with the highest assets of domestic banks was France. The second-ranked were banks in Germany, the leading European economy.

The end of traditional banks in Europe?

It is widely discussed that traditional banks will lose their monopoly.

One is clear, individual banks will no longer have a monopoly over their customers’ data. PSD2 is opening up the market, promoting technological innovation and creating a more competitive environment. Indeed, banks will face particular challenges. According to a McKinsey survey, increased pressure on pricing and margins is a top concern for bank executives as they plan for the implementation of PSD2.

Concurrently, Europe’s second Payment Services Directive opens attractive opportunities for banks: e.g. a chance to get revenues from new products and services, gain market share from other banks.

In order to stay competitive, banks need to react promptly. Forward-thinking banks, who embrace the change, will be able to turn the market disruption to their advantage. The key to success is to reshape products according to customer needs.

Find out more about Qulix Banking & Software Development Services

Sources: Banking in Europe - Statistics & Facts, PSD2: The End Of A Banking Monopoly In Europe?, PSD2: Taking advantage of open-banking disruption

Contacts

Feel free to get in touch with us! Use this contact form for an ASAP response.

Call us at +44 151 528 8015

E-mail us at request@qulix.com